Keith offers a fresh look at some of those “oft-repeated yet difficult to get your mind around” macro problems with the dollar and our monetary system. Of particular interest is Keith's concept of Yield Purchasing Power the Marginal Productivity of Debt. They help shed light on where the economy really is. The value of each dollar of additional debt undertaken is helping economic activity less and less, until the system collapses.

Read More »Keith Weiner – Update on Gold and Silver and Debt #3930

Keith offers a fresh look at some of those “oft-repeated yet difficult to get your mind around” macro problems with the dollar and our monetary system. Of particular interest is Keith's concept of Yield Purchasing Power the Marginal Productivity of Debt. They help shed light on where the economy really is. The value of each dollar of additional debt undertaken is helping economic activity less and less, until the system collapses.

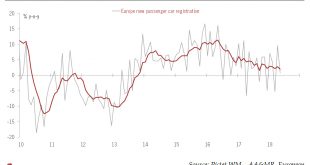

Read More »European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry. The motor vehicle industry is of major importance to the EU economy and to global trade. According to Eurostat, total exports (to countries outside the EU) amounted to EUR205bn in 2017. Germany accounted for 52% of total motor exports. The US was the largest destination for EU motor...

Read More »Swiss Offshore Wealth Management Sector still World’s Largest by far

A report by The Boston Consulting Group highlights the size of Switzerland’s personal offshore wealth management sector. ©-Valeriya-Potapova-_-Dreamstime.com_ - Click to enlarge Total personal offshore wealth grew by 6% to reach US$8.2 trillion in 2017. US$2.3 trillion (28%) of this was managed in Switzerland. The top three offshore centres: Switzerland ($2.3 trillion), Hong Kong ($1.1 trillion) and Singapore ($0.9...

Read More »FX Daily, June 18: Politics and Economics Weigh on European Currencies

Swiss Franc The Euro has fallen by 0.40% to 1.1533 CHF. EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against most of the major and emerging market currencies. The prospects of escalating trade tensions and the divergence of policy that was confirmed by the major central banks are disrupting the markets. Norway’s...

Read More »FX Weekly Preview Warning: Treacherous Week Ahead

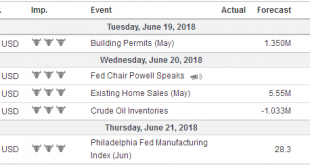

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data. There are three major disruptive forces the make for a challenging investment climate just the same: the US policy mix, trade tensions, and immigration. The mix of tighter monetary...

Read More »Emerging Markets: What Changed

Summary US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned. Chile central bank signaled...

Read More »Gold Divergences Emerge

Bad Hair Day Produces Positive Divergences On Friday the ongoing trade dispute between the US and China was apparently escalated by a notch to the next level, at least verbally. The Trump administration announced a list of tariffs that are supposed to come into force in three week’s time and China clicked back by announcing retaliatory action. In effect, the US government said: take that China, we will now really hurt...

Read More »Union européenne. Les chiffres de la dette. LHK

L’histoire de la construction de l’Union européenne est avant tout une histoire d’endettement public. La preuve en un graphique: Le volume cumulée d’endettement de l’UE atteint en 2017 le chiffre respectable de 12, 46664 billions d’euros (à ne pas confondre avec le billion américain!). Cela revient à un endettement cumulé de 12 466 640 000 000 euros, soit 12 trillions d’euros (référence de mesure US) Maintenant, la...

Read More »Switzerland remains biggest offshore wealth centre

Switzerland still attracts a lot of wealth The stock market boom boosted personal financial wealth around the globe by 12% last year – to the benefit of Switzerland. It is still the world’s biggest centre for managing offshore wealth at $2.3 trillion (CHF2.3 trillion). Figures revealed in a Boston Consulting Group reportexternal link published on Thursday put the country ahead of Hong Kong ($1.1 trillion) and Singapore...

Read More » SNB & CHF

SNB & CHF