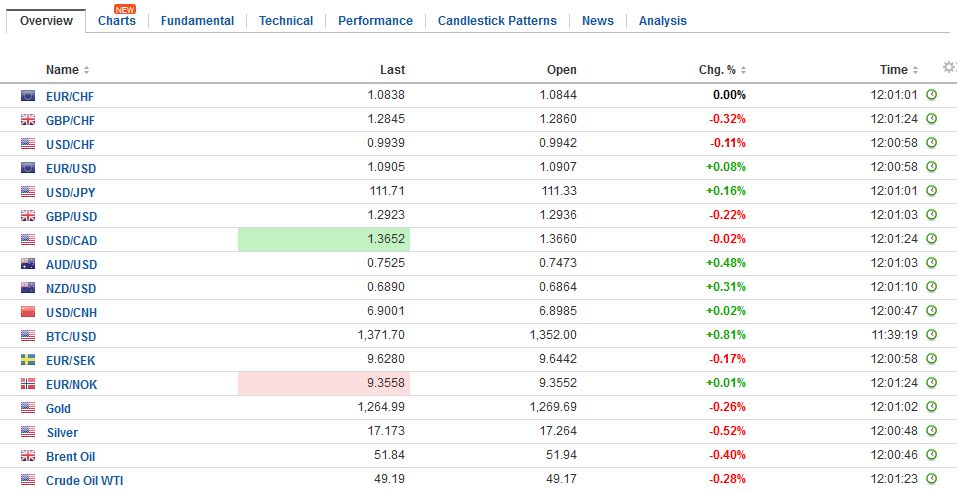

Swiss Franc Switzerland Retail Sales YoY, March 2017(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge FX Rates Many financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed. The yen is the weakest of the majors, off about 0.3% as the greenback pushes above least week’s high as it draws a bead on the JPY112.00 level. This area corresponds with a 50% retracement of the dollar’s decline from JPY115.50 in early March (~JPY111.85) and 38.2% retracement from the year’s high near JPY118.60 (JPY112.15). US 10-year yields are a touch firmer, which is correlated with a stronger dollar against the yen. The main news today is that the US Congress appears to have struck a compromise on the spending for the remainder of the fiscal year that averts a government shutdown. The bipartisan agreement apparently has little in common with the wish list that President Trump had proposed. There is no money for a border wall with Mexico. There is money for Planned Parenthood. There are funds for famine relief and the National Institute for Health.

Topics:

Marc Chandler considers the following as important: China Manufacturing PMI, China Non-Manufacturing PMI, EUR, Featured, FX Trends, GBP, Japan Manufacturing PMI, JPY, newslettersent, Switzerland retail sales, U.S. Treasuries, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

Switzerland Retail Sales YoY, March 2017(see more posts on Switzerland Retail Sales, ) Source: Investing.com - Click to enlarge |

FX RatesMany financial centers are closed for May. Japanese markets were open today, but will be closed for three sessions beginning Wednesday for the Golden Week celebrations. The US dollar is narrowly mixed. The yen is the weakest of the majors, off about 0.3% as the greenback pushes above least week’s high as it draws a bead on the JPY112.00 level. This area corresponds with a 50% retracement of the dollar’s decline from JPY115.50 in early March (~JPY111.85) and 38.2% retracement from the year’s high near JPY118.60 (JPY112.15). US 10-year yields are a touch firmer, which is correlated with a stronger dollar against the yen. The main news today is that the US Congress appears to have struck a compromise on the spending for the remainder of the fiscal year that averts a government shutdown. The bipartisan agreement apparently has little in common with the wish list that President Trump had proposed. There is no money for a border wall with Mexico. There is money for Planned Parenthood. There are funds for famine relief and the National Institute for Health. The Department of Defense got about half the funds that the President requested and numerous policy restrictions were eliminated. While the Republican Party has a majority in the Senate and House of Representatives, it suffers internal divisions. The budget compromise illustrates that moderate Republicans and moderate Democrats have more in common with each other that with the more extreme wings of the respective parties. Recall, for example, that 16 Republicans rejected the agreement before the weekend for a few day extension to avert a government shutdown. |

