Cryptocurrencies are increasingly being integrated into traditional finance, driven by both retail and institutional interest. Financial institutions are embracing tokenization and institutional investors are increasingly entering the cryptocurrency market. Bitcoin, in particular, is emerging as a valuable diversification tool in wealth management, highlighted for its low correlation with traditional asset classes and its strong growth performance, a new report by Bitcoin Suisse, a Swiss crypto services provider, says. The inaugural “Crypto Wealth Management Report”, released in July 2024, looks at the historic performance of bitcoin, showcasing the crypto’s position as a potential powerhouse within diversified portfolios. The report explores the key drivers

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Cryptocurrencies are increasingly being integrated into traditional finance, driven by both retail and institutional interest. Financial institutions are embracing tokenization and institutional investors are increasingly entering the cryptocurrency market.

Bitcoin, in particular, is emerging as a valuable diversification tool in wealth management, highlighted for its low correlation with traditional asset classes and its strong growth performance, a new report by Bitcoin Suisse, a Swiss crypto services provider, says.

The inaugural “Crypto Wealth Management Report”, released in July 2024, looks at the historic performance of bitcoin, showcasing the crypto’s position as a potential powerhouse within diversified portfolios. The report explores the key drivers behind the performance of bitcoin and the potential benefits of incorporating the cryptocurrency into wealth management strategies.

Banks embrace crypto

Following record highs in 2021 and a subsequent slump, cryptocurrency prices have risen significantly in recent months. This resurgence has prompted various retail banks in Switzerland to develop crypto offerings, adapting to changing market dynamics and customer preferences, the report says.

A recent study by the Lucerne University of Applied Sciences and Arts found that 28% of Swiss banks currently offer or plan to offer cryptocurrency investment opportunities. State-backed banks, such as the cantonal banks of Zug, St Gallen and Lucerne, as well as Postfinance, the banking arm of the Swiss Post Office, have recently launched their crypto offerings.

The Bitcoin Suisse report also highlights the broader potential of blockchain technology beyond cryptocurrencies, noting that projects involving tokenization have proliferated and witnessed remarkable traction. For example, BlackRock’s introduction of its tokenized treasury fund, the BlackRock USD Institutional Digital Liquidity Fund, achieved a market value of US$500 million just four months after its launch, according to CoinDesk. This surge is part of the broader growth of the tokenized treasury market, which has more than doubled this year, rising from US$780 million in January 2024 to US$1.8 billion in June 2024.

In Switzerland, the central bank has also been exploring the concept of a central bank digital currency (CBDC). In collaboration with the Bank for International Settlements the Swiss National Bank (SNB) has been actively involved in Project Helvetia, an initiative which began in 2020 and which aims to integrate wholesale CBDCs (wCBDCs) into existing financial systems.

Project Helvetia recently entered a new phase, with the SNB and the SIX Digital Exchange (SDX) expanding their exploration of settling tokenized securities through a wCBDC to other financial institutions and transaction types.

