Lukas Reimann, a parliamentarian and member of the Swiss Peoples Party (UDC/SVP), fought to have parliamentarians paid by health companies partially excluded from government commissions dealing with health issues. © Martin Šandera | Dreamstime.com - Click to enlarge He thinks vested interests are behind high health premiums and that cartels must be broken. According to him 23 out of 25 of the members on such health...

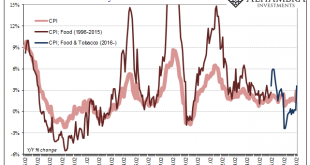

Read More »China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices. Rising...

Read More »The latest horse meat scandal:

Horses in South American slaughterhouses are mistreated – and their meat might end up on Swiss plates. Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and...

Read More »Stock and Bond Markets – The Augustine of Hippo Plea

Lord, Grant us Chastity and Temperance… Just Not Yet! Most fund managers are in an unenviable situation nowadays (particularly if they have a long only mandate). On the one hand, they would love to get an opportunity to buy assets at reasonable prices. On the other hand, should asset prices actually return to levels that could be remotely termed “reasonable”, they would be saddled with staggering losses from their...

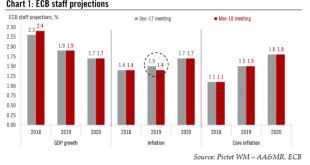

Read More »ECB begins to rotate forward guidance

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has...

Read More »Drive for women in top jobs suffers setback

For the first time since 2009 the percentage of women in top management positions has decreased (Keystone) - Click to enlarge The percentage of women in top executive positions dropped slightly in Switzerland last year, a report has found. The annual survey by the Schilling human resource consultancyexternal link shows a 1% drop to 7% in 2017 compared with the previous year. In 2016, the share of women in...

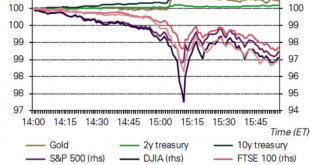

Read More »Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk – Recent stock market selloff showed gold can deliver returns and reduce portfolio risk– Gold’s performance during stock market selloff was consistent with historical behaviour– Gold up nearly 10% in last year but performance during recent selloff was short-lived– The stronger the market pullback, the stronger gold’s rally– WGC: ‘a good time for investors to...

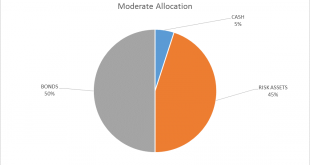

Read More »Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock...

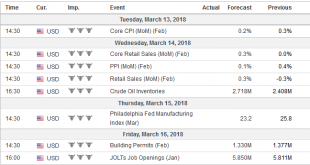

Read More »FX Weekly Preview: Another Goldilocks Moment

Spring is around the corner in the Northern Hemisphere, and with it, a sense of a Goldilocks moment. Growth is sufficiently strong to see employment grow and absorb the economic slack. In the US, the participation rate of the key 25-54 aged demographic group has risen and now stands at 89.3%, the highest since 2010. Europe enjoys the broadest economic expansion in more than a decade, and while Japanese growth has not...

Read More »Emerging Markets: Preview Week Ahead

Stock Markets EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month. Stock Markets Emerging Markets,...

Read More » SNB & CHF

SNB & CHF