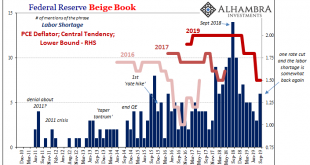

Federal Reserve policymakers appear to have grown more confident in their more optimistic assessment of the domestic situation. Since cutting the benchmark federal funds range by 25 bps on July 31, in speeches and in other ways Chairman Jay Powell and his group have taken on a more “hawkish” tilt. This isn’t all the way back to last year’s rate hikes, still a pronounced difference from a few months ago. The common forecast relies entirely on the subjective...

Read More »CHARLES HUGH SMITH – Having A Recession Is Healthy For Us

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »CHARLES HUGH SMITH – Having A Recession Is Healthy For Us

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week...

Read More »Nationalbank – SNB-Präsident Jordan: Libra könnte Geldpolitik gefährden

Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank, in einem früheren Interview mit cash. Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten “eher den Charakter von spekulativen Anlageinstrumenten als von ‘gutem’ Geld”, sagte der SNB-Präsident in einer Rede an der Universität...

Read More »“The Eurozone faces the worst combination of economic and systemic risk”

Eurozone faces the worst combination Interview with Alasdair Macleod: The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally. Although these developments...

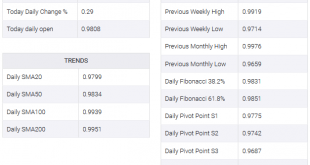

Read More »USD/CHF bounces from trend-line support on trade news

US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support. The announcement that trade talks are back on track as given the markets the extra fuel needed to recover with respect to risk appetite. Currencies, such as the Yn and CHF, would otherwise benefit from investment, but in such a case that a trade deal could eventually emerge from the...

Read More »Will Everything Change in 2020-2025 or Will Nothing Change?

Any domino-like expanding crisis will unfold in a status quo lacking any coherent response. Longtime readers know I’ve often referenced The Fourth Turning, the book that makes the case for an 80-year cycle of existential crisis in U.S. history. The first crisis was the constitutional process (1781) following the end of the Revolutionary War, whether the states could agree on a federal structure; the 2nd crisis was the Civil War (1861) and the 3rd crisis was global...

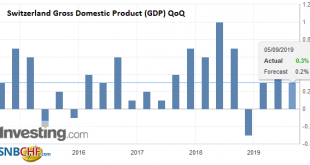

Read More »Switzerland GDP Q2 2019: +0.3 percent QoQ, -0.2 percent YoY

Switzerland’s GDP rose by 0.3% in the 2nd quarter of 2019, after increasing by 0.4% (revised) in the previous quarter.1 The development of domestic and foreign demand was weak, as in other European countries, which had a particularly negative impact on the service sectors. Switzerland Gross Domestic Product (GDP) QoQ, Q2 2019(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge Switzerland’s GDP rose by 0.3% in the...

Read More »FX Daily, September 05: Brexit becomes a Dog’s Breakfast as Dollar’s Correction Continues

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Dollar Index fell the most in three months yesterday and is experiencing mild follow-through selling today. With hopes that Hong Kong has turned a corner, news that in-person US-China talks will resume next month, and a no-deal Brexit is well on the way to being averted,...

Read More » SNB & CHF

SNB & CHF