Institutional adoption on the rise

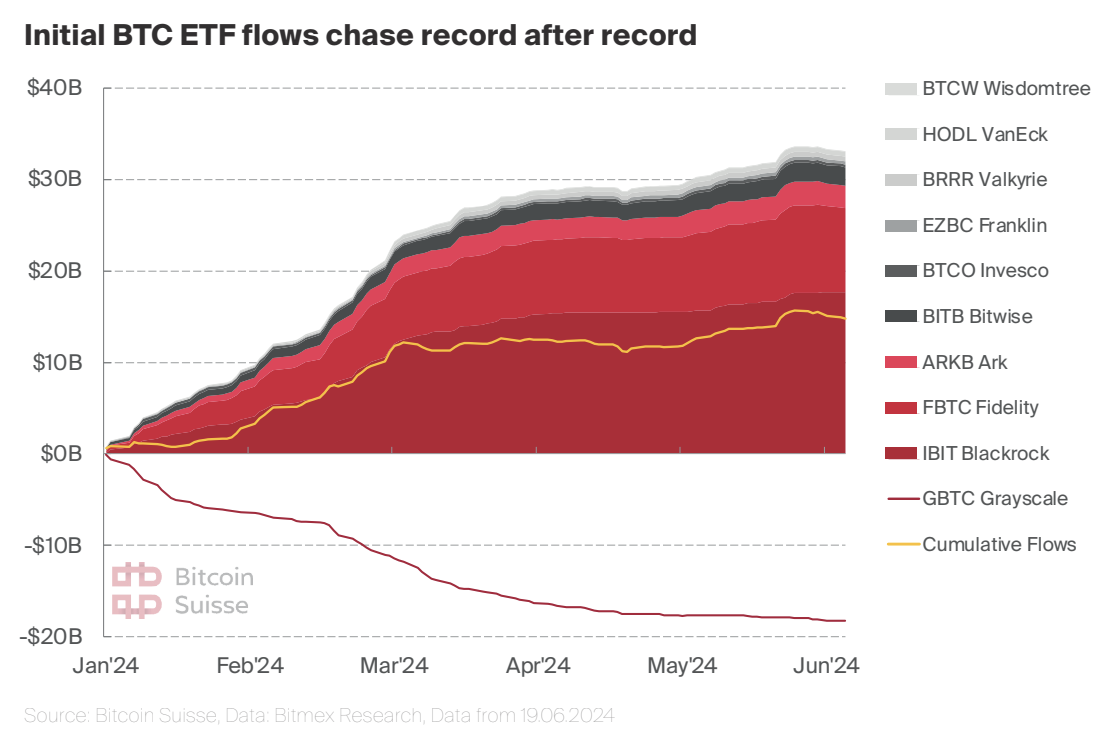

Adoption of cryptocurrencies has also increased among institutional investors. The world’s first bitcoin exchange-traded funds (ETFs), which debuted in the US in January 2024, have exceeded expectations, attracting US$12 billion in inflows within the first three months and almost US$300 billion in year-to-date trading volume. Globally, net flows into crypto exchange-traded products reached a record US$88.1 billion in assets under management (AUM) in Q1 2024.

Currently, bitcoin ETF flows largely stem from registered investment advisors, asset managers, hedge funds and family offices that have already established access. Bitcoin Suisse predicts that as more institutional consultants, corporations, pension funds, and sovereign wealth funds complete their due diligence, even more substantial capital flows will follow.

Bitcoin: a tool for diversification

Across the crypto market, bitcoin in particular is emerging as a powerful source of diversification. Bitcoin has low correlation with traditional asset classes, offering the lowest average correlation (0.04) to all relevant asset classes over a 12-month period, according to the report.

This low correlation makes the cryptocurrency a powerful tool for risk management and a diversification opportunity. By including bitcoin in a portfolio, wealth managers can potentially mitigate overall portfolio volatility while enhancing risk-adjusted returns, the report says.

