Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary...

Read More »Housing Bubble Symmetry: Look Out Below

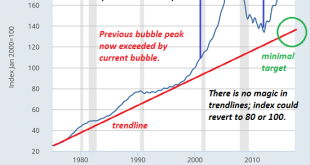

Housing markets are one itsy-bitsy recession away from a collapse in domestic and foreign demand by marginal buyers. There are two attractive delusions that are ever-present in financial markets:One is this time it’s different, because of unique conditions that have never ever manifested before in the history of the world, and the second is there are no cycles, they are illusions created by cherry-picked data;...

Read More »Place financière genevoise, une noyade dans l’anonymat.

“Avant, à Genève, il régnait une effervescence certaine. Les gens dépensaient de l’argent, certes pas forcément déclaré. Aujourd’hui, ce temps est fini et on ne voit pas vraiment ce qui pourrait extraire la ville et sa place financière de cette stagnation”. Exprimé en privé voici quelques jours par un professionnel de la finance de la cité de Calvin, ce constat rejoint celui de beaucoup, beaucoup d’autres gens ayant...

Read More »Geneva and Lausanne remain Switzerland’s toughest home markets

© Nwanda76 | Dreamstime - Click to enlarge Home vacancy rates in Switzerland’s main cities have all risen over the last few years, bringing some hope to those looking for a place to live. The latest 2017 data confirm this trend. While these percentage shifts might appear big, very low vacancy rates underly them. On 1 June 2012, none of these cities had a vacancy rate above 1%. Zurich (0.29%), Bern (0.48%), Basel...

Read More »Emerging Markets: What has Changed

Summary: China plans to issue its first USD-denominated bond since 2004. China’s largest banks banned North Koreans from opening new accounts. The UN Security Council approved new sanctions on North Korea. Relations between Poland and the European Commission remain tense. Brazil’s central bank appears to be signaling discomfort with ongoing BRL strength. Brazil President Temer faces a second set of criminal charges....

Read More »Gold Up, Markets Fatigued As War Talk Boils Over

North Korea threatens to reduce the U.S. to ‘ashes and darkness’ Markets becoming used to ongoing provocations from North Korea Russia and China continue to support watered down versions of sanctions on Kim’s regime Both NATO and Russia running war games on one another’s borders Putin says Russia will “give a suitable response” to NATOs threatening behaviour Gold set to climb as fears over economy and war will drive...

Read More »21st Century Shoe-Shine Boys

Anecdotal Flags are Waved “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.” – Joseph Kennedy It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning,...

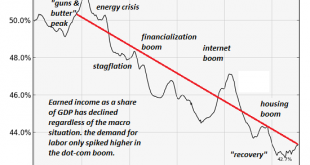

Read More »The Real Reason Wages Have Stagnated: Our Economy is Optimized for Financialization

Labor’s share of the national income is in freefall as a direct result of the optimization of financialization. The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing...

Read More »Les «diamants de sang» zimbabwéens circulent librement sur les marchés internationaux. La Tribune

Une mine de diamants… - Click to enlarge L’ONG britannique Global Witness vient de publier ce 11 septembre un rapport explosif qui met à nu des opérations de détournement des revenus du secteur minier zimbabwéen par l’élite militaire et politique du pays pour financer les opérations répressives du régime du président Mugabe. Le document, intitulé «An Inside Job», est basé sur l’examen de près des activités et bilans...

Read More »FX Daily, September 15: Short Note Ahead of the Weekend

(Sporadic updates continue as the first of two-week business trip winds down) Swiss Franc The Euro has risen by 0.03% to 1.1481 CHF. EUR/CHF and USD/CHF, September 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates North Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit...

Read More » SNB & CHF

SNB & CHF