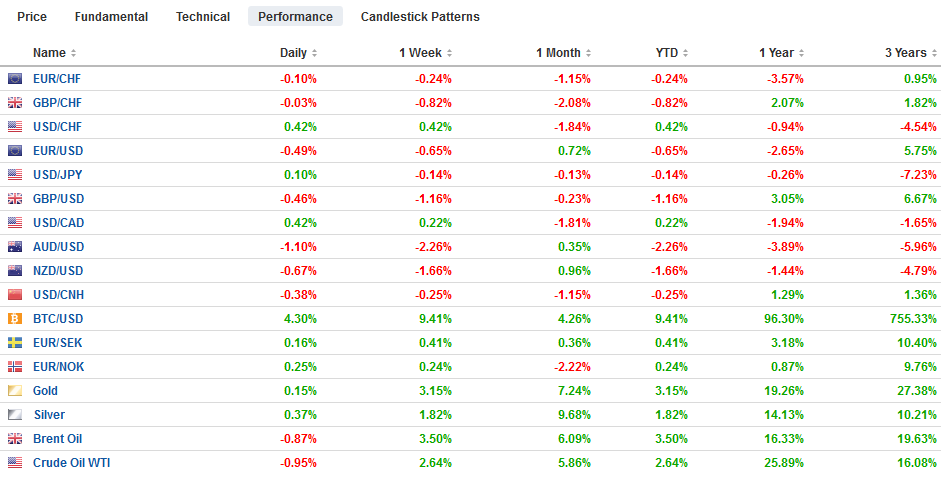

Swiss Franc The Euro has fallen by 0.10% to 1.0827 EUR/CHF and USD/CHF, January 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today’s rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a nearly 1.4% advance in Australia, with the exception of Taiwan. Europe is also recouping much of what was lost over the past two sessions, and US shares are trading firmly. Bond yields have not risen as much as one might expect. Core bond yields are little changed, while European peripheral yields are

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, 4.) Marc to Market, Brexit, China, EMU, Featured, newsletter, SPX, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.10% to 1.0827 |

EUR/CHF and USD/CHF, January 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today’s rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a nearly 1.4% advance in Australia, with the exception of Taiwan. Europe is also recouping much of what was lost over the past two sessions, and US shares are trading firmly. Bond yields have not risen as much as one might expect. Core bond yields are little changed, while European peripheral yields are around two basis points higher, and UK Gilts are also under pressure. The dollar is trading higher against nearly all the major currencies, with the Antipodean currencies the heaviest. Among emerging market currencies, Asia is faring best, with the Chinese yuan the strongest currency in the world today, rising a little more than 0.5% against the US dollar. At the same time, eastern and central European currencies underperform. The combination is leaving the JP Morgan Emerging Market Currency Index little changed. Gold’s seven-day rally under threat, but after a drop to about $1555, it has recovered $10 to trade little changed on the day. Similarly, February WTI recovered from its initial pullback to hover a little below $63 a barrel. |

FX Performance, January 7 |

Asia Pacific

The setback in the yen yesterday helped set the stage for the recovery in Japanese stocks today. Japan’s 10-year bond auction was well received with a little concession offered by the initial rise in yields. The sale was oversubscribed 3.7x, the most since August. Recent reports suggest foreign central banks have also bought JGBs and hedged back into dollars to secure a larger yield than available in the US Treasury market. The MOF will report the latest portfolio flows Thursday morning in Tokyo, but at the end of last year, foreign investors were net sellers of JPY1.33 trillion of Japanese bonds. The selling offset the bulk of the four-week buying spree that was snapped. It was the largest divestment since September. If year-end window dressing was the culprit, a return to the market may not be surprising if not in this week’s report, then next week’s.

While China’s reserves draw attention, that does not seem to be the main development today. China’s reserves rose to $3.107 trillion in December from $3.096 trillion in November. The increase appears to reflect valuation adjustments rather than intervention. Reserves stood at $3.073 trillion at the end of 2018 and have been virtually flat in the last several months. Still, we think the bigger story that has not received much attention (yet) is the comment from China’s Vice Minister of Agriculture that cautioned that the country will not boost its annual grain import quotas to accommodate the higher farm purchases from the US. Wheat, corn, and rice were specified, though not soy. There are two implications. First, it seems like meeting the numerical targets the US has touted will be more difficult, and second that the increase in US agriculture exports to China will come at the expense of other countries.

