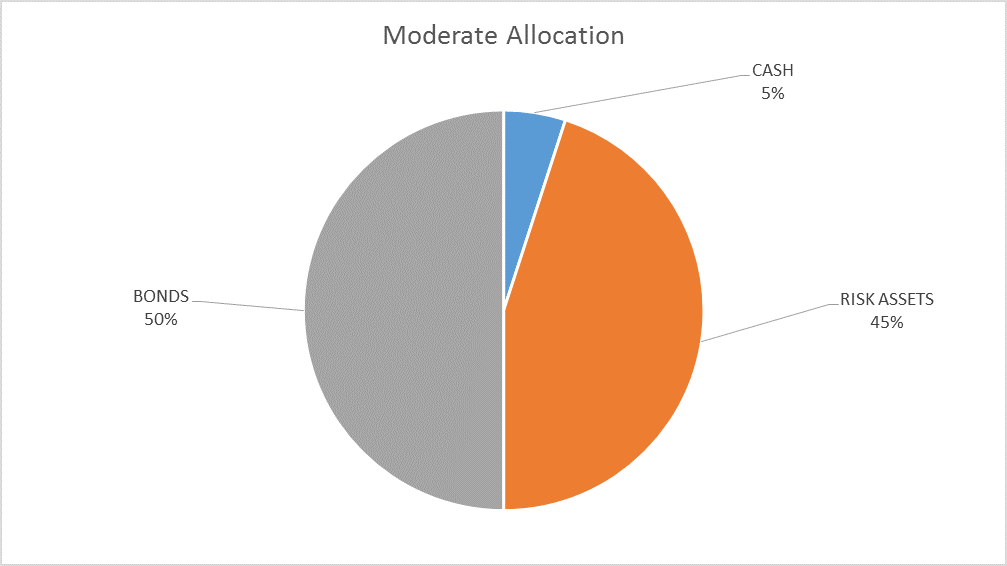

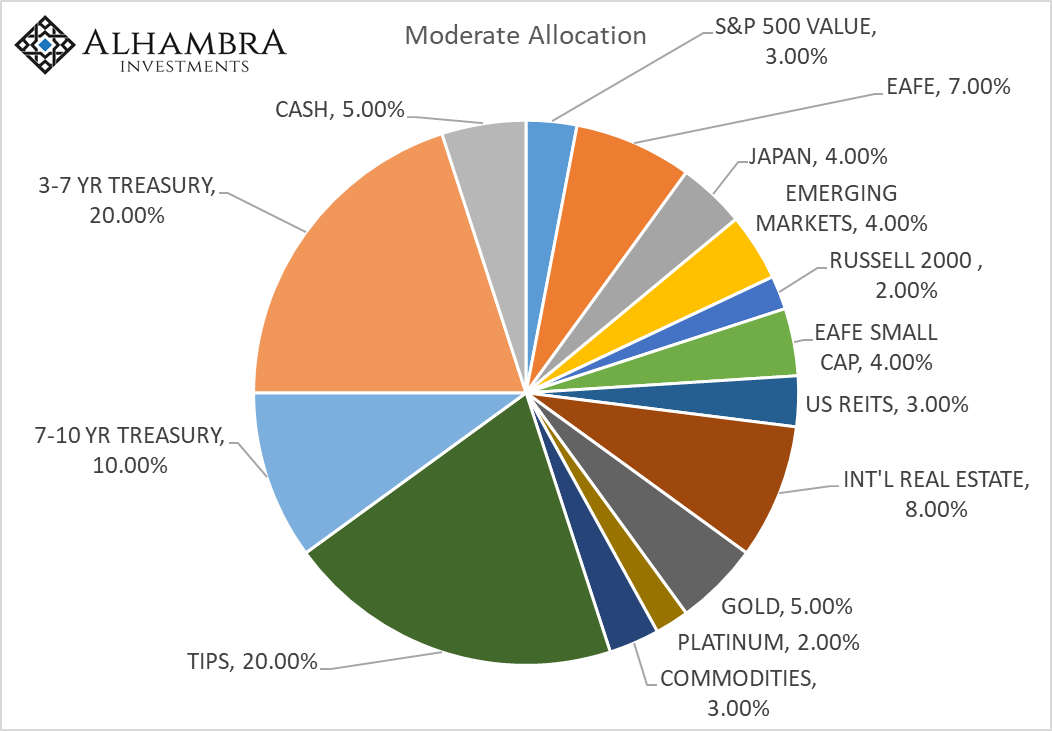

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock market correction. We did have another bout of selling that was halted above the initial low and that too is pretty classic market action. All in all, what we’ve seen over the last month is a textbook case of a correction. At least so far. While the overall allocation is unchanged, there are changes to

Topics:

Joseph Y. Calhoun considers the following as important: Alhambra Research, asset allocation, bonds, commodities, credit spreads, currencies, Donald Trump, economy, emerging markets, Featured, Friedrich Hayek, Global Asset Allocation Update, Gold, Investing, Japan, Markets, Model Portfolios, momentum, newslettersent, Politics, protectionism, stocks, tariffs, The United States, TIPS, US dollar, valuations, Yield Curve

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

| There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock market correction. We did have another bout of selling that was halted above the initial low and that too is pretty classic market action. All in all, what we’ve seen over the last month is a textbook case of a correction. At least so far.