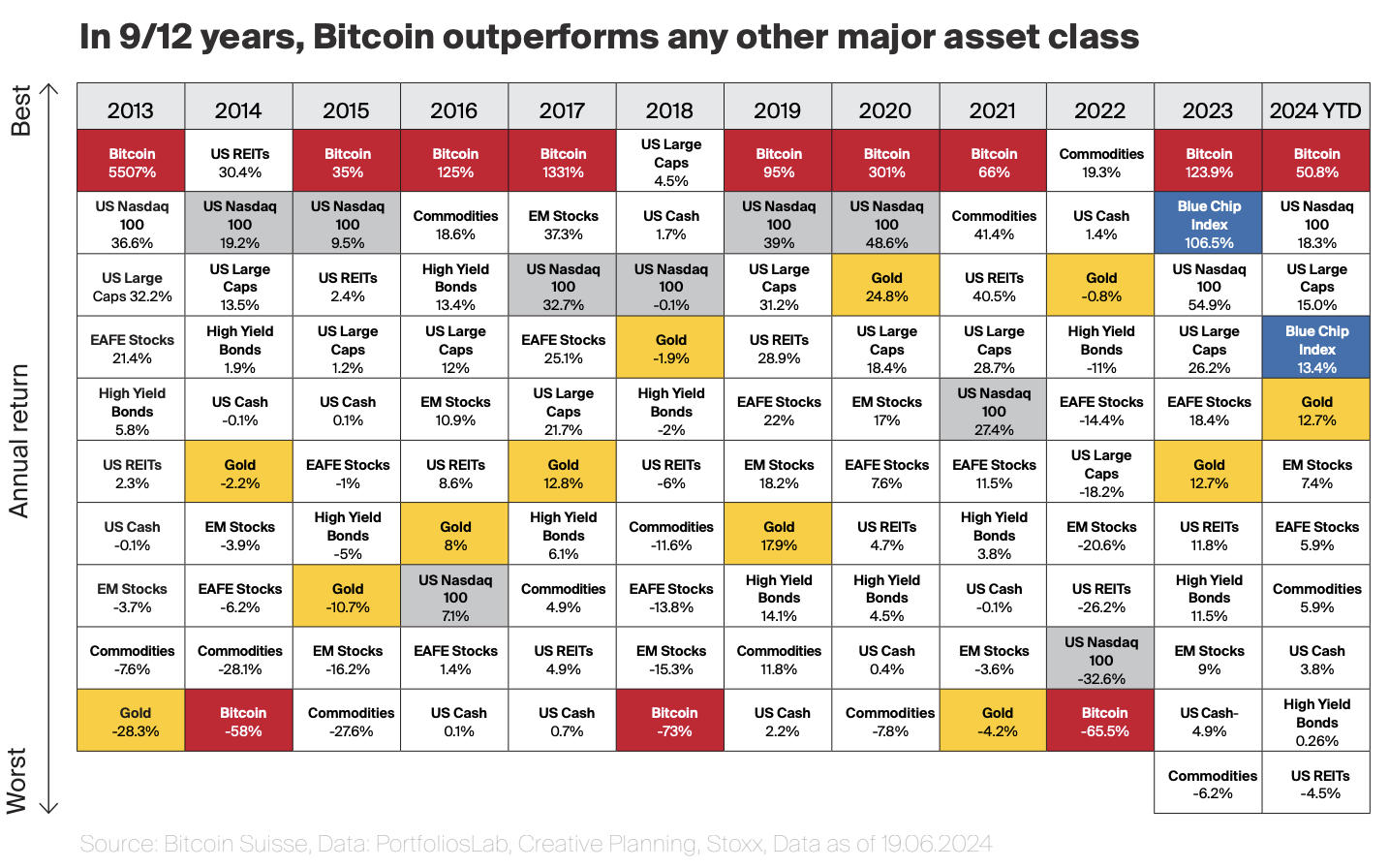

Bitcoin has recorded remarkable growth. Since 2013, the cryptocurrency has dominated every other asset class in annual performance in nine out of twelve years, providing an annualized return of ~109% and an astounding cumulative return of ~470,000%, according to the report.

Many factors contribute to bitcoin’s remarkable performance. One key differentiator lies in its finite supply, capped at 21 million coins. This scarcity creates a unique economic long-term value proposition where demand is almost guaranteed to outpace supply in the long run, the report says.

Another key property of bitcoin is its function as a store of value. Mimicking gold, bitcoin serves as an inflation hedge, carries no credit or counterparty risks, mostly features an inverse relation to the dollar, and can serve as a source of trust, because its network is decentralized, permissionless, and immutable.

Finally, bitcoin resonates with the new generation of investors. These investors are typically more technologically savvy and comfortable with digital innovations. They also value autonomy and have a growing distrust of traditional financial institutions, making bitcoin’s decentralized nature particularly appealing.

Featured image credit: edited from freepik

The post Crypto Wealth Report: Integration of Cryptocurrencies Boosted by Institutional Interest appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain,Featured,newsletter