After recovering yesterday from almost JPY107.75 to the JPY108.50 area, the US dollar is consolidating in about a quarter yen range below JPY108.50. This area corresponds to a (38.2%) retracement of the greenback’s decline from the December 26 high. The 200-day moving average is near JPY108.65, and the next retracement objective is around JPY108.70. The Australian dollar is extending its downdraft for the fifth consecutive session, and its loss of over 0.75% today could be the biggest decline since last April. Recall that the leg-up had begun in late November from around $0.6750 and peaked on New Year’s Eve near $0.7030. The dramatic correction has brought seen it retracement 50% (~$0.6895), which also corresponds to the 200-day moving average. It appears set to test the next retracement target closer to $0.6860. The Chinese yuan firmed above its 200-day moving average (~CNY6.9490) for the first time since last May.

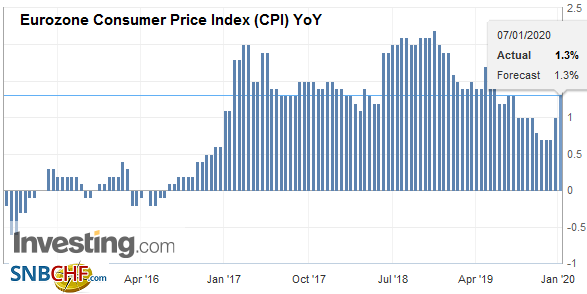

EuropeTwo data points from the eurozone are important today. First, the preliminary December CPI rose 0.3% as economists expected. This lifts the year-over-year rate from 1.0% to 1.3%. The core rate was unchanged at 1.3%. Service inflation eased slightly to 1.80% from 1.85%, while core goods prices rose 0.45%, a two-year high, from 0.37% in November. We anticipate a further rise in EMU inflation as a result of the base effect and higher oil prices. |

Eurozone Consumer Price Index (CPI) YoY, December 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The core rate may rise a bit more, and around 1.5% would begin to spur a change in tone from the ECB. The second data point was the November retail sales report. It rose by 1.0% compared with the median forecast in the Bloomberg survey for a 0.7% gain. Plus, October’s 0.6% decline was revised to only 0.3%. The resilience of eurozone retail sales, which is domestic demand, and dovetails with the relative strength of the service sector, picked up on the PMI, is impressive. |

Eurozone Retail Sales YoY, November 2019(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

With the Tory majority in the House of Commons, the Brexit bills are expected to easily be approved before the House of Lords’ vote on the measures on Thursday. This seems like simply a formality at this juncture. Separately, Chancellor of the Exchequer Javid’s office has confirmed the budget will be presented on March 11. The government intends to jettison the fiscal rules so that the UK can take advantage of the low-interest rates to boost spending.

The euro is weaker but is trading within yesterday’s range. Initial support is seen in the $1.1155-$1.1160 area. A break could spur another half-cent loss. Resistance now is pegged near $1.1190. Sterling built on yesterday’s recovery but ran out of steam after poking above $1.3200. Support is seen near the recent lows near $1.3155-$1.3165. There is an option for about GBP220 mln at $1.3155 that expires today.

America

The US reports November trade and factory goods orders today and the non-manufacturing ISM that will help shape Q4 GDP forecasts. As we noted, the Atlanta Fed’s GDP tracker is looking at a strong quarter with above-trend growth, while the NY Fed’s model has the US economy slowing to a little more than 1% at an annualized rate. Investors know from the preliminary goods balance that the trade deficit fell in November. They know from the 2.0% decline in initial durable goods orders that factory orders likely fell as well. Today’s data, barring a significant surprise, is unlikely to clarify the picture. That may have to wait until the employment data at the end of the week. Canada reports its merchandise trade balance (November), and a wider shortfall is expected. The IVEY survey jumped in November (to 60 from 48.2), and the December reading likely slipped back.

The US dollar remains pinned near its recent trough against the Canadian dollar. We like the US dollar higher, and a move above CAD1.3000 would suggest it has begun, but it may take a move through CAD1.3040 to be convincing. Similarly, the US dollar has not been able to distance itself from the MXN18.80 area that has been the floor since the end of last year. Here too, we like the greenback on technical grounds. The Dollar Index is slightly firmer within yesterday’s range. A move, and ideally a close above 97.00, would lift the tone. It has not closed above there since Boxing Day. Lastly, we note that the S&P 500 posted an outside up day by trading on both sides of the previous session’s range, and closing above its high. This is seen as a bullish development that projects to new record highs. However, the lack of follow-through today would be disappointing.

Tags: #USD,$CNY,Brexit,China,EMU,Featured,newsletter,SPX