As we enter the final quarter of 2024, there are a lot of questions facing investors. There are, of course, always a lot of questions because investors are always dealing with the future, but today’s environment does seems to have more than usual. Some of these questions concern short-term considerations and while they are important, it is more important to remain focused on the long-term trends. Here’s what I’m thinking about lately:

Let’s get the one everyone is thinking about out of the way first – the election. I have no idea who will win and I don’t think anyone else does either. But assuming neither party manages a sweep of the House, Senate, and White House, economic policy probably remains pretty much status quo. There will be minor changes, probably in

Articles by Joseph Y. Calhoun

Weekly Market Pulse: It’s An Uncertain World

September 3, 2024You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year. You’ll see a lot of pundits say with great confidence that this means we are on the verge of recession. Which may or may not be true but if we are, I’d suggest that the yield curve is a lot more effect than cause. Let’s take a little walk down yield curve memory lane.

The yield curve has become a notorious recession indicator, with short-term rates rising above long-term rates before every US recession back to,

Market Morsel: SLOOSing

August 6, 2024The Senior Loan Officer Survey came out yesterday and I’m sure you’ve been waiting on pins and needles, as I have, to see the results. Okay, maybe you had better things to do. I sure hope so because it isn’t exactly riveting. Here’s the description from the Fed’s website:

Survey of up to eighty large domestic banks and twenty-four U.S. branches and agencies of foreign banks. The Federal Reserve generally conducts the survey quarterly, timing it so that results are available for the January/February, April/May, August, and October/November meetings of the Federal Open Market Committee. The Federal Reserve occasionally conducts one or two additional surveys during the year. Questions cover changes in the standards and terms of the banks’ lending and the state of

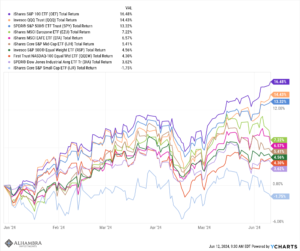

Market Morsel: How “The Market” Is Really Doing

June 12, 2024When people talk about “the market” they are usually referring the big indexes – the S&P 500 or the NASDAQ. For more casual observers, “the market” is the Dow which is a lousy index for a lot of reasons but has the advantage of history. But are any those really representative of how “the market” is doing? Not really.

All markets – stocks, bonds, currencies, commodities – provide us with valuable information about the economy. The stock market generally reflects corporate profit growth and interest rates which provides us with important feedback about economic growth and inflation. The broader the index, the more representative of the economy as a whole.

The way indexes are constructed makes a big difference in the information you can extract about the economy. The

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

April 15, 2024Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market. In the short run, all that matters is what the majority believes is the truth. What they believed last week was that inflation isn’t falling fast enough and the Fed will not be cutting rates anytime soon. That was enough to send the bond market into a tizzy which impacted, well, everything. Stocks were down with small and midcaps taking it worse than large caps. Real estate was down but wasn’t the worst performing sector as financials, materials, and healthcare all fared worse. Commodities and crude oil were down even with the Middle East bracing for

Read More »Weekly Market Pulse: Monetary Policy Is Hard

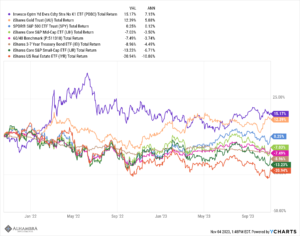

November 6, 2023So, is that it? Have rates peaked? Is the long bear market finally over?

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by more than a rounding error over that time.

The culprit, the reason stocks and bonds did so poorly over that time, is pretty simple – interest rates. The 10-year Treasury note yield roughly tripled during that time and all assets have been affected by those higher rates. Since January 1. 2021, the consumer price index

Read More »Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

February 13, 2023As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS getting past the Oval Office secretary might prove difficult. But if these turn out to be our own weather balloons, I will predict confidently now that President Biden will soon announce a program to replace them and a count of the jobs created to do so.

The State of the Union address by the President

Weekly Market Pulse: Happy Days Are Here Again!

February 7, 2023Your cares and troubles are gone

There’ll be no more from now on!

Happy days are here again!

The skies above are clear again

Let us sing a song of cheer again

Happy days are here again!

Lyrics: Jack Yellen, Music: Milton Ager

That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P 500. Bonds have been cooperating too with the longest term bonds putting up returns that rival stocks while interest rates have avoided a collapse that might indicate recession is nigh.

Indeed, it is the lack of recession that is driving this rally that includes everything but commodities (except for a small rally by gold).

It is

Weekly Market Pulse: A Fatal Conceit

January 24, 2023Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Real disposable income is up 0.8% in the last six months but was down 3.3% in the six months prior. Real (inflation-adjusted) personal consumption of goods is down 0.7% over the last year but real personal consumption of services is up 3.5% and services spending is 60% higher than that for goods. US payrolls are up 4.5 million jobs in the last year and there are still

Weekly Market Pulse: The Consensus Will Be Wrong

January 9, 2023What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business. So, no, I don’t know what’s going to happen this year. I do know what the consensus view is, what the majority expects to happen, and that may be more useful. Because if the consensus is right this year it may well be the first time ever.

