Tidjane ThiamTidjane Thiam, Credit Suisse CEO since 2015. (Keystone) - Click to enlarge A Swiss hedge fund is poised to launch an activist campaign to break up Credit Suisse, tapping into investor impatience with the progress of the bank’s turnround under chief executive Tidjane Thiam. RBR Capital Advisors, supported by Gaël de Boissard, a former Credit Suisse investment bank co-head, is set to unveil the...

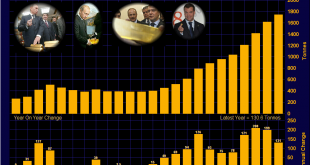

Read More »Neck and Neck: Russian and Chinese Official Gold Reserves

Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those...

Read More »About Those “Hedonic Adjustments” to Inflation: Ignoring the Systemic Decline in Quality, Utility, Durability and Service

The quality, durability, utility and enjoyment-of-use of our products and services has been plummeting for years. One of the more mysterious aspects of the official inflation rate is the hedonic quality adjustments that the Bureau of Labor Statistics makes to the components of the Consumer Price Index (CPI). The basic idea is that when innovations improve the utility (and pleasure derived from) a product, the price is...

Read More »Top Swiss guns show off shooting skills

Every autumn, Swiss Air Force pilots show off their professional skills at the highest aerial firing range in Europe. (SRF/swissinfo.ch) The annual Swiss Air Force live fire eventexternal link is underway at the Axalp–Ebenfluh air force shooting range in the Bernese Oberland. Tuesday’s training brought hoards of hikers to the spectators’ areas at an altitude of 2,200m above sea level. The venue can only be reached on foot by taking marked mountain paths. The event, which attracts thousands,...

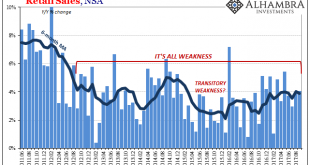

Read More »US Retail Sales: Retail Storms

Retail sales were added in September 2017 due to the hurricanes in Texas and Florida (and the other states less directly impacted). On a monthly, seasonally-adjusted basis, retail sales were up a sharp 1.7% from August. US Retail Sales, Jun 2011 - Aug 2017(see more posts on U.S. Retail Sales, ) - Click to enlarge The vast majority of the gain, however, was in the shock jump in gasoline prices. Retail sales at...

Read More »Weekly Technical Analysis: 16/10/2017 – USDJPY, EURUSD, GBPUSD, EURJPY

USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 16(see more posts on USD/JPY, ) - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 16(see more posts on EUR/USD, ) - Click to enlarge GBP/USD [embedded content]...

Read More »Bern’s SkyWork could be grounded at end of month

SkyWork currently serves some 17 destinations from the Swiss capital (Keystone) - Click to enlarge SkyWork Airlines, which flies to various European destinations from Bern Airport, may be forced to cease operations by the end of October due to its unstable financial situation. The Federal Office of Civil Aviation (FOCA) has limited SkyWork’s operating permit to the end of this month because the company is...

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece...

Read More »Migration of the Tax Donkeys

Dear local leadership: here’s the formula for long-term success. A Great Migration of the Tax Donkeys is underway, still very much under the radar of the mainstream media and conventional economists. If you are confident no such migration of those who pay the bulk of the taxes could ever occur, please consider the long-term ramifications of these two articles: Stanford Says Soaring Public Pension Costs Devastating...

Read More »FX Weekly Preview: The Markets and the Long Shadow of Politics

Summary: Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month. Why should we think there is anything amiss by looking at the global capital markets? The S&P 500 and the German Dax are at record levels. The Japanese market is at 20-year...

Read More » SNB & CHF

SNB & CHF