While the overall allocation is unchanged, there are changes to the composition of some of the asset classes. Momentum is part of our process and we are trying to take advantage of it where we can while maintaining a well diversified portfolio. |

One of the most common investor mistakes I see is allowing your political views to color your investment process. How many Republicans let their dislike of President Obama affect their portfolio decisions? How many Democrats have let their opinion of Donald Trump and Republicans more generally impact their asset allocation? Politics, especially in more recent times, is an emotional experience with many people today viewing almost everything they do through a political lens. I think that is to our society’s detriment but that’s a topic for another day. When it comes to investing, emotion is your enemy and that means politics needs to take a backseat when you start thinking about how to achieve your financial goals.

President Trump announced last week that he would be implementing tariffs on aluminum and steel based on national security concerns. While I personally find it hard to believe that tariffs are warranted on those grounds, there seems little doubt that the President has the authority to impose these tariffs. And despite push-back from steel and aluminum users across a spectrum of industries, the President seems intent on following through with his threat (Note: The President made the tariffs official while I was writing this). So we are about to get another set of tariffs on top of the ones already imposed by this administration (Canadian soft lumber, washing machines and solar panels). Is anyone in the Trump administration aware that washing machines require steel and aluminum to manufacture? Will the steel tariffs negate the cost advantage gained by the washing machine manufacturers in the earlier tariffs? I have no idea and I’d bet my last dollar that no one in the Trump administration does either. This is what happens when you start micro-managing – some might call it central planning – the economy.

In case that last paragraph didn’t make it clear, let me state openly that I have a visceral, negative reaction to protectionism. It is rooted in a lifetime of being taught that Smoot-Hawley was a significant cause – maybe the main cause – of the Great Depression. It is rooted in my beliefs about individual freedom and the right of individuals to trade freely without government interference. But I will also acknowledge that these are emotional responses. The word visceral means “relating to deep inward feelings rather than to the intellect”. I could spend the rest of this update detailing all the reasons I believe these tariffs are unwise from an economic as well as a geo-political standpoint. I could use that reasoning to make changes to our portfolios that align them with these beliefs. And those changes might in the end be the correct ones – but they wouldn’t be in accordance with the process I’ve developed for making investment decisions.

Two of my favorite phrases in economics are “fatal conceit” and “pretense of knowledge” both coined by Friedrich Hayek. Both phrases refer to the same wrong headed idea – that the future is knowable. Hayek’s book, The Fatal Conceit, subtitled The Errors of Socialism, is actually a reference to an idea expressed in Adam Smith’s Theory of Moral Sentiments (his lesser known but greater work in my opinion):

The man of sentiment…is apt to be very wise in his conceit; and is often so enamoured with the supposed beauty of his own ideal plan of government, that he cannot suffer the smallest deviation from any part of it….

He seems to imagine that he can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chess board.

He does not consider that in the great chess-board of human society, every single piece has a principle of motion of its own, altogether different from that which the legislature might choose to impress upon.

Trump’s tariffs are a perfect example of this fatal conceit, the President and his advisers presuming they can, through these taxes, reorder the economy in a more just manner – or at least in a way that gets them re-elected. Their pretense of knowledge leads them to believe they can predict the outcome of the tariffs, how exactly they will affect the economy.

If I were to allow my personal views on the tariffs to dictate our investments I would be guilty of the same sort of conceit. I believe these tariffs will have a negative effect on the economy in a variety of ways and that may be correct. But even if I’m correct about the direction of change I cannot predict the magnitude or the unintended consequences of the tariffs, some of which could be positive. The future is as opaque to me as it is to President Trump’s advisers.

The initial stock market reaction to these tariffs and Gary Cohn’s subsequent resignation was negative but short term moves such as this are not sufficient to make changes to our portfolios. Although shorter term measures of momentum have turned negative, the longer term measures we use for big picture asset allocation remain positive. More importantly, bond markets, which comprise our most important macro-economic indicators, have not signaled any imminent threats to the expansion.

We have a defined investment process that dictates changes under certain circumstances. These changes are infrequent because it involves a change in our underlying strategic allocation. Your investment strategy – your strategic allocation – should not change except under extraordinary circumstances such as an imminent recession. Tactical changes are more frequent but are generally confined to changes within an asset class. Nothing that has happened over the last month, including the imposition of these economically ignorant tariffs, is sufficient to warrant a change in our strategic allocation.

