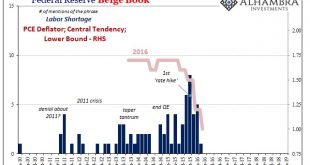

Today was supposed to see the release of the Census Bureau’s retail trade report, a key data set pertaining to the (alarming) state of American consumers, therefore workers by extension (income). With the federal government in partial shutdown, those numbers will be delayed until further notice. In their place we will have to manage with something like the Federal Reserves’ Beige Book. It may not be close to the same...

Read More »Workers paid in euros may not claim for currency losses

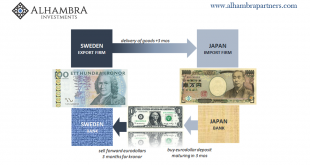

The two employees demanded they be reimbursed for losses in exchange rates The Swiss Federal Court has ruled that two Swiss companies do not have to compensate two employees who were paid in euros and who ended up with less than their franc-earning colleagues. Explaining its decisionexternal link on Tuesday, the country’s highest court said the cross-border workers from Germany and France had agreed to a corresponding...

Read More »That’s A Big Minus

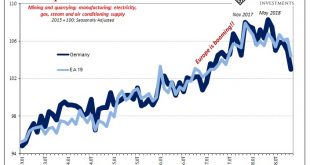

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention. China put up some bad trade numbers for last month, but Europe’s goods downturn came first. According to...

Read More »Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S. Caution among traders had deepened “ahead of a no-confidence vote on British Prime Minister Theresa May’s government and other...

Read More »Swiss Producer and Import Price Index in December 2018: +0.6 percent YoY, -0.6 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »FX Daily, January 18: Markets Finishing Week on Positive Note

Swiss Franc The Euro has fallen by 0.13% at 1.1311 EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF and USD/CHF, ) - Click to enlarge FX Rates Overview: Sentiment has improved since the volatility last month spooked investors and, perhaps, some policymakers. Global equities are rallying. The Shanghai Composite and the Nikkei are at their best levels in almost a month, while the Dow Jones Stoxx 600 is at...

Read More »Swiss and Italian leaders discuss cross-border tax deal

Swiss Foreign Affairs Minister Ignazio Cassis, left, with his Italian counterpart, Enzo Moavero Milanesi, in Lugano By spring, the Italian government is expected to clarify its position on a new tax system for cross-border commuters between Italy and Switzerland. “It is a delicate issue that must be digested sufficiently, with both administrative and political evaluations. It takes time, but spring is not far away,”...

Read More »Spreading Sour Not Soar

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve. There are real economic processes underneath....

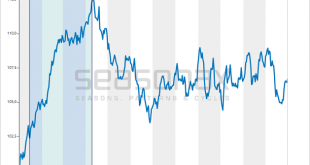

Read More »The Strongest Season for Silver Has Only Just Begun

Commodities as an Alternative Our readers are presumably following commodity prices. Commodities often provide an alternative to investing in stocks – and they have clearly discernible seasonal characteristics. Thus heating oil tends to be cheaper in the summer than during the heating season in winter, and wheat is typically more expensive before the harvest then thereafter. Precious metals are also subject to seasonal...

Read More »Charles Hugh Smith JAN 18, 2019 We Already Passed The Point Of No Return Collapse is Inevitable !

Thank You

Read More » SNB & CHF

SNB & CHF