USD/CHF recovers amid the recent risk reset. 200-bar SMA adds to the upside barrier, 2019 low holds the key to further declines. USD/CHF bounces off the intra-day low of 0.9665 to 0.9702 while heading into the European session on Wednesday. The pair benefits from the absence of immediate US-Iran war after Tehran hit US bases in Iraq. Even so, the pair stays well below the descending trend line since November 29, at 0.9730, which limits the near-term advances. Should...

Read More »Swiss rents fall but property prices increase in 2019

Access to home ownership became more expensive. (© Keystone / Ennio Leanza) Rents in Switzerland fell by an average of 0.5% last year but some regions bucked the trend. Last year was a good one for tenants, according to the Swiss Real Estate Offer Indexexternal link, which was published on Tuesday. December alone saw rents dropping 0.4% on average. The most significant drops were in central Switzerland (-1.7%), the Lake Geneva region (-1.1%) and northwestern...

Read More »More Trends That Ended 2019 The Wrong Way

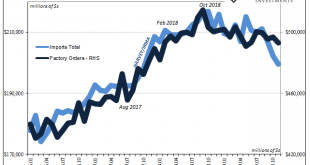

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019. That’s the version that is being described, Jay Powell’s underlying...

Read More »The S&P’s Biggest Bear Capitulates

First it was Dennis Gartman shutting down his newsletter after more than three decades, lamenting a market that no longer made any sense (a lament shared by Deutsche Bank’s Aleksanda Kocic), and now the market’s QE4-driven meltup has forced Wall Street’s biggest sellside bear to capitulate on his November call that the market will drop in 2020; instead UBS’ head of US equity strategy, Francois Trahan, has joined the bullish herd hiking his year-end S&P price...

Read More »Gold’s New Bull Market and Why $7,000 Per Ounce Is “Logical” (Part I)

◆ Gold could rise to more than $7,000 an ounce according to respected MoneyWeek contributor and fund manager Charlie Morris (Part I today and Part II tomorrow) A year ago, in my occasional free newsletter, Atlas Pulse, I upgraded gold – which was trading at $1,239 an ounce at that point – to “bull market” status for the first time since 2012. Unlike the gold bugs, I’m not a broken record. And unlike the barbarous relic brigade, I recognise gold’s importance in the...

Read More »FX Daily, January 7: Geopolitical Angst Eases, Helps Equities and Underpins the Greenback

Swiss Franc The Euro has fallen by 0.10% to 1.0827 EUR/CHF and USD/CHF, January 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today’s rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a...

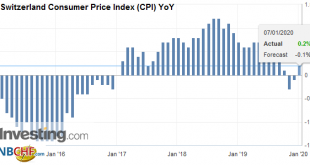

Read More »Swiss Consumer Price Index in December 2019: +0.2 percent YoY, +0.4 percent MoM

07.01.2020 – The consumer price index (CPI) remained stable in December 2019 compared with the previous month, remaining at 101.7 points (December 2015 = 100). Inflation was +0.2% compared with the same month of the previous year. The average annual inflation reached +0.4% in 2019.These are the results of the Federal Statistical Office (FSO). The average annual inflation for 2019 corresponds to the rate of change between the annual average of the CPI for 2019 and...

Read More »USD/CHF Technical Analysis: Inside descending channel below 200-HMA

USD/CHF clings to 23.6% Fibonacci retracement of the pair’s downpour from Christmas to December 31. The falling channel, 200-HMA will challenge the Bullish MACD. The current month top will lure the buyers during further upside. The USD/CHF pair’s latest recovery seems to struggle around 0.9690 during early Tuesday. A short-term falling trend channel and prices below 200-Hour Moving Average (HMA) seem to question the recently bullish MACD. As a result, buyers will...

Read More »Hoher Gewinn der SNB weckt Begehrlichkeiten

Die SNB wird am Donnerstag voraussichtlich einen Gewinn von rund 50 Milliarden Franken vermelden. (Bild: Shutterstock.com) Am nächsten Donnerstag publiziert die Schweizerische Nationalbank (SNB) ihr Finanzergebnis für das Jahr 2019. Sie dürfte gemäss den Berechnungen der UBS für das Gesamtjahr einen Gewinn von rund CHF 50 Mrd. erzielt haben, im Schlussquartal resultierte hingegen ein Verlust von rund CHF 1 Mrd. Bund und Kantone können mit einer Auszahlung von CHF 2...

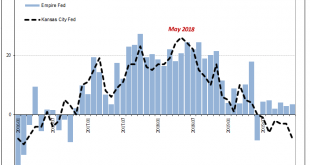

Read More »Manufacturing Clears Up Bond Yields

Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month. Subsequent months of data had continued the trend. By November, the PMI registered 52.6...

Read More » SNB & CHF

SNB & CHF