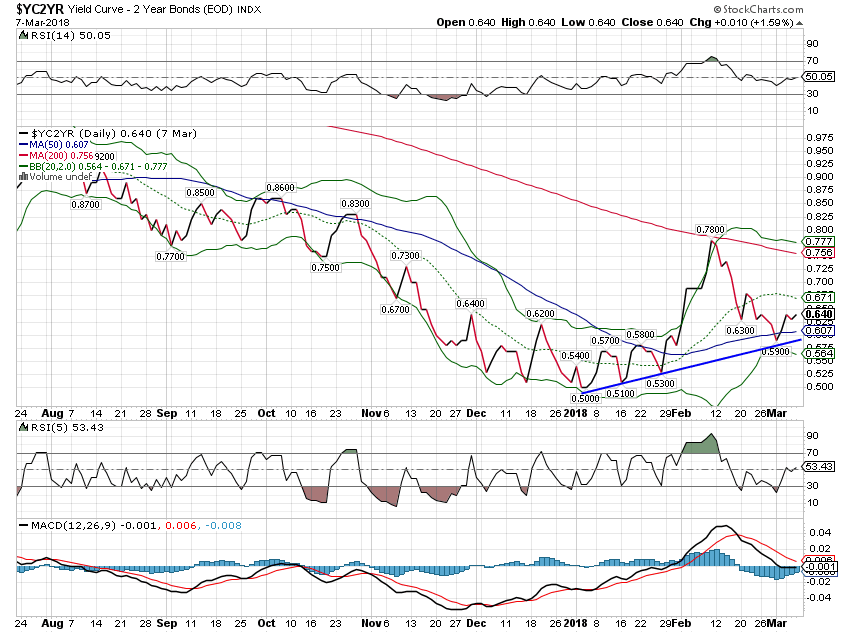

Yield CurveThe 10/2 yield curve flattened over the last month but the move was minor, a change of just 5 basis points. However, since the nadir right near the beginning of the year at 50 basis points, the curve has steepened by 14 basis points. I am monitoring this closely as a steepening curve, should it continue, would likely dictate some changes to the portfolio. This move has been driven mostly by rising inflation expectations but real growth expectations have risen too. A steepening such as this, with long rates rising faster than short rates, is called a bear steepener but it is actually less worrisome than a bull steepener when short rates are falling faster than long rates. That generally happens just prior to recession as the market anticipates Fed easing. For now, the yield curve movements are small and not worrisome. |

Yield Curve Bonds Index, Aug 2017 - Mar 2018 |

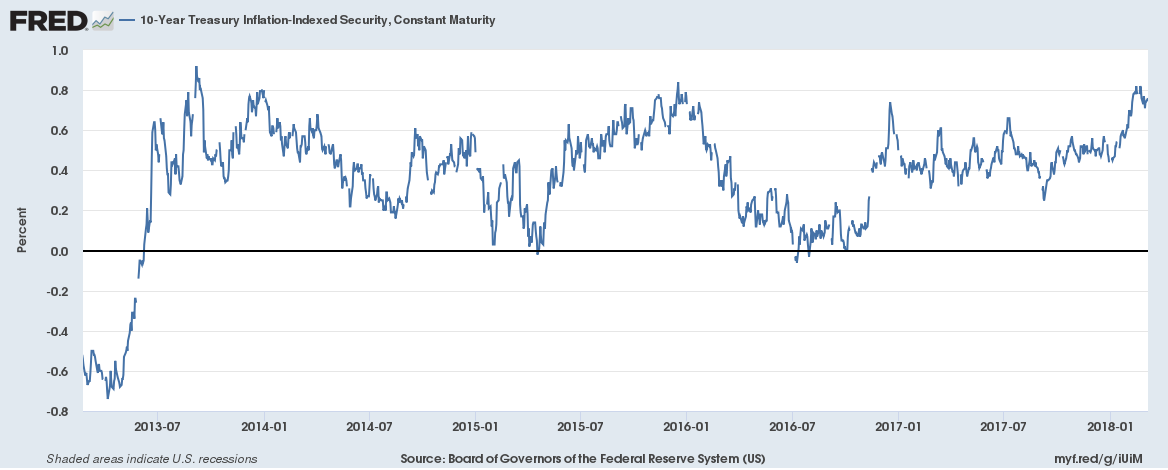

| 10 year TIPS yields rose by six basis points over the last month but have backed off the recent high. Real rates are still at the high end of the range that has prevailed since mid-2013. A break out move higher would be seen as a significant positive signal about future growth. But it hasn’t happened yet. |

