The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has started the process of “delinking” QE from the inflation outlook and “rotating” its forward guidance, towards a policy stance that will be driven by the whole set of instruments, including reinvestment and “especially” policy rates. We continue to expect the ECB to announce a tapering of QE in June or

Topics:

Frederik Ducrozet considers the following as important: Featured, Macroview, newslettersent, Pictet Macro Analysis, Swiss and European Macro

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has started the process of “delinking” QE from the inflation outlook and “rotating” its forward guidance, towards a policy stance that will be driven by the whole set of instruments, including reinvestment and “especially” policy rates. We continue to expect the ECB to announce a tapering of QE in June or July.

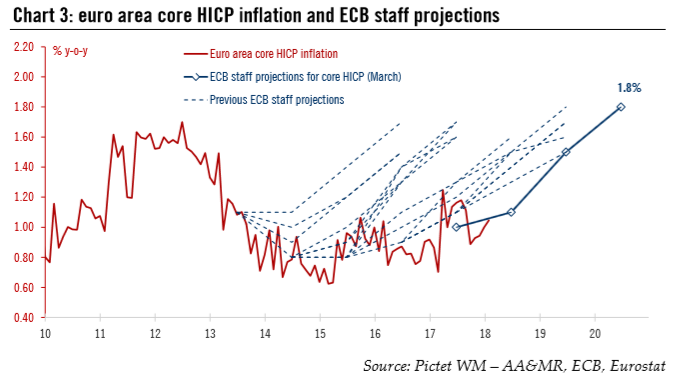

This rotation is not hawkish in itself – the ECB can push back against rate hikes expectations, and it will do just that if inflation disappoints. A sustained adjustment in core inflation is still required to provide the burden of proof, hence the ‘patient, persistent, prudent’ motto before proper policy normalisation can start in H2 2018. Ultimately, we expect the market’s focus to shift from the timing of the first rate hike to the broader pace of tightening. The general tone of today’s press conference was broadly neutral, with upbeat comments on domestic developments offset by downside risks to global growth linked to the threat of protectionist measures by the US. The revisions to ECB staff projections were small but dovish, on balance, including a slightly lower end-point for quarterly inflation forecasts in spite of lower unemployment, in our view reflecting the lagged impact of a stronger currency. Still, the ECB remains confident that the rapid decline in economic slack will lead to inflationary pressure over the medium term. |

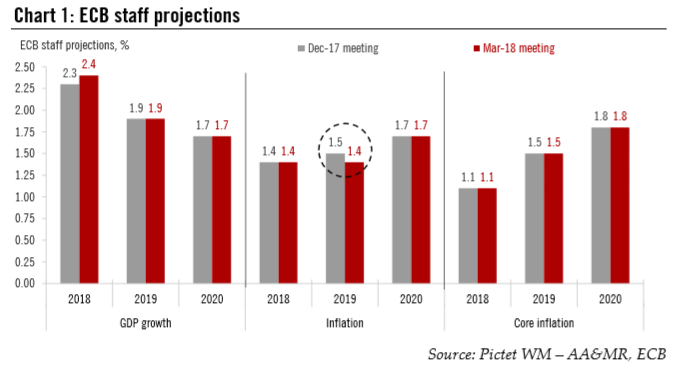

ECB Staff Projections, 2018 - 2020 |

| The obvious focus was on the removal of the ECB’s option to expand QE, which President Mario Draghi largely described as a tool of the past aimed at responding to specific contingencies. Today’s situation is very different, Draghi said, not only because the euro area economic momentum is stronger, but also because the ECB has deployed a broader set of policy tools that it can (re)activate, if needed.

