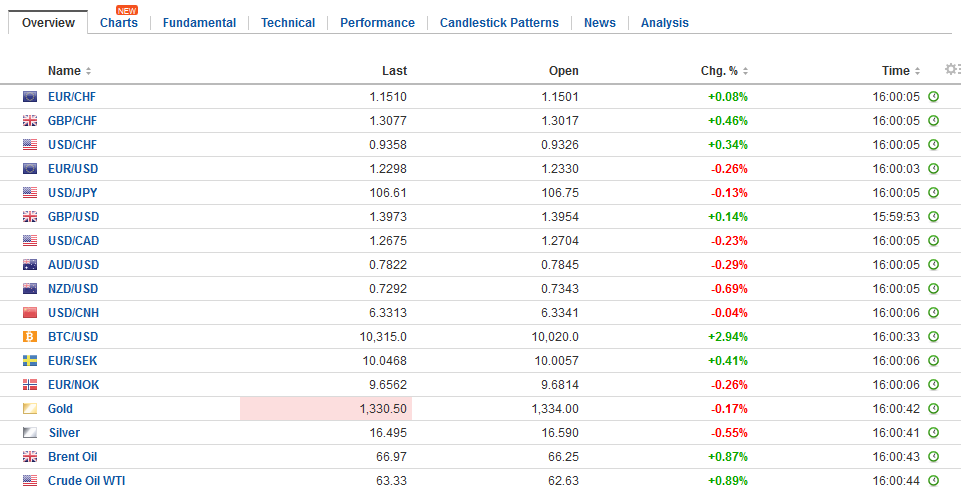

Swiss Franc The Euro has risen by 0.20% to 1.152 CHF. EUR/CHF and USD/CHF, February 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A light economic schedule in North America may help the markets close the week on a quiet note. Perhaps if there is one number that captures this sense, it may be the VIX. It is soft and barring a new disruption today, it is poised to close lower for the second consecutive week, for the first time this year. The US dollar is steady to higher today and barring a reversal, will close stronger on the week against the major currencies. Today, sterling is the only currency gaining on the greenback. The press reports that a fragile consensus

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, FX Trends, GBP, Germany Gross Domestic Product, Japan National Consumer Price Index, Japan National Core Consumer Price Index, JPY, newslettersent, Spain Producer Price Index, SPY, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has risen by 0.20% to 1.152 CHF. |

EUR/CHF and USD/CHF, February 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

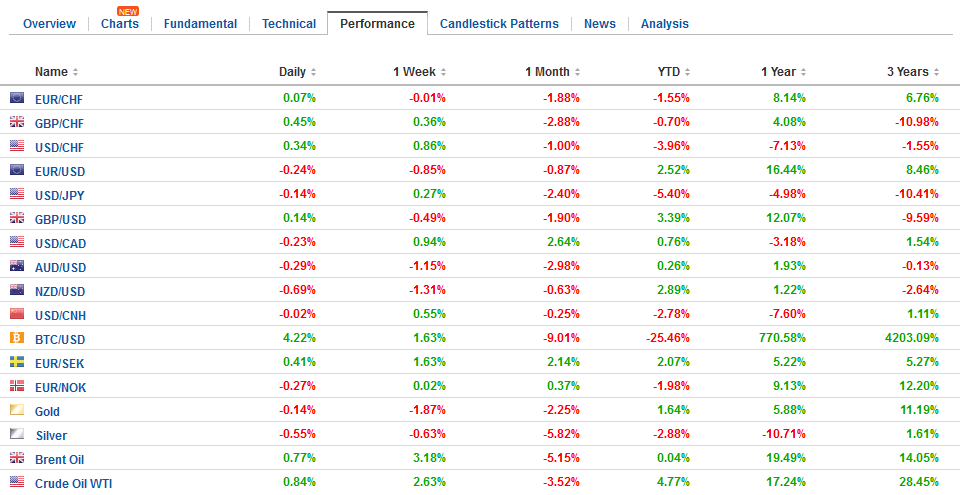

FX RatesA light economic schedule in North America may help the markets close the week on a quiet note. Perhaps if there is one number that captures this sense, it may be the VIX. It is soft and barring a new disruption today, it is poised to close lower for the second consecutive week, for the first time this year. The US dollar is steady to higher today and barring a reversal, will close stronger on the week against the major currencies. Today, sterling is the only currency gaining on the greenback. The press reports that a fragile consensus in the UK government has emerged, seemingly in favor of a free-trade agreement like the one recently struck with Canada and greater access to the Single Market. The problem with this position is that some in the EU regard this as cherry-picking and reject it. Next week’s speeches by May and Corbyn are the next Brexit focus. |

FX Daily Rates, February 23 |

| The US 10-year benchmark yield is a couple of basis points lower today, cutting the weekly advance in half. The yield reached almost 2.96% in the middle of the week, which represents new highs for the move, but buyers emerged, and the yield is now near 2.90%. The two-year yield is slipping below 2.25% but is still almost six basis points higher on the week. The FOMC minutes and the recent string of data and comments give investors little reason to doubt that another 25 bp hike will be delivered next month.

