This will be the fourth attempt in two decades to reform the state pension system because of a structural deficit (Keystone) - Click to enlarge The Swiss government on Friday fixed the outlines of a new state pension reform plan, including raising VAT to fund it, and raising the retirement age for women from 64 to 65. The proposed reform is to be financed by an increase in VAT of up to 1.7%. Home Affairs Minister...

Read More »Emerging Markets: What Changed

Summary Indonesia will freeze prices for electricity, gasoline, and diesel fuel until next year. US President Trump and North Korean President Kim Jong Un will hold a summit meeting this spring. National Bank of Poland has tilted even more dovish. Moody’s downgraded Turkey a notch to Ba2 with a stable outlook. Saudi Arabian Energy Minister hinted that the Aramco IPO could be delayed until 2019. Tanzania finally...

Read More »US Equities – Mixed Signals Battling it Out

A Warning Signal from Market Internals Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator. S&P 500 New High Lows Percent, Feb 2015 - Apr 2018(see more posts on...

Read More »March 24, 2018 ! Charles Hugh Smith Has The Date Been Set For The Great Economic Collapse

Please Subscribe to my NEW Channel! Thank You. March 24, 2018 ! Charles Hugh Smith Has The Date Been Set For The Great Economic Collapse. Financial writer Charles Hugh Smith sees one very big problem coming at us, and that is a dramatic loss in buying power of the U.S. dollar, but it's not just the dollar. According to Smith,. Please, Follow my channel on . Thank you ! X22 Report Spotlight cuts through propaganda of the corporate media and gets right into the real issues. By interviewing...

Read More »FX Daily, March 09: Today is about Jobs, but Not Really

(About to set off on another business trip. I will spend the next two weeks in Asia. The updates will be sporadic. Thanks for your patience.) Swiss Franc The Euro has fallen by 0.01% to 1.1706 CHF. EUR/CHF and USD/CHF, March 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US Administration has softened its initial hardline position of no exemptions for the new...

Read More »Une TVA à 9.4 % avec une perspective de retraite à 70 ans.

M Berset a présenté, ce 2 mars, les lignes directrices de sa réforme de l’AVS. Nous en retiendrons deux propositions phares. La première consiste à faire passer la TVA de 7,7% à 9,4%. M Berset impose une majoration de celle-ci de plus de 22%! L’information nous arrive au lendemain d’une annonce d’un excédent de 4,8 milliards de francs sur l’exercice 2017! Deux milliards avaient été provisionnés pour l’impôt anticipé…....

Read More »Train business deal with Iran causes confusion

The Swiss firm, Stadler Rail, has rejected reports that it signed off on a major infrastructure contract with Iran’s Industrial Development & Renovation Organization for 960 wagons for an underground railway system. The companyexternal link said there is no deal or decision but merely a public tender, according to SRF public radio. The details of the reported deal remain unclear (Keystone) - Click...

Read More »Gold Does Not Fear Interest Rate Hikes

Gold Does Not Fear Interest Rate Hikes – Gold no longer fears or pays attention to Fed announcements regarding interest rates – Renewed interest in gold due to inflation fears and concern Fed won’t do enough to control it – Higher interest rates on horizon will make debt levels unsustainable – New Fed Chair warns “the US is not on a sustainable fiscal path” and could lead to an “unsustainable” debt load – Higher...

Read More »London Property Sees Brave Bet By Norway As Foxtons Profits Plunge

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge – Sales in London property market at ‘historic lows’ – 65% fall in pre-tax profits in 2017 to £6.5m reported by London estate agents Foxtons – Foxtons warns 2018 will ‘remain challenging’ for London property – Norway’s sovereign wealth fund is backing London’s property market – RICS: UK property stock hits record low as buyer demand falls – Own physical...

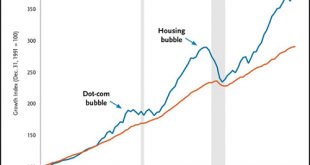

Read More »The Death of Buy and Hold: We’re All Traders Now

The percentage of household assets invested in stocks fell from almost 40% in 1969 to a mere 13% in 1982, after thirteen years of grinding losses. The conventional wisdom of financial advisors–to save money and invest it in stocks and bonds “for the long haul”–a “buy and hold” strategy that has functioned as the default setting of financial planning for the past 60 years–may well be disastrously wrong for the next...

Read More » SNB & CHF

SNB & CHF