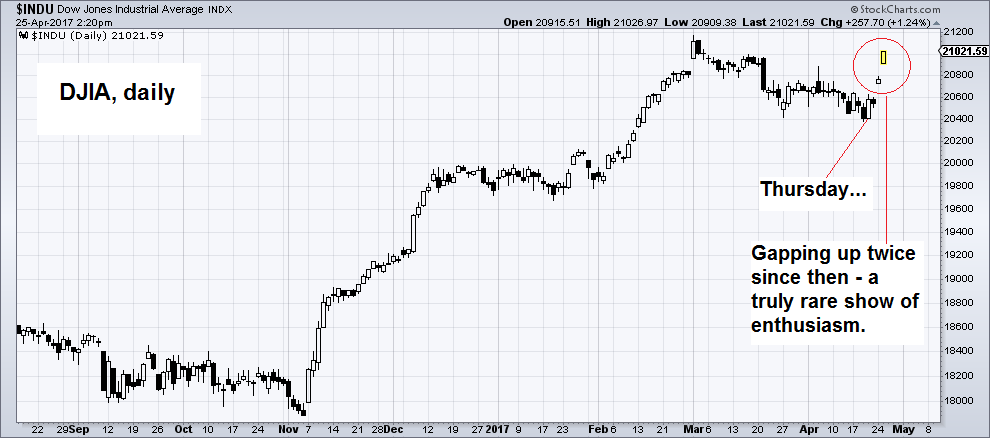

Honest Profession GUALFIN, ARGENTINA – The Dow rose 174 points on Thursday. And Treasury Secretary Steve Mnuchin said we’d have a new tax system by the end of the year. Animal spirits were restless. But which animals? Dumb oxes? Or wily foxes? Probably both. But what caught our attention were the central bankers strutting across the yard and crowing with such numbskull cackles that even barnyard animals would be embarrassed by them. There was a time when central banking was an honest profession. Dow Jones Industrial Average Index, Daily, Sep 2016 - May 2017(see more posts on Dow Jones Industrial Average, )Since Thursday there have been two additional very spirited up days with large gaps – this is very rare in the DJIA, particularly from such a high level after a ~240% rally since the lows made 8 years ago… it continues to feel like a blow-off (and it happens against the backdrop of a sharp slowdown in money supply growth). - Click to enlarge Central bankers provided financing for the government. They backed the banking system, too, by holding savings as reserves, which they lent to solvent member banks in emergencies. They were tight-lipped, tight-laced, and tightwads. Their role was to say “no” more often than “yes.

Topics:

Bill Bonner considers the following as important: Central Banks, Debt and the Fallacies of Paper Money, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Honest ProfessionGUALFIN, ARGENTINA – The Dow rose 174 points on Thursday. And Treasury Secretary Steve Mnuchin said we’d have a new tax system by the end of the year. Animal spirits were restless. But which animals? Dumb oxes? Or wily foxes? Probably both. But what caught our attention were the central bankers strutting across the yard and crowing with such numbskull cackles that even barnyard animals would be embarrassed by them. There was a time when central banking was an honest profession. |

Dow Jones Industrial Average Index, Daily, Sep 2016 - May 2017(see more posts on Dow Jones Industrial Average, ) Since Thursday there have been two additional very spirited up days with large gaps – this is very rare in the DJIA, particularly from such a high level after a ~240% rally since the lows made 8 years ago… it continues to feel like a blow-off (and it happens against the backdrop of a sharp slowdown in money supply growth). - Click to enlarge |

| Central bankers provided financing for the government. They backed the banking system, too, by holding savings as reserves, which they lent to solvent member banks in emergencies. They were tight-lipped, tight-laced, and tightwads. Their role was to say “no” more often than “yes.”

