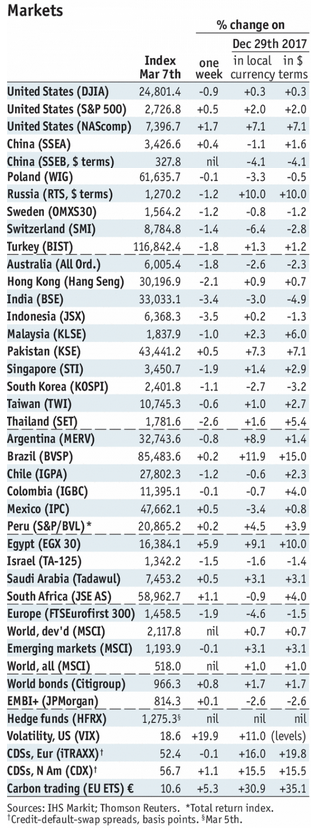

Stock Markets EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month. Stock Markets Emerging Markets, March 07 Source: economist.com - Click to enlarge Peru Peru reports February trade this week, but no date has been set. Last week, the central bank cut rates 25 bp to 2.75% and focused on downside risks to the economy. As such, we think the easing cycle is likely to continue. It’s been cutting

Topics:

Win Thin considers the following as important: Brazil, China, Colombia, Czech Republic, emerging markets, Featured, India, Indonesia, Israel, Malaysia, Mexico, newsletter, Peru, Poland, Singapore, South Africa, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month. |

Stock Markets Emerging Markets, March 07 Source: economist.com - Click to enlarge |

