Like guests at this restaurant in canton Lucerne, government debt analysts will also have a lot on their plate (Keystone) A further CHF14.9 billion ($15.5 billion) has been agreed by parliament to cope with the coronavirus pandemic. Most of it will go towards unemployment insurance, which finances short-time work compensation. With the new credit package approved in the Senate on Thursday, coronavirus costs for the government will almost double. In an extraordinary...

Read More »Coronavirus: Switzerland holds off on open borders with Italy

© Alexirina27000 | Dreamstime.com Switzerland’s Federal Council announced on June 2 that it plans to maintain border restrictions with Italy until further notice as a reciprocal border arrangement with Italy would be premature. From 3 June 2020, Swiss residents will be able to travel to and return from Italy, but Italians or Italian residents will not be able to travel to and from Switzerland unless they are able to under current border restrictions, for example...

Read More »What Did Everyone Think Was Going To Happen?

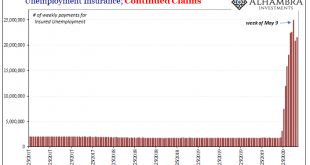

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign. The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this expected? All this...

Read More »When Institutions Fail, Fragmentation and Decentralization Become Solutions

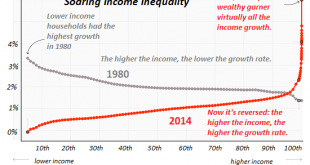

That which has failed is unsustainable, no matter how many trillions the Federal Reserve tosses against the tides of history. The Gulfs Between the Classes The Credibility Gap The Partnerships That Failed The Groups That Opted Out The Undermining of Effort Every one of these is a manifestation of institutional failure. The Gulfs Between the Classes (see chart of soaring inequality below) manifests a completely broken economic and social order, and the abject...

Read More »Cool Video: The Liquidity Hypothesis

Jackie Pang from Meigu TV called and wanted to talk about the seeming disconnect between Wall Street and Main Street. In this nearly 4.5 minute clip that she posted here, she gave me plenty of time to explain what I make of it. At the beginning of the year, as the S&P 500 was making new record highs, many observers wondered about the connection. The growing disparity of wealth and income may also raise questions about the linkages between Wall Street and Main...

Read More »The Media Has Conveniently Forgotten George W. Bush’s Many Atrocities

Former president George W. Bush has returned to the spotlight to give moral guidance to America in these troubled times. In a statement released on Tuesday, Bush announced that he was “anguished” by the “brutal suffocation” of George Floyd and declared that “lasting peace in our communities requires truly equal justice. The rule of law ultimately depends on the fairness and legitimacy of the legal system. And achieving justice for all is the duty of all.” Bush’s...

Read More »CHARLES HUGH SMITH – Made, Spend and Stay ın The Local Economy

SUBSCRIBE For The Latest Issues About ; can economy grow forever, how indian economy can grow, can the economy ever recover, can the economy recover after covid, how did economy start, how do economy works #DEEP STATE #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ For More Info;...

Read More »CHARLES HUGH SMITH – Made, Spend and Stay ın The Local Economy

SUBSCRIBE For The Latest Issues About ; can economy grow forever, how indian economy can grow, can the economy ever recover, can the economy recover after covid, how did economy start, how do economy works #DEEP STATE #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ For More Info;...

Read More »FX Daily, June 5: Greenback Remains Soft Ahead of Employment Report, but Reversal Possible

Swiss Franc The Euro has risen by 0.64% to 1.0898 . FX Rates Overview: The modest loss in the S&P 500 and NASDAQ yesterday did not signal the end of the bull run. All the markets in the Asia Pacific region rallied, with the Hang Seng among the strongest with a 1.6% advance that brought the week’s gain to around 7.8%. South Korea’s Kospi was not far behind with a weekly gain of 7.5%. In the past two weeks, the MSCI Asia Pacific Index is up nearly 10%. European...

Read More »Que fait une banque centrale pour soutenir l’économie locale par temps de confinement? La BNS au menu

Voici une vidéo tournée par Christian Campiche lors d’une rencontre matinale autour d’un café. Christian s’est mis à enregistrer alors que nous parlions de ce que la BNS faisait, et surtout ne faisait pas, pour soutenir la population suisse dans cette période de post-confinement. Mon point de vue est non seulement qu’elle ne fait rien pour l’économie locale, mais qu’elle fait tout pour le marché financier international auquel elle appartient pleinement. embedded...

Read More » SNB & CHF

SNB & CHF