Importantly, the decision to drop the QE expansion bias was unanimous. As a reminder, “several members” pushed for that change back in January. This is a strong signal consistent with our view that QE tapering is coming in 2018 regardless of business cycle fluctuations. A major shock would be required for the ECB to change its mind, not least because another QE extension would likely require a loosening of the 33% issuer limit, a move that would face sharp opposition from the hawks and the ECB legal experts. We suspect that the arguments pushed forward by Executive Board member Benoît Coeuré in a recent speech (including evidence that the stock effect of asset purchases will be amplified by a reduction in the free float of German bonds, as explained in our preview) played a role in today’s decision, although Draghi further stressed the importance of QE flows. In the end, today’s decision reflects the ECB’s growing confidence over the medium-term outlook. The ECB has long described QE as a deflation-fighting tool. Although the ‘de-linking’ between QE and the inflation outlook was not yet explicit in the March statement, it is implicitly linked to the ‘rotation’ in the forward guidance. The ECB would likely respond to a change in the outlook using the full set of instruments at its disposal, including guidance on reinvestment (which are still projected to continue “for an extended period of time after the end of [the] net asset purchases, and in any case for as long as necessary”) and on policy rates. Once again, Draghi described the latter as one crucial element of the ECB’s toolkit. |

Main Elements of the ECB’s Introductory Statement |

Conflicting forces leave staff projections broadly unchangedThe revisions to ECB staff projections were limited overall, reflecting conflicting forces at play. If anything, the lack of upward revisions to GDP growth beyond this year, along with a small downward revision to the headline inflation profile, were marginally more dovish than expected. Euro area GDP growth was revised marginally higher, to 2.4% in 2018 (from 2.3% in December), reflecting a “somewhat faster” pace of economic expansion at the start of the year. However, GDP growth projections for (1.9%) and 2020 (1.7%) were left unchanged. A large part of the press conference was indeed dedicated to downside risks to the economic outlook, including the threat of a global trade war, but our impression is that the ECB is not yet overly concerned. The same is true for the exchange rate, which the Governing Council will “continue to monitor” with regard to its potential implications for the inflation outlook. But, there was no escalation in the ECB’s FX rhetoric1. Last but not least, Draghi said that the Council did not discuss the situation in Italy, which speaks volume about their degree of confidence over the outlook. Meanwhile, unemployment was revised somewhat lower, to 7.2% by 2020, as the result of stronger economic growth and the most recent data releases. Wage growth was revised higher by 0.1 percentage point, to 2.2% this year and 2.0% next year, although the 2020 projection was left unchanged at 2.7%. We may have to wait for the June projections, jointly produced by the ECB and national central banks, to better gauge the impact of the latest wage negotiations in Germany. |

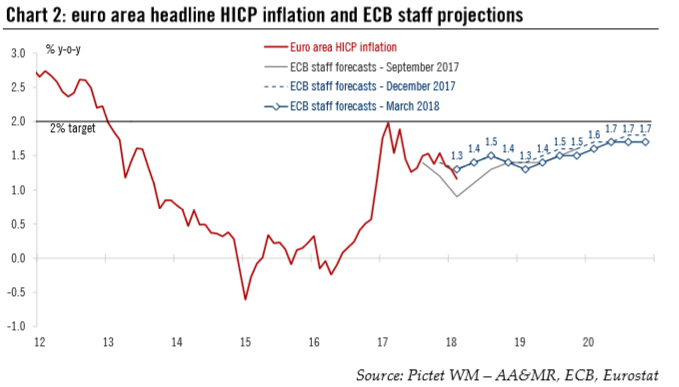

Euro Area Headline HICP Inflation and ECB Staff Projections, 2012 - 2018 |

| Turning to inflation, the projection for headline HICP was revised slightly lower in 2019, from 1.5% to 1.4%, despite higher oil and food prices. The annual average for 2018 (1.4%) and 2020 (1.7%) were left unchanged, but looking at the quarterly profile, the end-point for inflation projections was revised lower by about 10bp, from 1.8% to 1.7% in H2 2020, in our view reflecting the lagged impact of a stronger currency.

In other words, the changes to ECB staff projections were modest but dovish on balance. On all relevant metrics, the staff projections remain some distance away from the ECB’s definition of price stability, and also from the inflation criteria set out by Mario Draghi before proper policy normalisation can start. The bottom line is that the ECB’s rising confidence about price stability has yet to materialise in the staff projections for inflation. We continue to see the June meeting as an important deadline from that perspective, three months before the latest QE extension comes to an end, which is when we would expect the Governing Council to move on with the hard decisions. |

Euro Area Core HICP Inflation and ECB Staff Projections, 2010 - 2018 |

Tags: Featured,Macroview,newslettersent