When the king wanted money to fight in a war… or build a bridge… the banker would give the terse reply: “Sire, we don’t have any.” Real money was backed by gold. And credit had to be backed by real money, which meant it had to be saved. Savings were limited, as was money. Savings backed 100% of U.S. credit needs until about 1973… two years after President Nixon first announced that the dollar would no longer be backed by gold. Then, almost unnoticed, a new financial system took over, with new central bankers in control of it. Forty-five years later, America saves scarcely 20% as much as it issues in new credit. The other 80% is “funny money” – credit created out of nowhere by the Fed, by banks, and by foreign central banks (mostly recycling trade surpluses). |

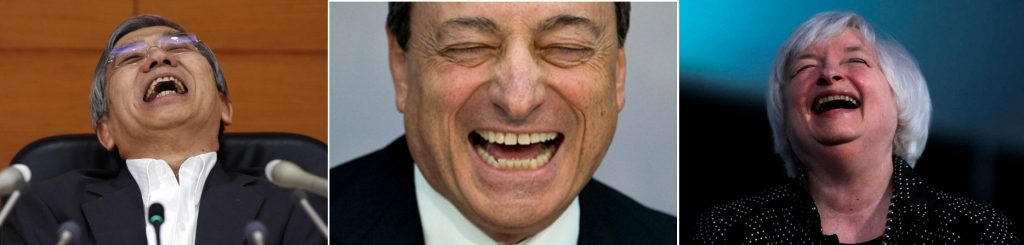

Cackling central planners – this reminds us of the “FOMC meeting laughtrack” of 2003-2007 – the more Fed members laughed at their meetings, the closer the economy and financial system came to the near fatal implosion of 2007-2009. - Click to enlarge Do today’s monetary bureaucrats have more of a clue than their predecessors just before the GFC? The answer is an emphatic no – they have simply doubled down and blown an even bigger credit and asset bubble. The notion that the monstrosity they have midwifed can somehow be “soft-landed” is laughable. |

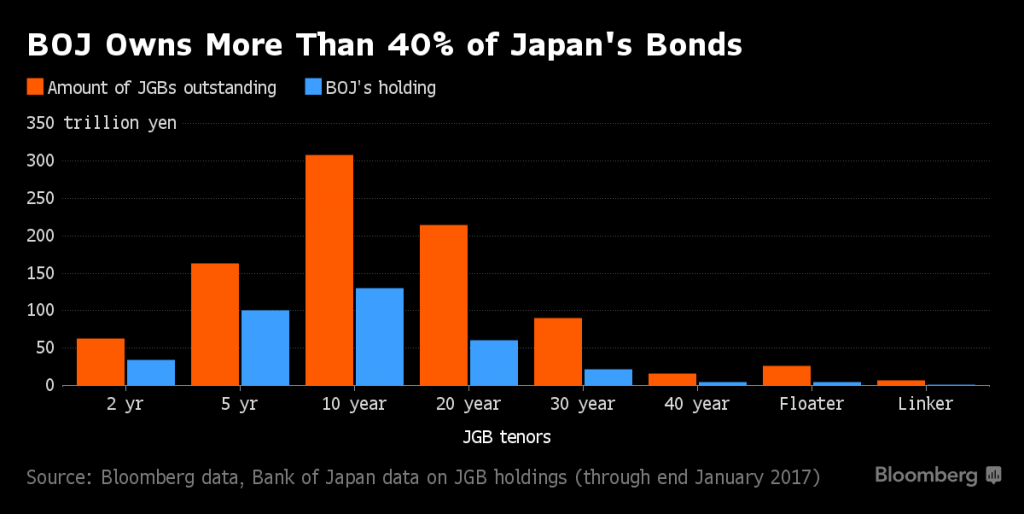

Doomsday BugHaruhiko Kuroda, governor of the Bank of Japan, says he’s going to put out a lot more of this funny money. Bloomberg:

“The target is 2%,” said Kuroda of the rate at which the BOJ hopes to destroy its own currency. “We’re still around 0%. So it’s a long way to go,” he said. The Bank of Japan already owns 40% of outstanding Japanese government debt. It apparently sees no barrier to buying all of it – financing Japan’s deficits with make-believe money. This is not going to happen. Readers will be quick to remember why. Our little secret: Unlike the real-money system that prevailed until 1971, this system – with its heavy reliance on credit – is, surprise, surprise, extremely vulnerable to the credit cycle. This is the “doomsday bug” buried in the world’s money system. When the credit cycle turns – when people begin to notice that the whole system is FUBAR and become reluctant to lend – the world’s money disappears… and the whole thing blows to smithereens. |