10 Year Treasury Inflation - Indexed Security, Jul 2013 - Jan 2018 |

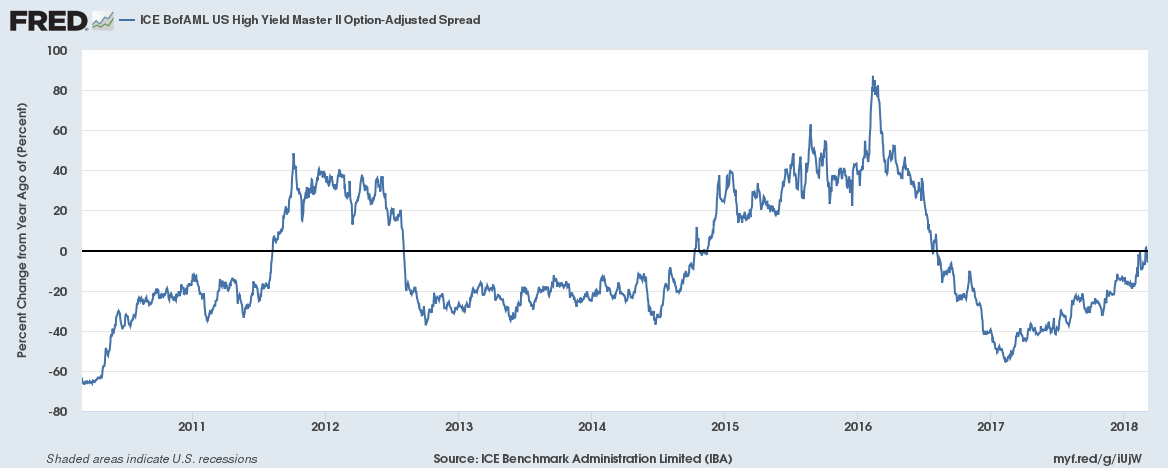

Credit SpreadsCredit spreads narrowed by an insignificant 4 basis points since the last asset allocation update. The spread turned positive year over year briefly on 3/1 and 3/2 but pulled back. The month to month change was less than 10% but positive from February to March. A year over year widening and a month to month widening of greater than 10% are both negative signals that would likely trigger a change in our allocation. But there has to be some persistence as well and the year over year change did not while the month to month reading never triggered a warning. We seem to be creeping toward something negative in credit markets but it isn’t here yet. |

ICE BofAML US High Yiled Master Option- Adjusted Spread, 2011 - 2018 |

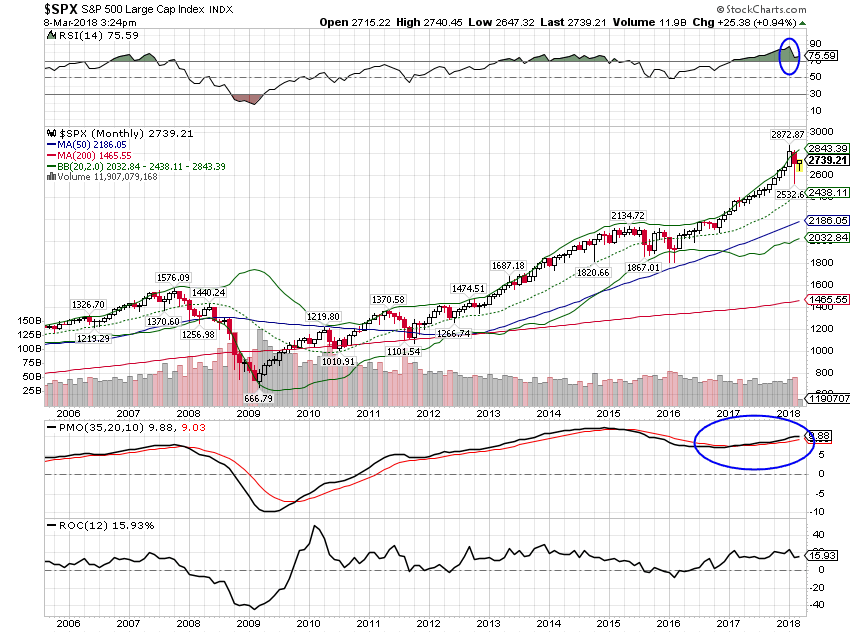

ValuationsValuations have improved some due to the market correction and rising earnings. Q4 earnings for the S&P 500 were up nearly 15% with revenue up about 8% which, by the way, are pretty darn good numbers. Estimates for next year are for continued double digit growth but I put little faith in that since we know they will be wrong – and spectacularly so – when the turn comes. Of course, foreign market valuations have also improved and they were cheaper to begin with. Developed Europe, emerging markets and Japan are all cheaper than the US in their own way. Of all these I still find Japan the most attractive because of the change in corporate culture. Europe has seen some positive changes too – especially in Spain and France – but Japan, Inc. is changing at a more fundamental level. Companies are more focused on ROE and shareholder returns than they have been in my entire career. Earnings were up over 30% last year as margins continued to rise and I expect another good year. Japanese companies are traditionally very conservative in their projections so estimates are probably still too low. MomentumAs I said above, short term stock market momentum turned negative in the correction but it has stabilized and with just a bit more upside will turn back to positive. Intermediate momentum is still slightly negative but again, not by much. And long term momentum never really wavered. |

S&P 500 Large Cap Index, 2006 - 2018(see more posts on S&P 500 Large Cap Index, ) |