We got a few things right last year but it wasn’t from predicting anything; it was from observing. Late in 2021 we made a decision to completely avoid US growth stocks because valuations had become so extreme. It was, frankly, one

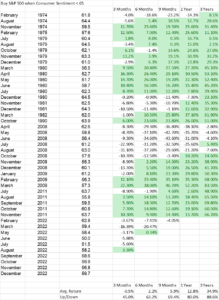

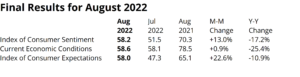

Great News! Consumer Sentiment Is Awful!

January 4, 2023I don’t know how many times I’ve seen blog posts or articles or Tweets about negative consumer sentiment over the last year. These articles rightly point out that the University of Michigan consumer sentiment survey is sitting near (or at a few months ago) 50 year lows. This fact is taken as a negative for the economy and therefore stocks. The only problem is that sentiment today tells you only how people view things today – and investing is about the future. If markets are even a little efficient – and that’s exactly how I’d describe them – then current stock prices should already reflect the poor sentiment. Future stock prices will reflect consumer sentiment when it is measured then.

And if you are near a 50 year low, future sentiment almost has to improve and

Weekly Market Pulse: Currency Illusion

November 28, 2022When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure there’s really any win to be had for the Chinese people.

Zero COVID has “worked” in the sense that it has limited the number of infections and deaths so far but it has also limited immunity since fewer have been infected.

Opening up completely, even if they decide to import mass quantities of western

Weekly Market Pulse: Good News, Bad News

November 14, 2022One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday. The same could be said of bonds which also had a good week, with the aggregate index up 2.3%.

The stock market rally probably says more about the people doing the buying than it does about the reality of the inflation situation. The CPI report was indeed better than expected, especially the core reading of 0.3% which bested expectations of 0.5%. The headline rate was better too at 0.4% vs 0.6% expected, but it was also the fourth

SPECIAL REPORT: Follow The Money Series – Dawn Of A New Era

October 25, 2022With inflation recently hitting a high not seen since 1981, it is now apparent that the factors that drove the disinflation trend of the last four decades are coming to an end. Globalization and demographics, the two big factors that combined to hold down prices and wages for so long, are reversing, and so too is the downtrend in prices, wages, and interest rates.

While 1970s levels of inflation seem unlikely, several trends are converging to keep upward pressure on prices for years – maybe decades – to come. And that means the long downtrend in interest rates is at an end. This new, inflationary environment will change how we invest for years to come.

It is the dawn of a new era.

Our Special Report on Inflation, Volume 6 in Alhambra’s “Follow The Money” series,

Weekly Market Pulse: Did Powell Just Blink?

October 24, 2022Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close. Then, “the article” hit the front page of the WSJ:

Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes

By Nick Timiraos

The article led with this quote:

“We will have a very thoughtful discussion about the pace of tightening at our next meeting,” Fed governor Christopher Waller said in a speech earlier this month.

And just like that, the markets turned. Interest rates fell across the board – well, except for the very long end of the curve – and stock

Weekly Market Pulse: Just A Little Volatility

October 17, 2022Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rear view mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and hoping for the best I guess.

A hotter than expected PPI didn’t change things much on Wednesday because through hundreds of speeches about inflation over the summer no one at the Fed has mentioned PPI. Apparently inflation at the wholesale level is irrelevant.

But Thursday, well, now that’s a different

Weekly Market Pulse: The Real Reason The Fed Should Pause

October 11, 2022The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to save the people from higher prices. They didn’t mention how shifting people from a job to the unemployment rolls would help those people afford the cheaper food, housing, transportation and iPhones the Fed is confident its policies will provide.

The big problem with the Fed’s plan to kill inflation by

Weekly Market Pulse: Peak Pessimism?

October 3, 2022Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year. The 10-year Treasury yield rose from 2.97% to 4% just a few days before the end of the quarter. The 3-7 year Treasury index – our benchmark for bonds – was down 3.9% for the quarter, only slightly less bad than the S&P 500’s -4.9%.

YTD, the S&P 500 is now down 24% while bonds have their own double-digit losses. Our bond benchmark is down 10.5% for the year and that actually isn’t so bad. The Aggregate index – “the bond market” – is down

Weekly Market Pulse: No News Is…

September 12, 2022Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy. A report that wholesale inventories rose 0.6% cannot be turned into market moving news no matter how hard the newsletter sellers try. Jobless claims fell 8,000? Yawn. Exports rose $500 million? In a $24 trillion economy? Give me a break.

