Mark O’Byrne, founder at GoldCore, gives IG TV’s Victoria Scholar his outlook for gold and silver prices and why he believes they will surpass their record nominal high prices of 2011 in the coming years. Gold is overbought and may go lower or higher in the short term, but the many financial, geopolitical and monetary risks in the world are issues which are here to stay. This bodes well for the price of gold and should...

Read More »How To Properly Address The Unusual Window Dressing

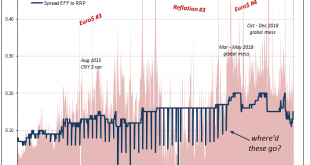

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses. Among the more prominent of these was Basel 3’s leverage ratio....

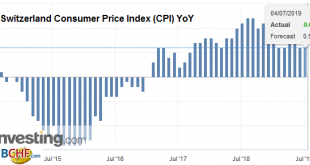

Read More »Swiss Consumer Price Index in June 2019: +0.6 percent YoY, 0.0 percent MoM

04.07.2019 – The consumer price index (CPI) remained stable in June 2019 compared with the previous month, remaining at 102.7 (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each other overall. Heating...

Read More »Another Swiss bank settles German tax evasion probe

[caption id="attachment_281116" align="alignleft" width="400"] Schaffhausen Cantonal Bank says the fine will not affect results as it had already put money aside to cover the penalty.[/caption] The Schaffhausen Cantonal Bank has settled a tax evasion dispute with the German state of North Rhine-Westphalia with a €3.9 million (CHF4.3 million) payment. The penalty clears the bank for all damages in Germany. The...

Read More »Keith Weiner – This Golden Bull is for Real #4402

As time goes by, Keith Weiner and others are more and more convinced that the long awaited bull market in gold has finally arrived. Both from a technical and fundamental point of view, there is agreement among most that this bull is the real deal. Of course anything can happen, and probably will, but things are looking up. And Keith has developed a way to play this market through gold bonds, his unique proprietary approach to gold leasing. Interesting times indeed.

Read More »Keith Weiner – This Golden Bull is for Real #4402

As time goes by, Keith Weiner and others are more and more convinced that the long awaited bull market in gold has finally arrived. Both from a technical and fundamental point of view, there is agreement among most that this bull is the real deal. Of course anything can happen, and probably will, but things are looking up. And Keith has developed a way to play this market through gold bonds, his unique proprietary approach to gold leasing. Interesting times indeed.

Read More »Keith Weiner Gets Interviewed

Our economic views and unique product are generating buzz. There have been a number of interviews recently (more will be posted soon). Lobo Tiggre interviewed Keith Weiner (video) about the unique Monetary Metals business model to pay interest on gold. Silver Bullion interviewed Keith Weiner (video) when he visited Singapore, about the belief that Basel III regulations are good for the price of gold. Claudio Grass...

Read More »FX Daily, July 03: Yields Extend Decline

Swiss Franc The Euro has fallen by 0.05% at 1.112 EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy’s benchmark is off 12 bp, while core yields are down 2-3 bp to new...

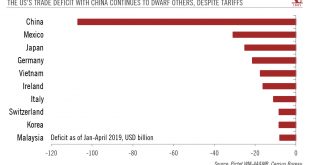

Read More »Fragile truce in Osaka

The US and China reached a ‘trade truce’ on the margins of the G20 summit this weekend, but existing tariffs remain in place. And we are only a tweet away from more Trumpian upheaval. The US and China leaders agreed on a truce during their much-anticipated meeting at the G20 summit in Osaka this weekend. Bilateral trade talks will restart. Trump put to bed the threat of additional tariffs, although the existing tariffs...

Read More »FX Daily, July 2: Post-G20 Euphoria Fades, Stuck with Same Reality

Swiss Franc The Euro has risen by 0.17% at 1.1162 EUR/CHF and USD/CHF, July 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euphoria that greeted the resumption of US-China and US-North Korea talks has subsided. Global equities have turned mixed after yesterday’s surge. Hong Kong played catch-up, and despite ongoing demonstrations, the Hang Seng rallied over...

Read More » SNB & CHF

SNB & CHF