Many commentators consider the spread between the long-term interest rate and the short-term interest rate as an important indicator to establish the future course of economic activity. An increase in the spread is seen as pointing toward good economic times ahead. Conversely, a declining spread raises the likelihood of an economic recession.Historically, in the U.S., the differential between the yield on the 10-year T-bill and the federal funds rate was leading the yearly growth rate of industrial production by 12 months (see Figure 1).Figure 1: Year-over-year U.S. industrial production versus 12-month yield curve lag (%)Source: Federal Reserve Bank of St. Louis (FRED)A popular explanation for the determination of the shape of the yield spread is provided by

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Many commentators consider the spread between the long-term interest rate and the short-term interest rate as an important indicator to establish the future course of economic activity. An increase in the spread is seen as pointing toward good economic times ahead. Conversely, a declining spread raises the likelihood of an economic recession.

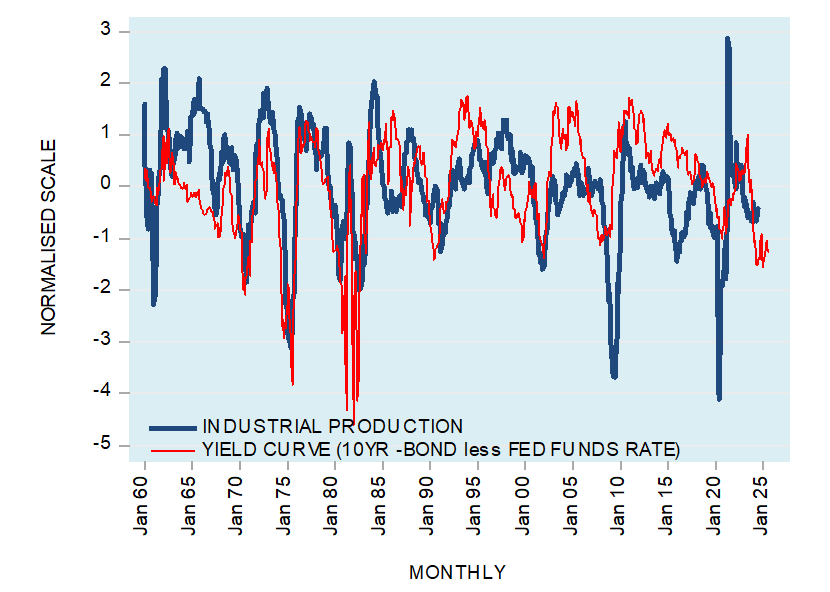

Historically, in the U.S., the differential between the yield on the 10-year T-bill and the federal funds rate was leading the yearly growth rate of industrial production by 12 months (see Figure 1).

Figure 1: Year-over-year U.S. industrial production versus 12-month yield curve lag (%)

Source: Federal Reserve Bank of St. Louis (FRED)

A popular explanation for the determination of the shape of the yield spread is provided by expectations theory. According to this theory, the key to the shape of the spread — also known as the yield curve — is that the long-term interest rates are the average of the present and the expected short-term interest rates.

Thus, if today’s one-year rate is 4% and the next year’s one-year rate is expected to be 5%, then the two-year rate today should be 4.5%, or (4 + 5) / 2 = 4.5. Here, the long-term interest rate (i.e., the two-year rate today) is higher than the present short-term interest rate (i.e., the one-year rate).

It follows then that expectations for increases in the short-term interest rate will make the yield curve upward sloping, as the long-term interest rate is higher than the short-term interest rate. Conversely, expectations for a decline in the short-term interest rate is going to result in a downward-sloping yield curve, as the long-term interest rate is lower than the short-term interest rate.

If today’s one-year interest rate is 4% and the next year’s one-year interest rate is expected to be 3%, then the two-year interest rate today should be 3.5%, or (4 + 3) / 2 = 3.5. The long-term interest rate (i.e., the two-year interest rate today) is lower than the present short-term interest rate.

According to expectations theory, whenever investors expect economic expansion, they anticipate rising short-term interest rates. Consequently, the long-term interest rate is going to be higher than the short-term interest rate — hence, an upward-sloping yield curve emerges.

Conversely, an economic slump is associated with the expectations for a declining short-term interest rate. As a result, according to expectations theory, the long-term interest rate today will be lower than the short-term interest rate — a downward-sloping yield curve emerges.

A good correlation between the yield curve and economic activity does not explain, however, why the yield curve is a good predictor of economic activity. The correlation only describes it.