Although the US will not report any economic data today, four Fed officials speak, including Dudley and Rosengren on the Fed’s balance sheet (Mester and Williams also speak in the afternoon). Also, the Fed will release its monetary report, which will serve as the basis for Chairman Powell’s testimony before Congress next week. |

FX Performance, February 23 |

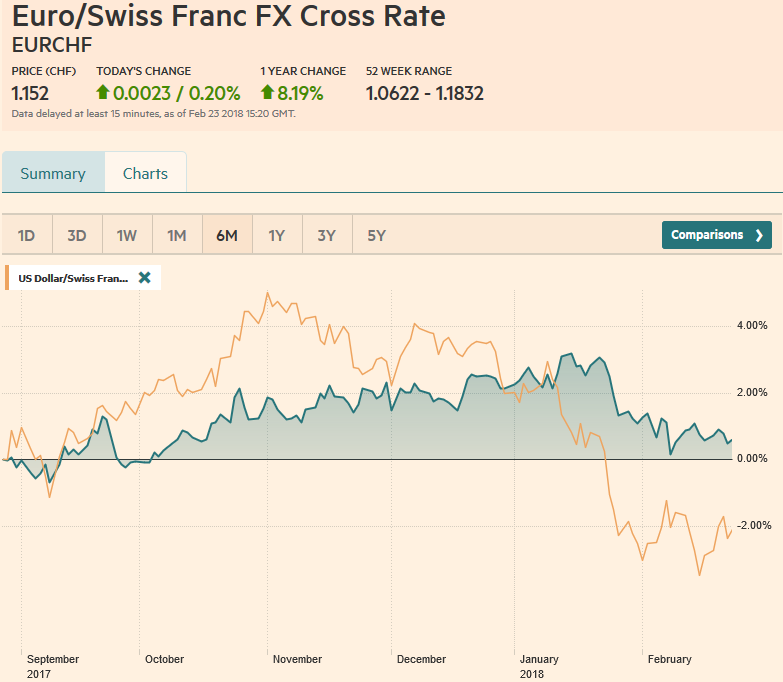

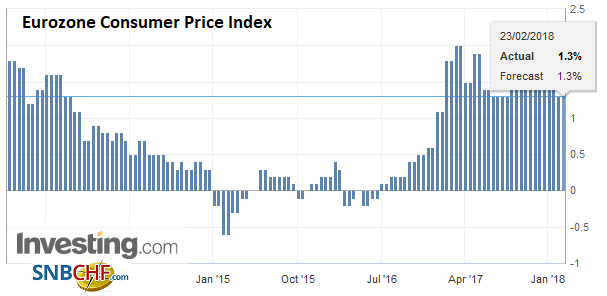

EurozoneThe eurozone confirmed the preliminary January CPI, which fell 0.9% on the month for a year-over-year pace of 1.3%, which represented a decline from 1.4% in December and 1.5% in November. |

Eurozone Consumer Price Index (CPI) YoY, Feb 2018(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

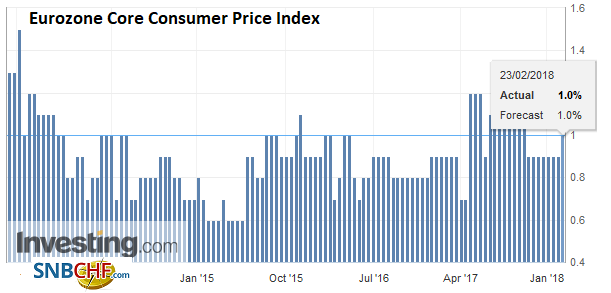

| The core rate was confirmed at 1.0%, after holding steady at 0.9% throughout Q4. Next week, the preliminary February reading will be released. The headline rate appears poised to slip to 1.3%, while the core may be steady with risk on the upside. Brent is off nearly 5% this month, and the euro is off about a cent so far this month. |

Eurozone Core Consumer Price Index (CPI) YoY, Jan 2018(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

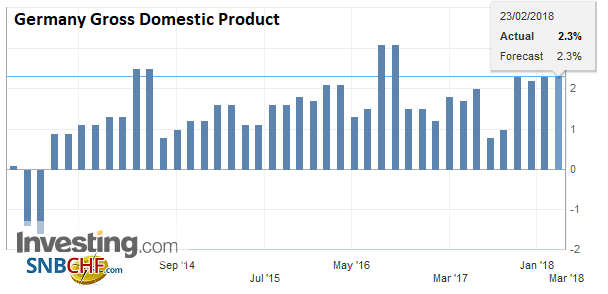

GermanyGermany provided details of its Q4 expansion of 0.6%. Private consumption and capital investment were flat. Government spending increased 0.5% in the final quarter the same as in Q3. Domestic consumption edged 0.1% higher. The strength of the German economy seemed to be spurred by the 2.7% rise in exports, the strongest showing since mid-2010. Imports rose 2.0%. It is the third quarter in the past five that German imports rose 2% or more. It suggests what private demand there was had been likely met by foreign production. |