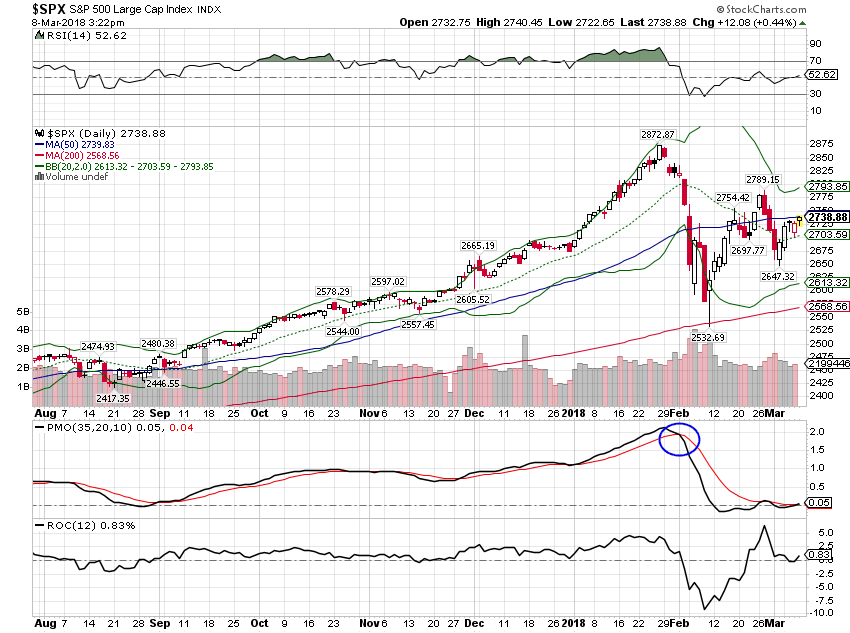

| One good up day is all it will take to turn short term momentum positive. So far, this is nothing more than a classic correction and recovery. |

S&P 500 Large Cap Index, Aug 2017 - Mar 2018 |

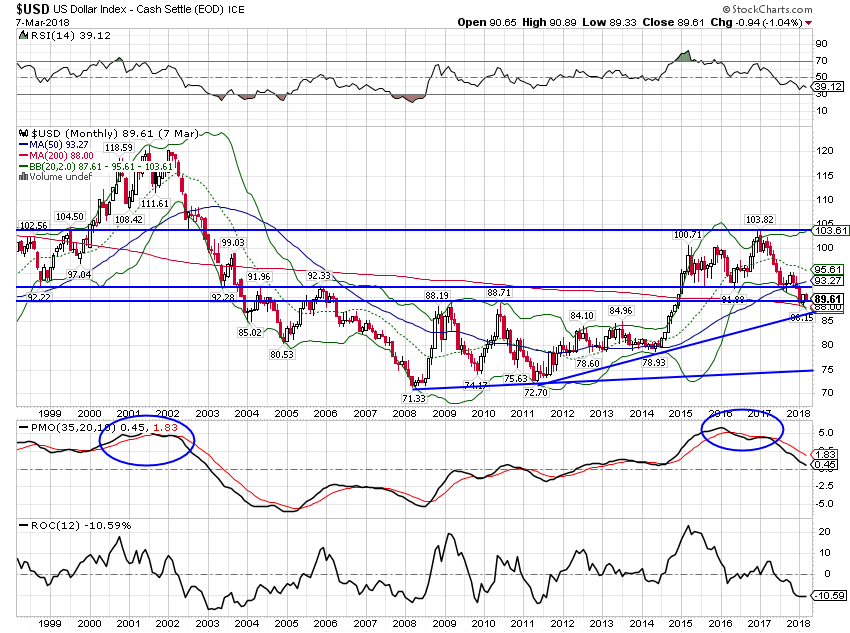

| The dollar did try to rally as I anticipated last month but it was a pretty feeble attempt that pushed above 90 for a day and then failed. Theoretically at least tariffs should tend to push the dollar higher to offset the tariffs but we don’t live in theory land. In the real world there are a plethora of factors affecting the exchange rate and so far the impact has been negligible. That could be because we don’t know what the retaliation will be or from what quarter. The momentum profile of the dollar is the inverse of the S&P 500 with short term momentum pointing higher (marginally) and intermediate/long term momentum continuing to point south. |

US Dollar Index, 1999 - 2018(see more posts on U.S. Dollar Index, ) |

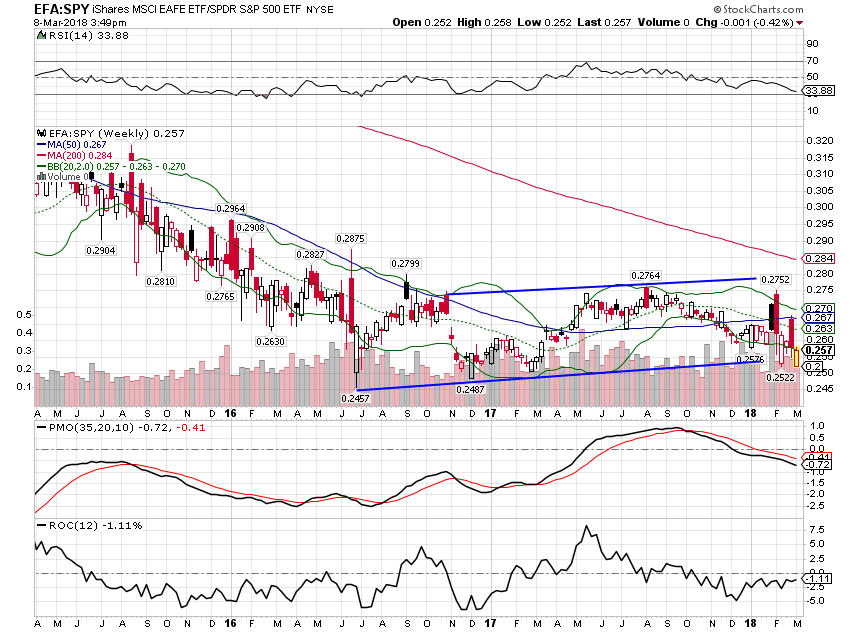

| Dollar weakness has not been as supportive of foreign stocks as would be expected based on history. Long term momentum is still positive but short and intermediate readings are still negative. |