There was the kerfuffle of the S&P US Services PMI versus the ISM Services PMI. The former fell all the way to 43.7 (50 is the dividing line between expansion and contraction) while the latter, supposedly measuring the same thing, rose to 56.9.

Which one is right?

Goldilocks Calling

September 2, 2022Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now.

There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend:

.

Now, some of that, as we know, is due to inflation so if we correct for that we still get a picture of goods consumption above the previous trend but working its way back down:

.

Consumption of services, at first glance, looks as if it is back on trend:

.

But again, if we correct for inflation we see a truer picture of services consumption still below the pre-COVID

Weekly Market Pulse: The Dog That Didn’t Bark

August 29, 2022Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason” for the selloff was Jerome Powell’s speech at the Fed’s Jackson Hole Symposium. Frankly, I don’t think Powell said anything new, his message remarkably similar to his last post-FOMC press conference. But two passages drew attention as being sufficiently different to upset the market. First was this bit,

Read More »Rate Hikes Are Working

August 25, 2022New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%. Obviously, the fall this year is related to rising mortgage rates but that can’t be the reason sales have been falling for nearly two years. For that, I think you have to look at prices which rose 34% from the beginning of 2021 to the peak in April of this year.

.

For housing though “price” isn’t just about the price of the house but also the financing and we all know mortgage rates have risen in recent months. A $250,000 mortgage at 6% has

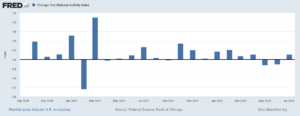

The Economy Improved In July

August 22, 2022The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7.

The index had been down for two consecutive months and both May and June were revised slightly lower. The data in August so far has been positive as well, particularly the production data with IP last week surprising to the upside.

I know it is trendy to see the US economy as heading for or in recession but the data just doesn’t agree. I am not unaware of the risks and if I had to guess I’d say we will have a recession, probably starting in the first half of next year which is when futures markets indicate rates are

Weekly Market Pulse: Same As It Ever Was

August 22, 2022History never repeats itself. Man always does.

Voltaire

Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

I have been a professional investor for now over 30 years and I have seen investors make the same mistakes over and over, as if they are ruled by some mysterious force that prevents them from learning from their past. And that may well be true. Reality is, as Einstein may have said, an illusion, albeit a very persistent one. What we see as reality is in actuality merely an

Weekly Market Pulse: Opposite George

August 1, 2022It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza

If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld

From the Seinfeld episode “The Opposite”

I was talking with a friend last week about the markets and the economy and she said she didn’t understand why the market went up after the GDP report. After all, it was the second quarter in a row of GDP contraction and that’s a recession.

Shouldn’t I be selling stocks? I explained that markets are

Weekly Market Pulse: There Is No Certainty In Investing

July 18, 2022Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record. In this case, it is demand that drives supply rather than the other way around. The constant demand for answers creates an audience for those willing to give them and also drives engagement on social media. You don’t get Twitter followers with a series of posts that effectively say “I don’t know”. I can attest to that personally. Prognostication in the investment business is more about drawing an

Read More »Weekly Market Pulse: A Most Unusual Economy

July 11, 2022The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since the onset of COVID, has been so unusual that anyone confidently predicting anything about how the economy will develop over the coming months is lying – to themselves or you or both. Any model or indicator or rule of thumb that has worked over the last few decades to predict the future course of the

Read More »Weekly Market Pulse: Things That Need To Happen

July 5, 2022Perspective: per·spec·tive | pər-ˈspek-tiv

b: the capacity to view things in their true relations or relative importance

Merriam-Webster

Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view.

Things that seemed so important at the time, years ago, turned out to be nothing more than bumps along the road of life. That is as true in my personal life as it is in my professional one but you don’t need to hear about the former so let’s focus on the latter.

I don’t view the economy through any preconceived lens. My natural state is not negative or positive but open-minded. I can’t predict how the billions of people who make up

Market Pulse: Mid-Year Update

June 24, 2022Note: This update is longer than usual but I felt a comprehensive review was necessary.

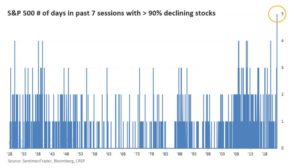

The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days have seen 90% of the stocks in the S&P 500 down on the day and there are only 11 stocks in the index up over the last month. Unprecedented is an overused word but not in this case. Last week was also the second week in a row that saw all the major asset classes down on the week.

And energy stocks led the

Weekly Market Pulse: Is The Bear Market Over?

May 31, 2022Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days. That still leaves the market 13.7% from the intraday high and most investors still down double digits on the year (-11.5% for the standard 60/40 portfolio). For Alhambra investors, the typical moderate risk account is down 4 to 5% or less than half the 60/40. That fact is something to be proud of I suppose but frankly, I hate being down at all. But drawdowns are part of being an investor and the best you can hope for is to minimize them when they happen.

Read More »