Germany Gross Domestic Product (GDP) YoY, Q4 2018(see more posts on Germany Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

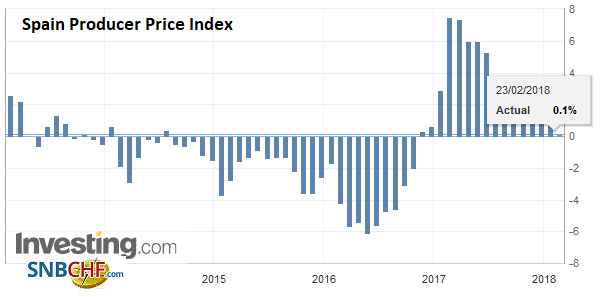

Spain |

Spain Producer Price Index (PPI) YoY, Feb 2018(see more posts on Spain Producer Price Index, ) Source: Investing.com - Click to enlarge |

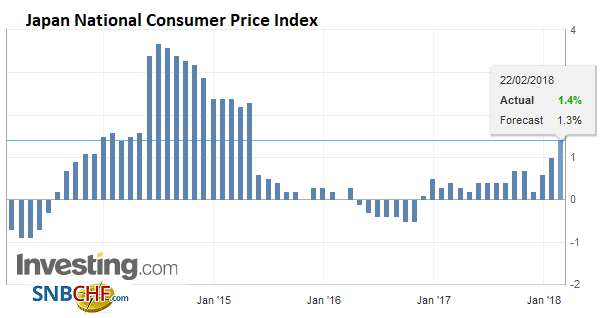

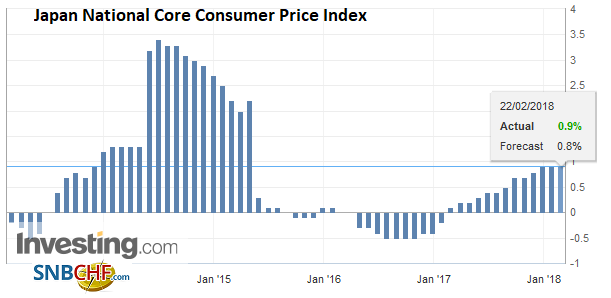

Japan |

Japan National Consumer Price Index (CPI) YoY, Jan 2018(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Japan National Core Consumer Price Index (CPI) YoY, Jan 2018(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Canada reports January CPI figures today. Prices are expected to have bounced back after falling 0.4% in December. However, the base effect suggests that even a 0.5% increase, which is what is expected, will not prevent the year-over-year pace from slipping to 1.5% from 1.9%. The underlying measures are expected to be steadier. Still, after yesterday’s disappointing retail sales report, which comes on the heels of other soft data, the market has downgraded the chances of an April hike. Interpolating the odds from the OIS suggest chances of a rate hike have slipped to about 44% from 54% a week ago.

The Canadian dollar is little changed on the day, but its 1.2% loss on the week, gives it the dubious honor of the second weakest of the majors this week. It was eclipsed by the 2.25% of the Swedish krona after Sweden also reported a softer than expected inflation report earlier this week. The US dollar reached its best level against the Canadian dollar this year with yesterday’s push to CAD1.2755. The technical indicators favor the greenback but do not rule out a consolidative session ahead of the weekend.

The MSCI Asia Pacific Index alternated between advances and declines this week and ended with a 1% gain, which ensured it an advance for the week. The 0.7% gain was the second consecutive weekly rise but keeps it knocking on the 50% retracement target of the recent swoon. European shares are a bit heavy, with the Dow Jones Stoxx 600 off fractionally, and it is nearly flat on the week. US shares are trading higher, and with a bit of luck (and mildly supportive technicals), it can close higher on the week.

The euro and yen are trading within yesterday’s ranges. There are some option expirations that could influence trading activity. There is an 842 mln euro strike at $1.23 that will be cut today. A $928 mln option struck at JPY107 expires. The Scandis have fallen to new lows for the week against the euro. This is especially true of the Swedish krona, against which the euro has made new highs since 2016, pushing a little through SEK10.06 today. The dollar-bloc currencies are also heavy. While the Australian dollar is holding above $0.7800, the New Zealand dollar has been sold to new lows for the week below $0.7300 and is approaching a pivotal level near $0.7275.

Lastly, both Fitch and S&P are set to announce the results of their reviews of Russia’s creditworthiness. Both rating agencies have a positive outlook and could boost Russia’s rating. The S&P decision may be more important. It currently gives Russia a BB+ rating. An upgrade could give it investment grade status, while Fitch has it at BBB-.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,Germany Gross Domestic Product,Japan National Consumer Price Index,Japan National Core Consumer Price Index,newslettersent,Spain Producer Price Index,SPY,USD/CHF