EFA:SPY, Apr 2015 - Mar 2018 |

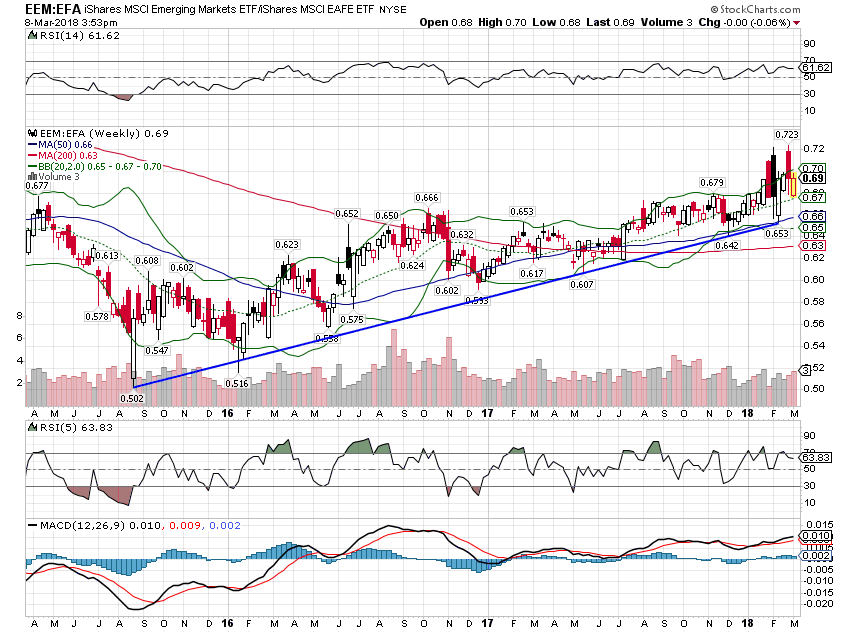

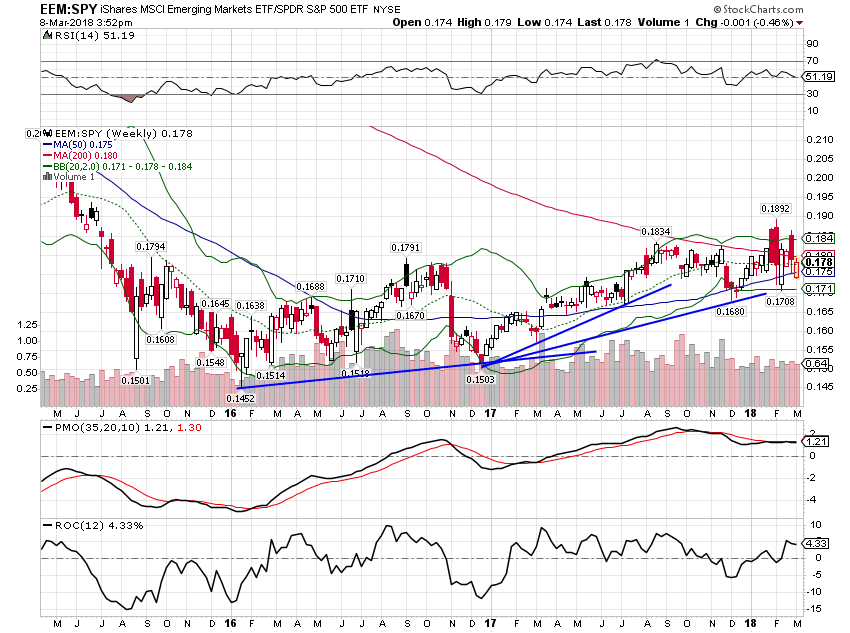

| The uptrend of emerging market stocks versus EFA and SPY remains intact however. |

