UBS beats market expectations with billion-euro quarterly profit Keystone-SDA Listen to the article Listening the article Toggle language selector English (US)

Topics:

Swissinfo considers the following as important: 3.) Swissinfo Business and Economy, 3) Swiss Markets and News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

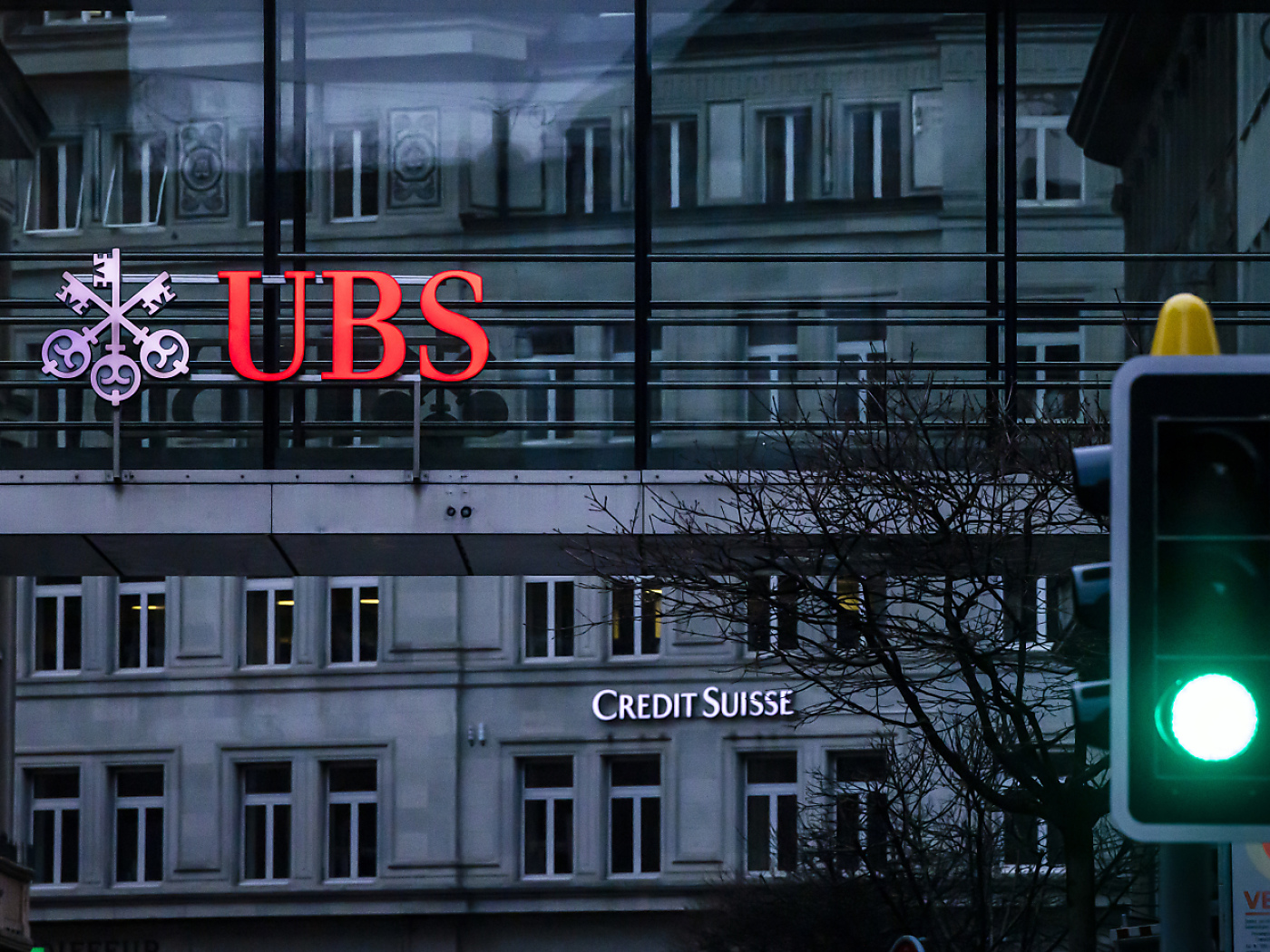

Swiss bank UBS generated a billion-franc profit in the third quarter of 2024 and once again significantly exceeded market expectations. The big bank continues to make rapid progress with the restructuring and integration of Credit Suisse.

+Get the most important news from Switzerland in your inbox

UBS generated a profit of $1.43 billion (CHF1.24 billion) in the months of July to September 2024, as announced on Wednesday. In the third quarter of 2023, the bank had still suffered a loss of $715 million, mainly due to high integration costs following the takeover of Credit Suisse.

However, in the first two quarters of 2024, the combined banking group had already generated profits in the billions (Q1 $1.76 billion; Q2 $1.14 billion). UBS put its pre-tax profit in the quarter under review at $1.93 billion; adjusted – excluding the costs of the Credit Suisse integration – it was as much as $2.39 billion. All of these figures were well above experts’ estimates.

At $12.3 billion, operating income was 5.5% higher than in the same quarter of the previous year. The cost/income ratio, which is important for financial institutions, was 83.4% (adjusted: 78.5%).

High inflow of new money

In its core business, global wealth management, UBS attracted net new money of $24.7 billion.

The bank also made further progress with the integration of Credit Suisse. UBS CEO Sergio Ermotti was quoted in the press release as saying that the implementation risks were being actively limited and that the cost and efficiency targets were also being pursued in a “disciplined” manner. As a result, risk-weighted assets in the settlement unit were further reduced and the bank continued to cut costs.

In the third quarter, gross cost savings amounted to $0.8 billion. UBS expects to achieve around $7.5 billion of the total targeted savings of around $13 billion (58%) by the end of 2024. The bank also believes it is “well on track” to achieve “further significant savings” towards the end of 2025 and in 2026.

The bank also emphasises that it intends to stick to its dividend and share buyback targets for 2025 and 2026 thanks to its continued strong capital position.

UBS is cautious as usual in its outlook for the operating business. Clients continued to be active in the third quarter and the market environment was positive, but characterised by phases of increased volatility and distortions. This environment continued at the beginning of the fourth quarter, supported by a soft landing of the US economy.

In the other regions, however, the economic outlook remained gloomy. In addition, the geopolitical conflicts and the upcoming US elections are causing uncertainty.

Adapted from German by DeepL/jdp

This news story has been written and carefully fact-checked by an external editorial team. At SWI swissinfo.ch we select the most relevant news for an international audience and use automatic translation tools such as DeepL to translate it into English. Providing you with automatically translated news gives us the time to write more in-depth articles.

If you want to know more about how we work, have a look here, if you want to learn more about how we use technology, click here, and if you have feedback on this news story please write to [email protected].

Tags: Featured,newsletter