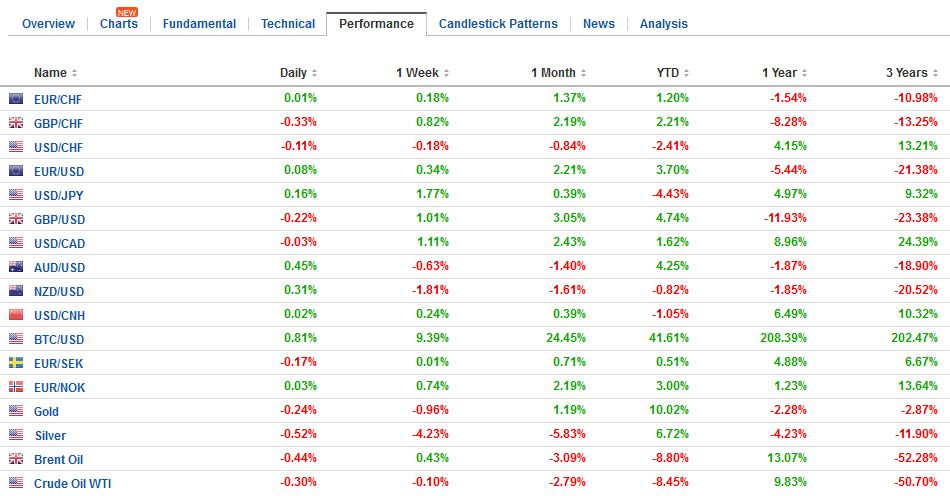

FX Daily Rates, May 01 |

| Sterling edged 1/100 of a cent through the pre-weekend high in early Asia (to $1.2966) before easing to $1.29. It has subsequently bounced about a third of a cent. At the EU Summit, UK Prime Minister May apparently learned that the EU holds the most important cards now. The EU insists on first settling the terms of the divorce before discussing the terms of a new agreement. This may take some time. May had hoped for parallel talks but has been consistently rebuffed.

Italy’s Renzi won the open primary in the PD fairly handily. According to initial projections, he won with around 70%-75% of the party vote. This was in line with estimates. The problem is that a part of the PD already broke off, and this could weaken the PD which is being challenged by the Five Star Movement. Meanwhile, current Prime Minister Gentiloni is facing banking issues (reports suggest the government will hold more than 70% of Banca Popolare di Vicenza and Veneto Banca after they are merged, and the bridge loan for Alitalia could be more than 500 mln euros., according to press reports. The euro gapped higher a week ago in response to the outcome of the first round of the French elections. It has been trading broadly sideways since then, mostly between $1.0850 and $1.0950. It is in the middle of that range as North American dealers return to their posts. Similarly, the Dollar Index gapped lower last week and had also been consolidating (~98.70-99.35). It is still not clear what kind of gap is in place. A normal gap is expected to be filled shortly, while a breakaway or measuring gap would suggest additional dollar losses likely. |

FX Performance, May 01 |

United StatesUS 10-year Treasury yields eased in the second half of last week. They slipped five basis points in the last three sessions but ticked up today. However, it is still is struggling to re-establish a foothold above 2.30%. The week’s key events include the FOMC meeting, US auto sales, April jobs report, the quarterly refunding announcement and a host of corporate earnings. On balance, after a weak March, both auto sales and employment is expected to bounce back. The FOMC meeting is unlikely to generate much excitement. No one expects a rate change after the move in March. The poor Q1 GDP is practically immaterial for a June move. Bloomberg estimates the odds of a June hike at a little more than 59%, while the CME sees it closer to 63% chance. Today’s personal income and consumption data was already incorporated in the advanced GDP estimate and hence contain no new information. The manufacturing PMI and ISM may garner some attention, but the market impact is likely to be muted. |

Yield US Treasuries 10 years May 2016 - May 2017(see more posts on U.S. Treasuries, ) Source: Bloomberg.com - Click to enlarge |

