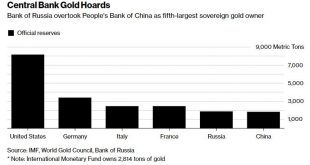

– Russian central bank buys gold – large 600,000 ounces or 18.7 tons of gold in January– Russia increased its holdings to 1,857 tons, topping the People’s Bank of China’s ‘reported’ 1,843 tons – Russia surpasses China as 6th largest holder of gold reserves – after U.S., Germany, IMF, Italy and France– Turkish central bank added 205 tons “over 13 consecutive months” – Commerzbank– Meanwhile, Russian ally Venezuela is...

Read More »Emerging Markets: What Changed

Summary China regulators have taken over Anbang Insurance. Group for at least one year RBI minutes from this month’s meeting were more hawkish than expected. The RBI is reportedly reviewing its process for allowing local companies to issue debt overseas. Effective June 1, IDR-denominated debt becomes eligible for the Barclays Global Aggregate Index. Israeli Prime Minister Netanyahu is coming under increasing...

Read More »Strange Economic Data

Economic Activity Seems Brisk, But… Contrary to the situation in 2014-2015, economic indicators are currently far from signaling an imminent recession. We frequently discussed growing weakness in the manufacturing sector in 2015 (which is the largest sector of the economy in terms of gross output) – but even then, we always stressed that no clear recession signal was in sight yet. US gross output (GO) growth...

Read More »FX Daily, February 23: Dollar Firms; VIX Set to Close Lower for Second Week

Swiss Franc The Euro has risen by 0.20% to 1.152 CHF. EUR/CHF and USD/CHF, February 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A light economic schedule in North America may help the markets close the week on a quiet note. Perhaps if there is one number that captures this sense, it may be the VIX. It is soft and barring a new disruption today, it is poised to...

Read More »US supermarket giant Walmart now selling Swiss-made chocolate

The chocolate for Walmart is produced in Coop's new production centre near Basel, named "Schoggihüsli" (Swiss-German for "little chocolate house"). (Keystone) - Click to enlarge Swiss retailer Coop is producing bars for Walmart’s own-brand chocolate, the SonntagsZeitung reported on Sunday. The chocolate is produced in a newly established production centre near Basel and has been available in Walmart stores since...

Read More »Swiss Post Bus company invested heavily in France and lost millions

French bus company owners regard the payments from Switzerland to CarPostal as illegal government subsidies by the Swiss Post. (SRF-SWI) - Click to enlarge The Post has been operating its French subsidiary, CarPostal France at a huge financial loss, reported Swiss public television, SRF, on Monday. The company is also accused of having used a price dumping policy to unfairly increase its market share in...

Read More »Bitcoin or British Pound ‘Pretty Much Failed’ As Currency?

– Bitcoin has ‘pretty much failed’ as a currency says Bank of England Carney– Bitcoin is neither a store of value nor a useful way to buy things – BOE’s Carney– Project fear against crypto-currencies or an out of control investing bubble?– Bitcoin will likely recover in value but is speculative and not for widows and orphans– British pound has been a terrible store of value – unlike gold– Pound collapsed 30% in 2016...

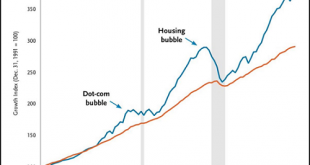

Read More »The End of (Artificial) Stability

The central banks’/states’ power to maintain a permanent bull market in stocks and bonds is eroding. There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close. The 9-year run of Bull-trend stability is ending as...

Read More »US Equities – Retracement Levels and Market Psychology

Fibonacci Retracements Following the recent market swoon, we were interested to see how far the rebound would go. Fibonacci retracement levels are a tried and true technical tool for estimating likely targets – and they can actually provide information beyond that as well. Here is the S&P 500 Index with the most important Fibonacci retracement levels of the recent decline shown: So far, the SPX has made it back...

Read More »Euro area: Flash PMI surveys pass their peak

The IHS Markit flash composite purchasing managers’ index (PMI) for the euro area eased to 57.5 in February from 58.8 in January, below consensus expectations (58.4). The index marked its the largest monthly decrease since August 2014. Activity in both services PMI (-1.3 points to 56.7) and manufacturing (-1.1 points to 58.5) cooled in February. But while the breakdown by sub-indices showed that the pace of growth in...

Read More » SNB & CHF

SNB & CHF