PeruPeru reports February trade this week, but no date has been set. Last week, the central bank cut rates 25 bp to 2.75% and focused on downside risks to the economy. As such, we think the easing cycle is likely to continue. It’s been cutting every other meeting, so if the bank holds to this pattern, look for no cut April 12 and then a 25 bp cut to 2.5% May 10. SingaporeSingapore reports January retail sales Monday, which are expected to rise 3.0% y/y vs. 4.6% in December. It then reports February trade Thursday, with NODX expected to rise 6% y/y vs. 13% in January. Real sector data has been firm but price pressures remain non-existent. MAS meets next month and it will be a tough call. We believe it will be cautious and keep policy steady then. TurkeyTurkey reports January current account data Monday, which is expected at -$6.9 bln. If so, the 12-month total would rise to -$51.4 bln, the highest April 2014. The external accounts are deteriorating even as FDI dries up. Turkey then reports January IP Friday, which is expected to rise 6.7% y/y vs. 8.7% in December. IsraelIsrael central bank releases its minutes Monday. Over the weekend, it reported Q4 GDP growth at 3.6% SAAR, as expected. Israel reports February trade Tuesday and CPI Thursday. Inflation is expected to remain steady at 0.1% y/y, which would be well below the 1-3% target range. Next central bank policy meeting is April 16, no change is expected. IndiaIndia reports February CPI and January IP Monday. The latter is expected to rise 4.74% y/y and the latter by 6.4% y/y. February WPI will be reported Wednesday, which is expected to rise 2.54% y/y vs. 2.84% in January. Price pressures may see a temporary lull, but the RBI remains concerned about inflation as it remains in the top half of the 2-6% target range. Next RBI meeting is April 5, no change is expected. MalaysiaMalaysia reports January IP and manufacturing sales Tuesday. IP is expected to rise 7.7% y/y vs. 2.9% in December. The economy remains firm, but price pressures are easing a bit. We do not think Bank Negara will hike aggressively and so we see steady rates for much of H1. Next policy meeting is May 10, no change is expected. South AfricaSouth Africa reports January manufacturing production Tuesday, which is expected to rise 2.5% y/y vs. 2.0% in December. The economy started to pick up late in 2017, and this should carry over into 2018. However, growth remains subpar and so we think SARB will resume easing. Next policy meeting is March 28. If the rand remains firm, a 25 bp cut to 6.5% is likely. BrazilBrazil reports January retail sales Tuesday, which are expected to rise 4.1% y/y vs. 3.3% in December. The economy is picking up even as price pressures remain low. February IPCA inflation was 2.8% y/y, near the bottom of the 2.5-6.5% target range. We believe COPOM will cut rates 25 bp to 6.5% at the next meeting March 21. MexicoMexico reports January IP Tuesday, which is expected to rise 0.4% y/y vs. -0.7% in December. The economy remains sluggish and yet the central bank has had to tighten policy with 25 bp hikes at both the December and February meetings. Next policy meeting is April 12, and much will depend on how the peso is trading then. ChinaChina reports January-February IP and retail sales Wednesday. The two months are combined to limit Lunar New Year distortions. The former is expected to rise 6.2% y/y and the latter by 10% y/y. For now, markets appear comfortable with the mainland macro backdrop. Policymakers kept the growth target for this year steady at 6.5%, which signals “steady as she goes.” ColombiaColombia reports January IP and retail sales Wednesday. The former is expected to rise 2.7% y/y and the latter by 1.1% y/y. The economy remains sluggish and so the easing cycle should continue. In recent months, the bank has cut rates every other meeting. Since it just cut 25 bp to 4.5% at its last meeting in January, it will likely stand pat at the next meeting March 20 in favor of a move at the April 27 meeting. IndonesiaIndonesia reports February trade Thursday. The external accounts have been deteriorating since mid-2017. Export growth has slowed to single digits even as import demand surged to 26% y/y in January. Bank Indonesia has expressed concern about recent rupiah weakness and could take action if the moves become disruptive. Czech RepublicCzech Republic reports January industrial and construction output and retail sales Thursday. The economy remains firm, but inflation of 1.8% is now below the 2% target for the first time since November 2016. Next policy meeting is March 29, and no change had been expected regardless since the bank has been hiking 25 bp every other meeting. While a hike at the May 3 meeting seemed possible, the soft CPI data suggests the bank may change its pattern and wait until the June 27 meeting. PolandPoland reports February CPI Thursday, which is expected to rise 1.8% y/y vs. 1.9% in January. If so, it would be the lowest rate since August and near the bottom of the 1.5-3.5% target range. No wonder the National Bank of Poland has tilted even more dovish. Governor Glapinski said the bank could keep rates steady until at least H2 2019 or even 2020. Previously, forward guidance saw steady rates until end-2018. January trade and current account data will be reported Friday. |

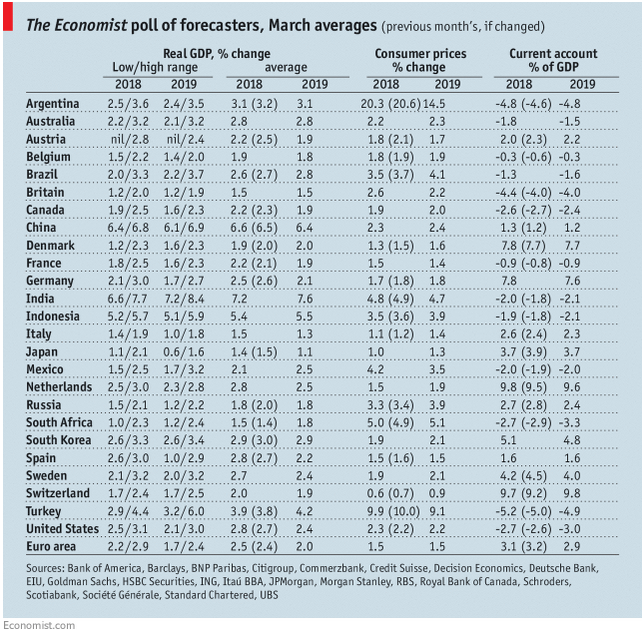

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Brazil,China,Colombia,Czech Republic,Emerging Markets,Featured,India,Indonesia,Israel,Malaysia,Mexico,newsletter,Peru,Poland,Singapore,South Africa,Turkey,win-thin