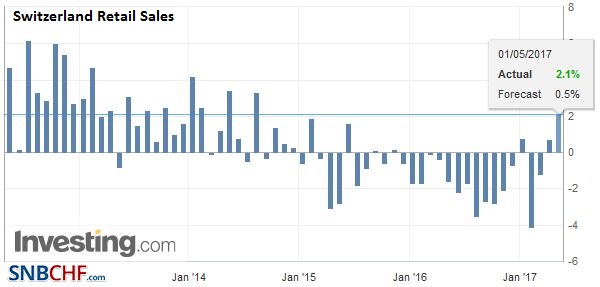

JapanMost Asian and European markets are closed. Japanese shares rose a little more than 0.5%. The Nikkei tried in vain to fill the downside gap created with last Wednesday’s higher opening. When this failed, it recovered smartly to its best level in over a month. The advance was led by information technology and materials, with energy and consumer discretionary noted drags. |

Japan Manufacturing PMI, April 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

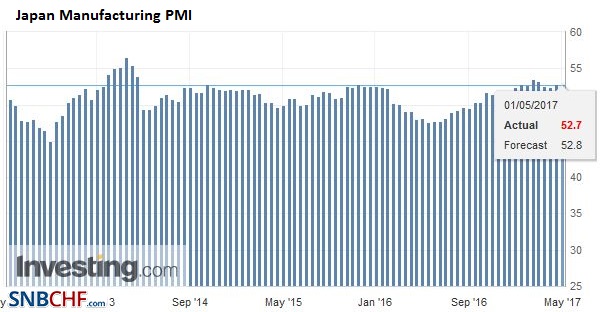

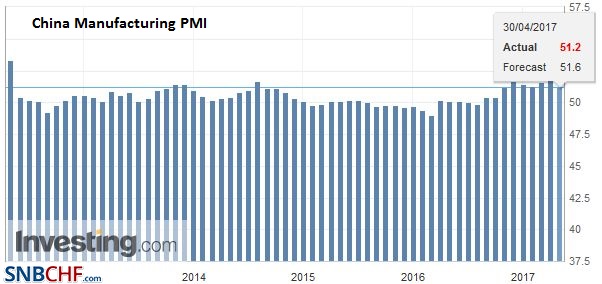

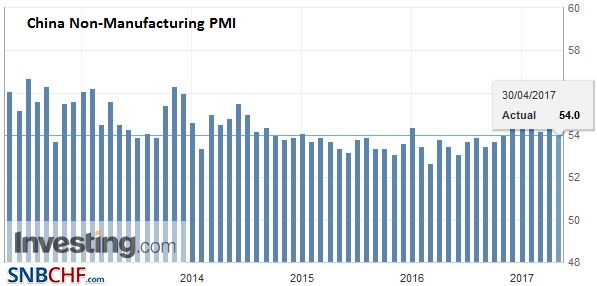

ChinaChina reported softer official PMI readings over the weekend. Many commentators are warning that the world’s second-largest economy may have seen peak growth in Q1. Officials, seemingly content with the better growth appear to have turned their attention to toughening the enforcement of regulations regarding lending and investing. |

China Manufacturing PMI, March 2017(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| There are some signs that capital outflows may have picked up and the April reserve figures due out perhaps toward the end of the week will be closely watched after small increases in February and March. Note that some central banks, like Brazil and Mexico, intervene via swaps which minimize the draw on reserves. |

China Non-Manufacturing PMI, March 2017(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Australia

Australian equities gained 0.55% ahead of tomorrow’s RBA meeting. Utilities, industrials, and consumer staples led the rally. Energy, health care, and materials were minor drags. The Reserve Bank of Australia is expected to remain on hold, where it has been for nine months. The Australian dollar is trading at three-day highs to poke through $0.7500. We don’t look for it to make much headway through the $0.7520-$0.7535 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,China Manufacturing PMI,China Non-Manufacturing PMI,Featured,Japan Manufacturing PMI,newslettersent,Switzerland Retail Sales,U.S. Treasuries