Bank of Japan Bond Holdings(see more posts on Bank of Japan, ) The Japanese government by now owes 40% of the money it has borrowed to itself – and it has borrowed a lot. Its previous lenders have received yen in return, which the BoJ literally creates from thin air. - Click to enlarge Since Haruhiko Kuroda seems bent on continuing to do this, the situation is bound to become ever more absurd. As long as “confidence” remains strong, such policies can be continued for a good while without triggering untoward developments. Soon everybody believes that nothing bad can possibly happen – until one fine day this air of false security evaporates in a flash… |

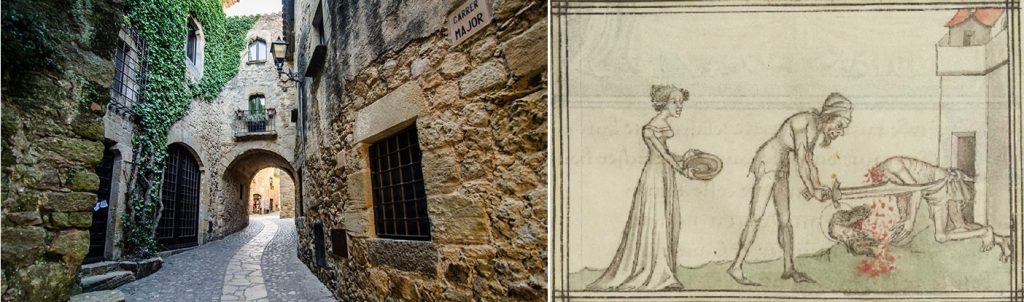

Cockamamie ProjectBut back to honest central bankers.´Another key responsibility of the pre-1971 central banker was to protect the national currency. Money was limited. Everyone knew it. You couldn’t afford to waste it. Or lose it. Or depreciate it. And if a banker failed, he was disgraced, fired and ruined. In ancient England, a banker who lost the kingdom’s money was castrated. Times have changed, as they say. Now, central bankers are more secure in their private parts and public illusions. They are no longer expected to act within an economy, but upon it. They are no longer expected to be the lender of last resort, but the lender of first, second, and every other resort. Nor are they expected to confine their credit – the precious savings of the realm – to solvent institutions that will pay it back. Instead, they are encouraged to spread their fake money far and wide, scattering it like manna upon every half-wit and spendthrift in the empire. Do the feds have some cockamamie spending project? Does a corporation want to borrow to buy back its shares? Do the baby boomers want more medical benefits? Hey, no problem, says the Fed. There is plenty of this fake money for everyone. No need to dip into the nation’s savings to fund the fool projects. Now the central bank can conjure up credit money – out of nowhere! |

Keeping bankers honest… Catalonia’s banking system was quite solvent for most of the 14th century. - Click to enlarge In February 1300 it was stipulated that a banker who went bankrupt would be publicly vilified throughout the country and forced to live on a strict diet of bread and water until he made his creditors whole. In August 1321 banking legislation was made more strict: Bankers who were unable to fulfill their obligations to depositors right away would be declared bankrupt. If they failed to pay their debts within one year, they would fall into public disgrace, which would be proclaimed by a town crier throughout Catalonia. Thereafter, the banker concerned would be beheaded in front of his counter, and his property auctioned off to pay his creditors. This did not end well for a banker by the name of Francesch Castello, who was indeed beheaded in 1360 after he was found to have kept insufficient funds in reserve to pay his depositors. No lender of last resort was available to quickly print up money substitutes suitable for fobbing off irate account holders. |

Gabbing LunaticsCometh the new money, cometh the new central bankers. Gone are the tight lips and carefully chosen words. Now they will say anything, gabbing away like inmates in a special asylum for lunatic economists. Japan’s central banker thinks he can replace real savings with phony credits, indefinitely. Today, the world’s major economies, twisted and befuddled by central bankers’ policies, depend on debt. In the U.S., $2.5 trillion in new credit is required every year – just to stay in about the same place. Less than that causes a recession, which sets off a credit contraction, the last thing the feds can tolerate. But total savings in the U.S. amount to only about $500 billion. Uh… you can do the math later. Meanwhile, Bloomberg reports that the U.S. Fed is less likely to “blink” than in the last tightening cycle:

Blink? The Fed will put out both eyes with a ballpoint pen before it will allow a return to honest finance. It’s not going to happen. |

Tags: central banks,Featured,newsletter