First it was Dennis Gartman shutting down his newsletter after more than three decades, lamenting a market that no longer made any sense (a lament shared by Deutsche Bank’s Aleksanda Kocic), and now the market’s QE4-driven meltup has forced Wall Street’s biggest sellside bear to capitulate on his November call that the market will drop in 2020; instead UBS’ head of US equity strategy, Francois Trahan, has joined the bullish herd hiking his year-end S&P price target from 3,000, where he set the bottom of the year-ahead market forecasts alongside Morgan Stanley’s notorious bear Michael Wilson, to 3,250. That said, as Bloomberg notes, Trahan’s new forecast is hardly exuberant, as it indicated a market that will close the year virtually unchanged from today’s level

Topics:

Tyler Durden considers the following as important: 3.) Swiss Banks, Dennis Gartman, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| First it was Dennis Gartman shutting down his newsletter after more than three decades, lamenting a market that no longer made any sense (a lament shared by Deutsche Bank’s Aleksanda Kocic), and now the market’s QE4-driven meltup has forced Wall Street’s biggest sellside bear to capitulate on his November call that the market will drop in 2020; instead UBS’ head of US equity strategy, Francois Trahan, has joined the bullish herd hiking his year-end S&P price target from 3,000, where he set the bottom of the year-ahead market forecasts alongside Morgan Stanley’s notorious bear Michael Wilson, to 3,250.

That said, as Bloomberg notes, Trahan’s new forecast is hardly exuberant, as it indicated a market that will close the year virtually unchanged from today’s level of 3,241. Still, he does joins other strategists in turning more optimistic after the S&P 500’s 29% rally in 2019 exceeded almost everyone’s expectations. |

|

| In a note to clients, Trahan writes that it will take time for the Fed’s lower borrowing costs to work though the economy and the benefits won’t take hold until 2021. As such, he believes that stocks are likely to pull back in the first half as earnings expectations are at risk of falling, and then recover during the later half in anticipation of a pickup in growth. This, as readers may recall, is the opposite of what BofA’s Michael Hartnett predicted: his forecast is for the S&P to ramp to 3,333 by March 3 after which it will drift lower heading into the political uncertainty of the November elections.

“We see this year as having two distinct phases for equities as markets transition from pricing in slower growth to pricing in an economic recovery,” Trahan wrote. “We expect a V-shaped year for the S&P 500”, he added although it is rather bizarre why the market will ramp into the election, especially if Democrats are gaining traction in the polls and as inflation starts to push higher, leaving the Fed with no opportunity to cut in the coming year. |

|

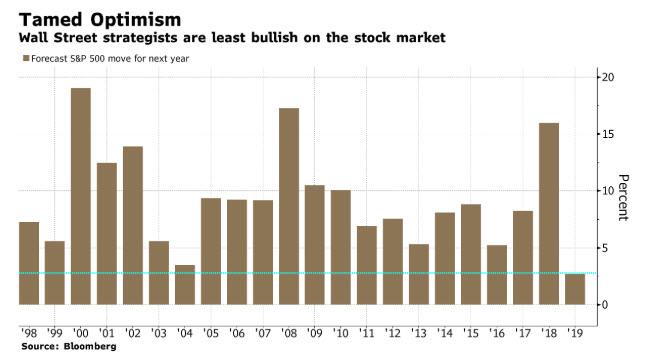

| While Trahan has skewed bearish for the past two years, his capitulation demonstrates a problem that has plagued most Wall Street strategists, whose modest 2019 year-end forecasts caught almost everyone scrambling to catch up to the market’s year-end rally. This skepticism has carried across, and according to Bloomberg’s latest survey, for 2020 sellside strategists provided the least optimistic annual outlook in two decades. As the chart below shows, the average prediction for the S&P 500 to end the year is at 3,318, which is only a 2.7% expected increase from current levels, the smallest for any year in data going back to 1999.

Earlier this week, two more strategists joined the bull parade, raising their own forecasts: Citi’s Tobias Levkovich hiked his price target by 75 points to 3,375 while RBC’s Lori Calvasina also boosted her target to 3,460 from 3,350. As we noted in December, even the market’s so-called permabear, Morgan Stanley’s Wilson, cautioned of the “risk” that the S&P 500 could melt up above his year-end fair projected range of 3,000 to 3,250, and in a Monday note, Wilson said that the index could surge as high as 3,500 in the first half because of central bank support. “Markets can overshoot fair value in liquidity driven bull market,” Wilson wrote. “Depending on how the economic and earnings data came in during the year will determine if we need to raise our year-end targets or not.” |

Tamed Optimism, 1998-2019 |

Tags: Dennis Gartman,Featured,newsletter