EEM:EFA, Apr 2015 - Mar 2018 |

EEM:SPY, May 2016 - Mar 2018 |

|

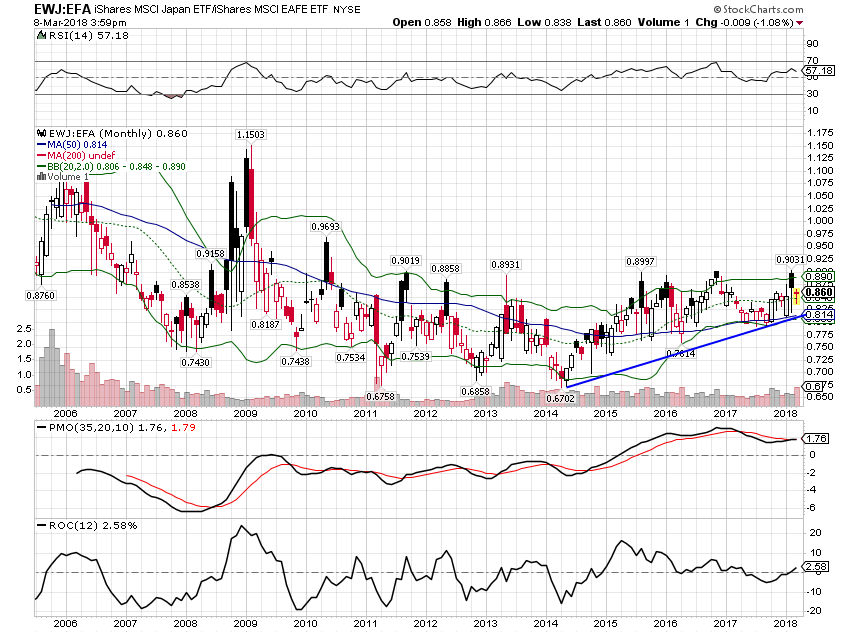

| Japan continues to look favorable versus EFA as well. |

EWJ:EFA, 2006 - 2018 |

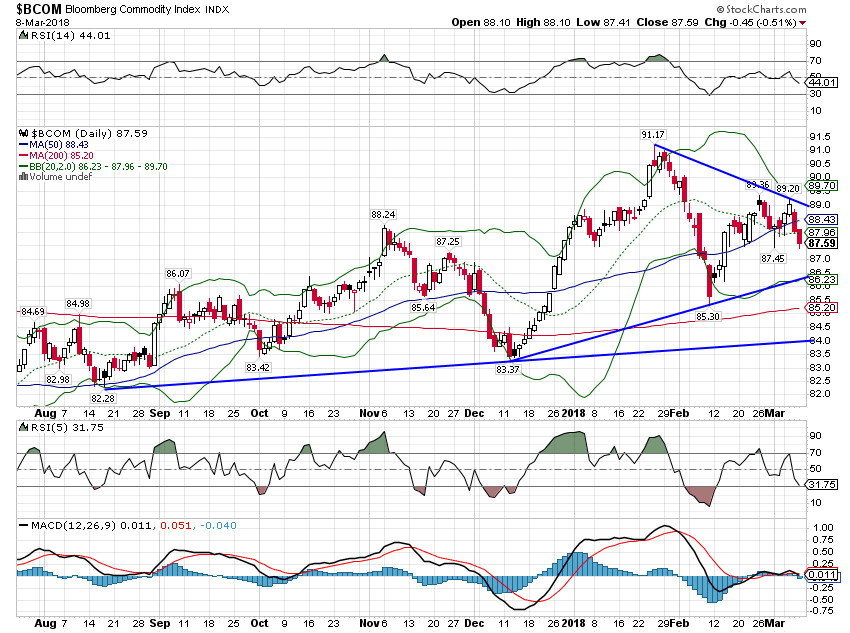

| The weak dollar continues to act as support for commodities as well but the impact of the tariffs is hard to judge. So far, it doesn’t seem to be having much of an impact but if the dollar rises commodities will gain a headwind. |

Bloomberg Commodity Index, Aug 2017 - Mar 2018 |

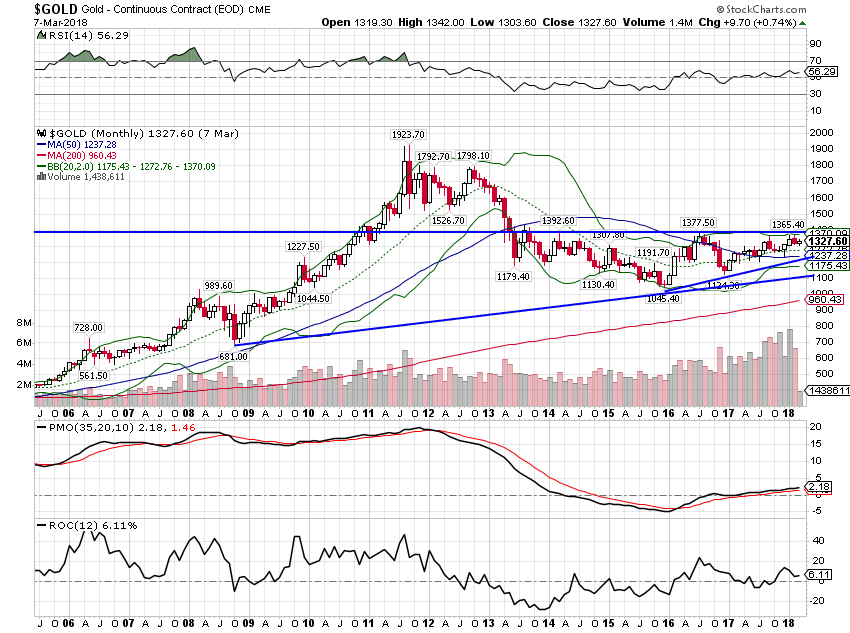

| Gold continues to act well and long term momentum is still positive. We have yet to see a sustainable breakout above $1350 though. |

