Summary: Speculators have a large net short 10-year Treasury position. The gross short position is a record. CPI is likely to be softer, while retail sales may show a still robust consumer. The US reports January CPI figures tomorrow. The market seems especially sensitive to it. The main narrative is that it is an inflation scare spurred by the jump in January average hourly earnings that pushed yields higher...

Read More »Idaho House Votes Overwhelmingly to Remove Income Taxation from Gold & Silver

- Click to enlarge Boise, Idaho (February 12, 2018) – The Idaho State House today overwhelmingly approved a bill which helps restore constitutional, sound money in the Gem State. State representatives voted 60-9 to pass House Bill 449 sending the measure introduced by House Majority Leader Mike Moyle and Senate Assistant Majority Leader Steve Vick to the Senate for a hearing in the Local Government and Taxation...

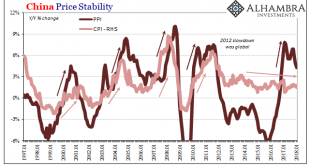

Read More »China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference. There was, to me anyway, a lot of Japan in it, even still if “globally...

Read More »Why I Own Gold and Gold Mining Companies – An Interview With Jayant Bandari

Opportunities in the Junior Mining Sector Maurice Jackson of Proven and Probable has recently interviewed Jayant Bandari, the publisher of Capitalism and Morality and a frequent contributor to this site. The topics discussed include currencies, bitcoin, gold and above all junior gold stocks (i.e., small producers and explorers). Jayant shares some of his best ideas in the segment, including arbitrage opportunities...

Read More »Jan Skoyles and John Butler about weak hands in gold

The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset Management, Lars Schall talks with both Jan Skoyles and John Butler. They both. The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset Management, Lars Schall talks with both Jan Skoyles and John Butler. They both. . The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset...

Read More »Jan Skoyles and John Butler about weak hands in gold

The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset Management, Lars Schall talks with both Jan Skoyles and John Butler. They both. The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset Management, Lars Schall talks with both Jan Skoyles and John Butler. They both. . The weak hands in the gold market have been shaken out. In this final short interview for Matterhorn Asset...

Read More »Swiss Labour Force Survey in 4th quarter 2017: 0.6 percent increase in number of employed persons; unemployment rate based on ILO definition at 4.5 percent

Swiss Labor Force Survey in the fourth quarter of 2017: Job Offer The number of persons in employment increases by 0.6 percent; Unemployment rate according to ILO is 4.5 percent Neuchâtel, 15 February (FSO) – The number of employed persons in Switzerland rose by 0.6% between the 4th quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined...

Read More »Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré...

Read More »FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

Swiss Franc The Euro has fallen by 0.24% to 1.1535 CHF. EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The significant development this week has been the recovery of equities after last week’s neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the...

Read More »Bitcoin and Crypto Prices Being Manipulated Like Precious Metals?

Bitcoin and Crypto Prices Being Manipulated Like Precious Metals? – FSN Interview GoldCore [embedded content] Kerry Lutz of the Financial Survival Network (FSN) interviewed GoldCore’s Mark O’Byrne about the outlook for crypto currencies, financial markets and precious metals. – Are bitcoin and crypto prices being manipulated like precious metals? – Is there a coordinated backlash against bitcoin from JPM and powerful...

Read More » SNB & CHF

SNB & CHF