The demand for the Swiss franc decreases as Wall Street indices are gaining strength. The level to beat for bulls are at 0.9790 and 0.9815 level. USD/CHF daily chart USD/CHF is trading off 2-month lows below the main daily simple moving averages (DSMAs). Equity markets are recovering from the recent selloff easing the demand for safe-haven currencies such as CHF and JPY. USD/CHF daily chart - Click to enlarge...

Read More »USD/CHF technical analysis: Traders await Swiss unemployment rate to break descending triangle

A four-day long descending triangle formation limits USD/CHF moves ahead of Swiss Unemployment Rate. 100-hour EMA offers an additional barrier to the upside. In addition to its choppy 11-pip trading range since morning, a four-day long descending triangle formation also limits USD/CHF pair moves as it trades near 0.9740 heading into Friday’s European market open. Investors will seek clues from Switzerland’s July month...

Read More »The US labels China a currency manipulator

The near-term impact will likely be limited but this is a clear negative for trade negotiations. Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator. According to the US Treasury Department, the decision was triggered by the perceived lack...

Read More »Novartis rejects suspected data manipulation in US

At its annual press conference in January, Novartis focused on “transformative treatments” – a therapy based on the belief that illness may be caused by the subconscious influences. Swiss pharmaceutical company Novartis has dismissed criticism that it allegedly withheld information about animal testing data inaccuracies to United States authorities for a human gene therapy. Novartisexternal link said its subsidiary in...

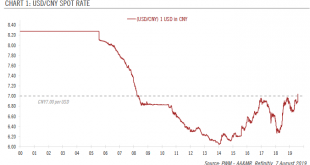

Read More »Currency update – the Chinese renminbi

Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD. The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the...

Read More »FX Daily, August 8: PBOC Helps Stabilize CNY, while US Equity Recovery Lifts Sentiment

Swiss Franc The Euro has risen by 0.27% to 1.0948 EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The challenges for investors have not gone away, but a combination of factors has helped stabilize the capital markets. The PBOC set the dollar’s reference rate above CNY7.0, but not as high as anticipated, and this has seen the yuan...

Read More »Yes, the Dollar is Above CNY7.0, but No, the Sky is Not Falling

The world’s two great powers are at loggerheads. Chinese nationalism meet your sister, US nationalism. Import substitution strategy of Made in China 2025 meet your cousin Make America Great Again. Paradoxically, or dialectically, the similarities are producing divergent interests that extend well beyond economics and trade policy. Consider that the intermediate-range nuclear missile treaty between the US and Russia did...

Read More »Chinese-owned Swissmetal sold to Swiss investors

Swissmetal has a long history beginning in the second half of the 19th century. But the company came under growing pressure in the 1980s as a result of international competition. The cash-strapped Baoshida Swissmetal company has been taken over by a group of Swiss investors six years after it was sold to a Chinese group. The newly-founded Swissmetal Industries, backed by two private investors, said it had acquired the...

Read More »The Gulag of the Mind

Befuddled and blind, we wander toward the cliff without even seeing it, focusing on our little screens of entertainment and self-absorption. There are no physical barriers in the Gulag of the Mind–we imprison ourselves, and love our servitude. Indeed, we fear the world outside our internalized gulag, because we’ve absorbed the narrative that the gulag is secure and permanent. We’ve also absorbed the understanding that...

Read More »SNB erhält Lektion von der neuen Stoosbahn

Quizfrage: Was kurbelt den Schweizer Tourismus mehr an? Der Kauf von Hanf-Aktien in den USA für 80 Millionen Franken oder der Bau der Stoosbahn für 80 Millionen Franken? Welches ist Ihre Antwort, verehrte Leserin, verehrter Leser? Meine Antwort ist schon jetzt klar: Der Bau der neuen Stoosbahn ist ungleich viel effizienter, um den Schweizer Tourismus anzukurbeln. Warum? Gerne begründe ich das. Der Stoos ist eine...

Read More » SNB & CHF

SNB & CHF