Shape of the yield curve in an unhampered market

Ludwig von Mises concluded that in a free, unhampered market economy, the natural tendency of the shape of the yield curve is neither toward an upward-sloping curve nor toward a downward-sloping curve but rather toward a flattening one.

Mises wrote:

“The activities of the entrepreneurs tend toward the establishment of a uniform rate of originary interest in the whole market economy. If there turns up in one sector of the market a margin between the prices of present goods and those of future goods which deviates from the margin prevailing on other sectors, a trend toward equalization is brought about by the striving of businessmen to enter those sectors in which this margin is higher and to avoid those in which it is lower. The final rate of originary interest is the same in all parts of the market of the evenly rotating economy.”

Also, Murray Rothbard held that in a free, unhampered market economy, an upward-sloping yield curve cannot be sustained because it would set in place an arbitrage between short- and long-term securities.

This would lift the short-term interest rates and lower the long-term interest rates, resulting in the tendency toward a uniform interest rate. Arbitrage will also prevent the sustainability of a downward-sloping yield curve by shifting funds from long maturities to short maturities — thereby flattening the curve. Hence, in a free, unhampered market economy, an upward- or a downward-sloping yield curve cannot be sustained.

What is the mechanism that generates a sustained upward- or downward-sloping yield curve? The shape of the yield curve is the outcome of the Federal Reserve’s monetary policies.

How the Fed’s tampering generates an upward- or a downward-sloping yield curve

While the Fed can exercise control over the short-term interest rates via the federal funds interest rate, it has less control over the longer-term interest rates. In this sense, the long-term interest rates can be seen as partially reflecting the time preferences of individuals.

The Fed’s interest rate policy disrupts the natural tendency toward the uniformity of interest rates. This leads to the deviation of the short-term interest rates from individuals’ time preferences as partially mirrored by the relatively less-manipulated long-term interest rate.

When the Fed lowers the policy interest rate target, this almost instantly lowers the short-term interest rates, while to a lesser extent affecting the longer-term interest rates. As a result, an upward-sloping yield curve develops. (The interest rate differential between the long-term interest rate and the short-term interest rate widens.)

Conversely, when the Fed reverses its stance and lifts the policy interest rate target, this lifts the short-term interest rates. As a result, a downward-sloping yield curve emerges. (The differential between the long-term interest rate and the short-term interest rate narrows.)

The deviation of short-term interest rates from long-term rates due to the Fed’s tampering falsifies the signals issued by consumers to producers. This, in turn, culminates in the misallocation of resources and leads to economic impoverishment. Consequently, producers generate products that are not in line with the consumers’ instructions.

For example, when the Fed lowers its policy interest rate to encourage an expansion in the production structure, it does so in contrast to consumers’ time preferences. Consumers have not allocated an adequate amount of real savings. Hence, producers do not have enough real savings to undertake the expansion of the infrastructure, which leads to an economic bust.

The Fed’s interest rate framework is not based upon individuals’ time preferences but rather on political factors. By using the expectations-theory framework, the Fed sets long-term interest rates. Hence, according to expectations theory, the Fed is a major factor in setting the shape of the yield curve. The Mises-Rothbard framework also assumes the Fed influences the shape of the yield curve. However, the Fed does this by disrupting the natural tendency of the curve to gravitate toward being horizontal.

Why do changes in the shape of the yield curve precede economic activity?

Whenever the central bank reverses the interest rate stance, altering the shape of the yield curve, it leads to either an economic boom or an economic bust, although they do not arise immediately. The reason is that the effect of a change in the interest rate policy shifts from one market to another market.

For example, during an economic slump, the central bank reduces the policy interest rate. Consequently, a steepening of the yield curve emerges. This, however, has a minimal effect on economic activity, which is still dominated by the previous tight interest rate stance. It is only later, once the easy stance begins to dominate the economy that economic activity starts improving. If the pool of real savings is declining, then — notwithstanding the increase in the yield curve — economic activity is likely to remain under pressure. Hence, the historical correlation between the yield curve and economic activity is going to provide misleading reading.

Conclusion

Historically, in the U.S., there has been a good visual correlation between the yield curve and economic activity. However, correlation can only describe but not explain. The economic bust is likely to emerge notwithstanding an upward-sloping yield curve if the pool of real savings is declining or exhausted. Expectations theory, which is based on historical good visual correlation between the yield curve and economic activity, cannot provide a trustworthy explanation regarding the boom-bust cycles.

Tags: Featured,newsletter