Summary:

The central banks’/states’ power to maintain a permanent bull market in stocks and bonds is eroding. There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close. The 9-year run of Bull-trend stability is ending as a result of a confluence of macro dynamics: 1. Central banks are under pressure to reduce, end or reverse their unprecedented monetary stimulus, and the consequences are unpredictable, given the market’s reliance on the certainty that “central banks have our back” is ending. 2. Interest rates / bond

Topics:

Charles Hugh Smith considers the following as important: Featured, newslettersent, The United States

This could be interesting, too:

The central banks’/states’ power to maintain a permanent bull market in stocks and bonds is eroding. There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close. The 9-year run of Bull-trend stability is ending as a result of a confluence of macro dynamics: 1. Central banks are under pressure to reduce, end or reverse their unprecedented monetary stimulus, and the consequences are unpredictable, given the market’s reliance on the certainty that “central banks have our back” is ending. 2. Interest rates / bond

Topics:

Charles Hugh Smith considers the following as important: Featured, newslettersent, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The central banks’/states’ power to maintain a permanent bull market in stocks and bonds is eroding.

There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close.

The 9-year run of Bull-trend stability is ending as a result of a confluence of macro dynamics:

1. Central banks are under pressure to reduce, end or reverse their unprecedented monetary stimulus, and the consequences are unpredictable, given the market’s reliance on the certainty that “central banks have our back” is ending.

2. Interest rates / bond yields may well plummet in a global recession, but if we look at a 50-year chart of interest rates, we see a saucer-shaped bottoming in play. Technician Louise Yamada has been discussing the tendency of interest rates/bond yields to trace out a multi-year saucer bottom for over a decade, and we can now discern this.

Even if yields plummet in a recession, as many analysts predict, this doesn’t necessarily negate the longer term trend of higher yields and rates.

3. The global economy is overdue for a business-cycle recession, which is characterized by a retrenchment of credit and the default of marginal debt. The “recovery” is the weakest recovery in the past 60 years, and now it’s the longest expansion.

4. The mainstream financial media is telling us that everything is going great in the global economy, but this sort of complacent (or even euphoric) “it’s all good news” typically marks the top of stocks, just as universal negativity marks secular lows.

5. What happens to markets characterized by uncertainty? Once certainty is replaced by uncertainty, markets become fragile and thus exposed to sudden shifts of sentiment. This destabilization is expressed as volatility, but it’s far deeper than volatility as measured by VIX or sentiment indicators.

|

Market participants have become accustomed to an implicit entitlement: that investors / speculators will earn consistently positive returns on their capital, as central banks and governments have both the power and the mandate to “save” participants from losses and generate phantom wealth (“gains”).

This entitlement is ending, as the central banks’/states’ power to maintain a permanent bull market in stocks and bonds is eroding, and I suspect few participants have a strategy for a permanently riskier environment going forward.

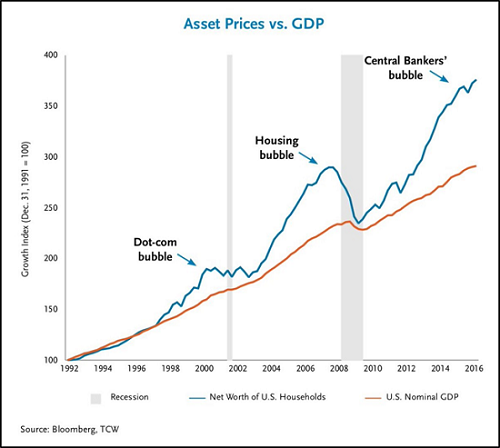

How much will risk assets have to decline for “wealth” to return to the production of real-world wealth in the real-world economy? Clearly, the answer is “a lot.”

|

Asset Prices vs GDP, 1992 - 2016 |

Tags: Featured,newslettersent