Gold Monthly, Oct 2005 - Mar 2018 |

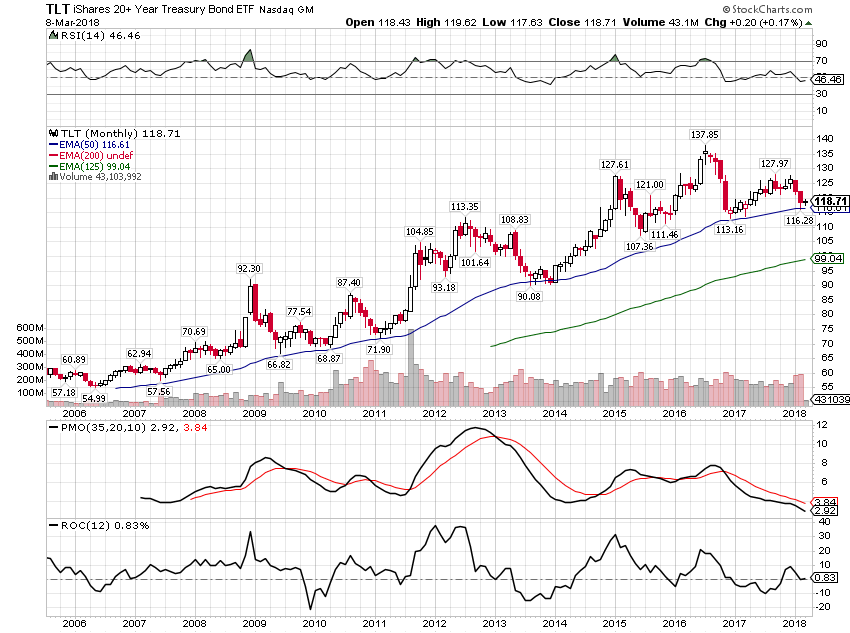

| Long term Treasuries are holding above the 50 month EMA which has acted as support for a very long time. |

TLT Monthly, 2006 - 2018 |

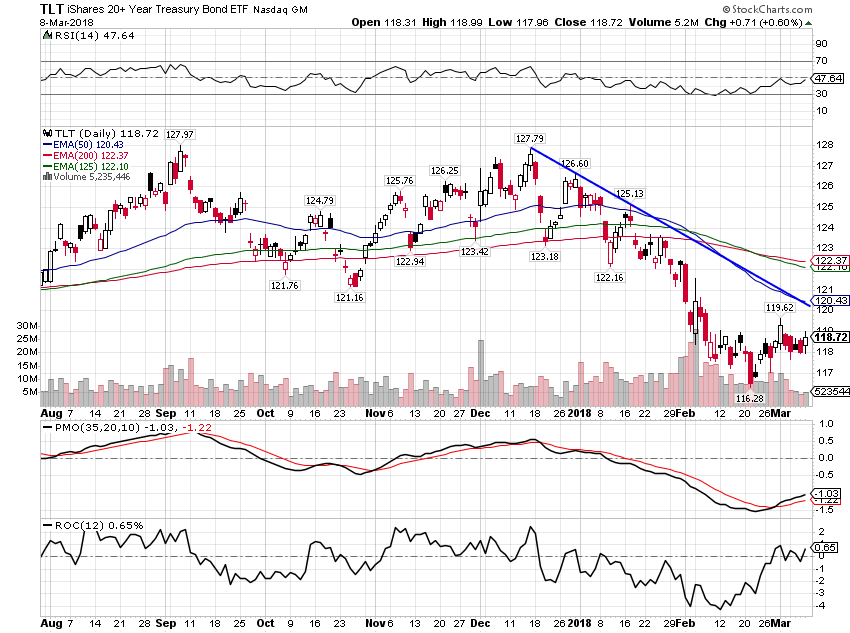

TLT Daily, Aug 2017 - Mar 2018 |

|

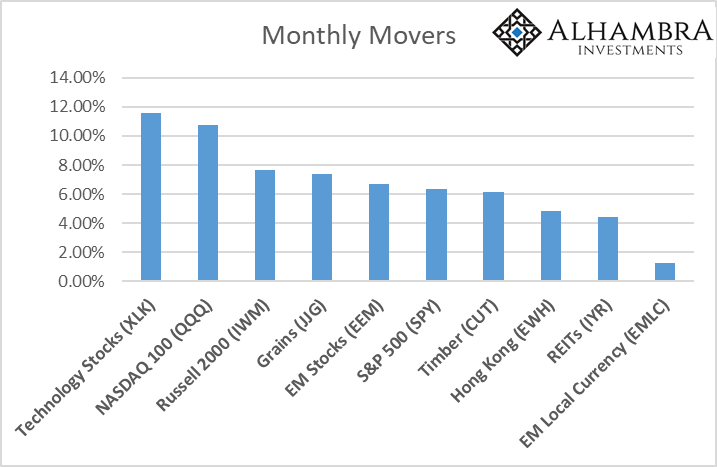

| The rebound from the correction was led by technology and NASDAQ stocks. Also of interest and making the movers list for the second straight month is grains. Grains and agricultural commodities more generally had not moved with the general commodity index over the last year. Fundamentals are improving though – inventories down – and prices have responded. I fear though that agriculture may bear the brunt of any retaliation from the tariffs. | |

I am making some minor changes to the equity portion of the portfolio:

Here’s the revised Moderate Allocation: |

Tags: Alhambra Research,Asset allocation,Bonds,commodities,credit spreads,currencies,Donald Trump,economy,Emerging Markets,Featured,Friedrich Hayek,Global Asset Allocation Update,Gold,Investing,Japan,Markets,Model Portfolios,momentum,newslettersent,Politics,protectionism,stocks,tariffs,TIPS,US dollar,valuations,Yield Curve