BRI, banque des banques centrales Tel Atlas soutenant le monde, les banques centrales portent sur leurs épaules le marché financier. Cette réalité demeure largement occultée, mais elle détermine pourtant massivement l’avenir de nos économies. Nous avions déjà évoqué ce sujet l’année dernière (Les banques centrales commencent-elles à nationaliser l’économie ?). Il importe d’y revenir car de nouveaux chiffres...

Read More »Toward The Housing Bubble, Or Great Depression?

During the middle 2000’s, one more curious economic extreme presented itself in an otherwise ocean of extremes. Though economists were still thinking about the Great “Moderation”, the trend for the Personal Savings Rate was anything but moderate, indicated a distinct lack of modesty on the part of consumers. In early 2006, the Bureau of Economic Analysis calculated that the rate had been negative for all of 2005. It...

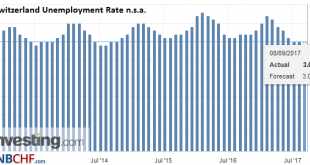

Read More »Switzerland Unemployment in August 2017: Unemployment Slightly Falling

Unemployment Rate (not seasonally adjusted) Bern, 08.09.2017 – Registered unemployment in August 2017 – At the end of August 2017 135’578 unemployed persons were registered at the Regional Employment Services Centers (RAV), according to the SECO (State Secretariat for Economic Affairs), 1’652 more than in the previous month. The unemployment rate remained at 3.0% in the reporting month. Compared to the previous month,...

Read More »FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

Swiss Franc The Euro has risen by 0.35% to 1.1433 CHF. FX Rates The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that...

Read More »Swiss retailers called on to remove palm oil from their products

Two Swiss NGOs have started a petition calling for Swiss retailers to reduce or remove palm oil from their products. Present in many processed foods, cosmetics and detergents, the ingredient has a bad reputation. The NGOs Bread for All and the Swiss Catholic Lenten Fund want to see a reduction in palm oil consumption. They believe voluntary initiatives by the palm oil sector to clean up the industry have done nothing to...

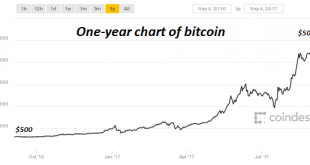

Read More »Bitcoin, Sour Grapes and the Institutional Herd

The point is institutional ownership of bitcoin is in the very early stages. If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I’d be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious: 1. Everything is in a bubble now: stocks, bonds, housing, heck, even bat guano is bubblicious. Exactly what insight is being added by yet another guru...

Read More »2017 Is Two-Thirds Done And Still No Payroll Pickup

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a...

Read More »How to Make the Financial System Radically Safer

Preventing the Last Crisis Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism. The terrible scourge of bruxism and its potentially terrifying...

Read More »The world’s steepest funicular

Switzerland has the world’s steepest funicular, able to surmount a 47-degree incline. Engineers in canton Schwyz had to develop a completely new sort of railway for it. Tests are currently underway to put the novel technology through its paces. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos...

Read More »Dommage que Monnaie pleine ait omis de prévoir des mesures pour brider les risques que fait porter la BNS sur le contribuable.

Site de l’initiative Monnaie pleine: http://www.initiative-monnaie-pleine.ch/texte-de-linitiative/ Le peuple suisse va voter sur une initiative qui porte le nom de « monnaie pleine ». Cette initiative est partie du constat que les banques émettent de la monnaie scripturale dite monnaie-dette ou monnaie bancaire, et souhaite rendre la BNS seule responsable de la création monétaire, comme c’est d’ailleurs prévue par...

Read More » SNB & CHF

SNB & CHF