We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM. Stock Markets Emerging Markets, March 14 Source: economist.com - Click to enlarge Poland Poland reports February...

Read More »Rolex ‘most reputable global brand’ for third straight year

Roger Federer's continued success plays a part in Rolex's image (Keystone) - Click to enlarge Swiss watch brand Rolex has topped a ranking of the world’s most reputable brands for a third year in a row. Rolex beat Danish toy firm Lego for the top spot, while Swiss food manufacturer Nestlé jumped 21 places to rank 33rd. The Reputation Institute compiled the list in its annual Global RepTrack 100external link,...

Read More »Swiss voters could get to decide on Switzerland’s Winter Olympics bid

In October 2017, when Switzerland’s Federal Council announced the government would stand behind Sion’s bid for the 2026 Winter Olympics, it sparked a backlash. South Korean Winter Olympics 2018_© Zhukovsky _ Dreamstime.com - Click to enlarge A survey run by Tamedia in February 2018 suggests 59% of the Swiss public are against the bid, according to RTS. The estimated cost to Swiss taxpayers is close to CHF 1 billion....

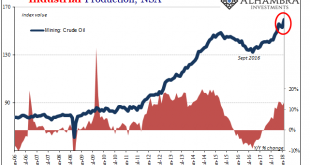

Read More »US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots. US Industrial Production, Jan 2006 - 2018(see more posts on U.S. Industrial...

Read More »New CHF200 banknote to be introduced in August

The CHF200 note will be unveiled to the public on August 15 and join the new CHF50, CHF20 and CHF10 notes of the same series already in circulation (Keystone) - Click to enlarge The Swiss National Bank (SNB) has announced that the latest addition to the new banknote series – the CHF200 note ($209) – will go into circulation on August 22. The brown note’s key motif will be physical matter. It will “showcase...

Read More »Bi-Weekly Economic Review

[embedded content] Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018. Related posts: Bi-Weekly Economic Review: The New Normal Continues Bi-Weekly Economic Review: Gridlock & The Status Quo Bi-Weekly Economic Review: Maximum Optimism? Bi-Weekly Economic Review: As Good As It Gets Bi-Weekly Economic...

Read More »Weekly Technical Analysis: 19/03/2018 – USD/JPY, EUR/USD, GBP/USD, NZD/USD, USD/CHF

USD/CHF The USDCHF pair leaned well on 0.9488 level to resume its positive trading, on its way towards our first waited target at 0.9581, as the price moves inside bullish channel that appears on the above chart, supported by the EMA50 that protects trading inside this channel, noting that breaching the targeted level will extend the pair’s gains to reach 0.9675. Therefore, the bullish trend will remain suggested for...

Read More »Buy Silver And Sell Gold Now

– Buy silver and sell gold now – Frisby– Gold should cost 15 times as much as silver– Silver might have disappointed in short term – But it’s time to buy – Editor’s note: Silver has outperformed stocks, bonds and gold over long term (see table) For those of you with busy schedules who like to see arguments made in 280 characters or less, let me come straight to the point: the time has come to sell your gold and buy...

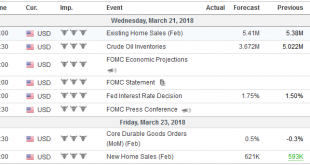

Read More »FX Weekly Preview: The Fed and More

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be...

Read More » SNB & CHF

SNB & CHF