A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag. A Virginia man who was part of the riot wore a T-shirt mocking the holocaust. A Brooklyn judge’s son was photographed in the Capitol wearing an elaborate outfit of furs accented by a bulletproof vest. A Florida man – because there is always a Florida man – walked out with Nancy Pelosi’s podium. One of the rioters had recently been elected to the West Virginia House of Delegates and others were off duty police officers but most of them looked like they missed the off ramp to Comic

Topics:

Joseph Y. Calhoun considers the following as important: 10 year tips, 5.) Alhambra Investments, Alhambra Research, bonds, capitol riot, commodities, Copper, copper to gold ratio, COVID-19, credit spreads, currencies, Donald Trump, economic growth, economy, Featured, Gold, Interest rates, Joe Biden, Markets, newsletter, Politics, Taxes, Taxes/Fiscal Policy, treasuries, US dollar

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag. A Virginia man who was part of the riot wore a T-shirt mocking the holocaust. A Brooklyn judge’s son was photographed in the Capitol wearing an elaborate outfit of furs accented by a bulletproof vest. A Florida man – because there is always a Florida man – walked out with Nancy Pelosi’s podium. One of the rioters had recently been elected to the West Virginia House of Delegates and others were off duty police officers but most of them looked like they missed the off ramp to Comic Con.

Last week the House of Representatives impeached President Trump for the second time in his one term. The one count impeachment charged Mr. Trump with “inciting violence against the Government of the United States”. The vote was putatively bipartisan with 10 Republicans voting in favor. A trial will proceed in the Senate but likely not until after the inauguration of President elect Joe Biden. The National Guard has been called up in many states to keep order during inauguration week.

Writing those two paragraphs was almost as surreal as watching these events unfold over the last two weeks. At the time, it seemed scary and I’m sure it was for anyone in the Capitol building when it happened. And the consequences for anyone who participated should be severe in light of the five deaths. But looking at the pictures of the event now one is struck by the fantasy, the delusion – the costumes – of the participants. Even if you are a Trump supporter you have to admit that this “insurgency” at times bore a striking resemblance to a Fellini film. Despite the overwhelming weirdness of the political moment, markets acted as if none of it mattered.

The S&P 500 is a mere 1.5% from its all time high set just a few days ago. Bond yields were rising before the riot, as the Democrats won complete control of the federal government, and continued to do so after. This unified government is seen as likely to increase government spending, as if the next trillion will accomplish something the last several didn’t. Believing that government spending is the key to increased economic growth is the epitome of the triumph of hope over experience.

Nevertheless, it will be some time before this generation of investors figures that out and in the meantime, bond yields rise because investors still have hope that this time is different. In this case, the hope is that this next tranche of COVID relief will get us past the virus so the real boom can start. The consensus narrative that has developed over the last few months is that once the virus is vanquished there will be a surge of activity as people get back to their old lives. That may or may not prove true but maybe more important for markets is that it will be months before we know.

In the meantime, there is the reality of a developing economic slowdown. The data has been somewhat mixed but the slowing is obvious in the employment data, incomes, retail sales and even in a slight slowing in the housing market. Most markets, however, are not really reacting yet, investors seemingly still focused on that post-virus period and the expected demise of social distancing.

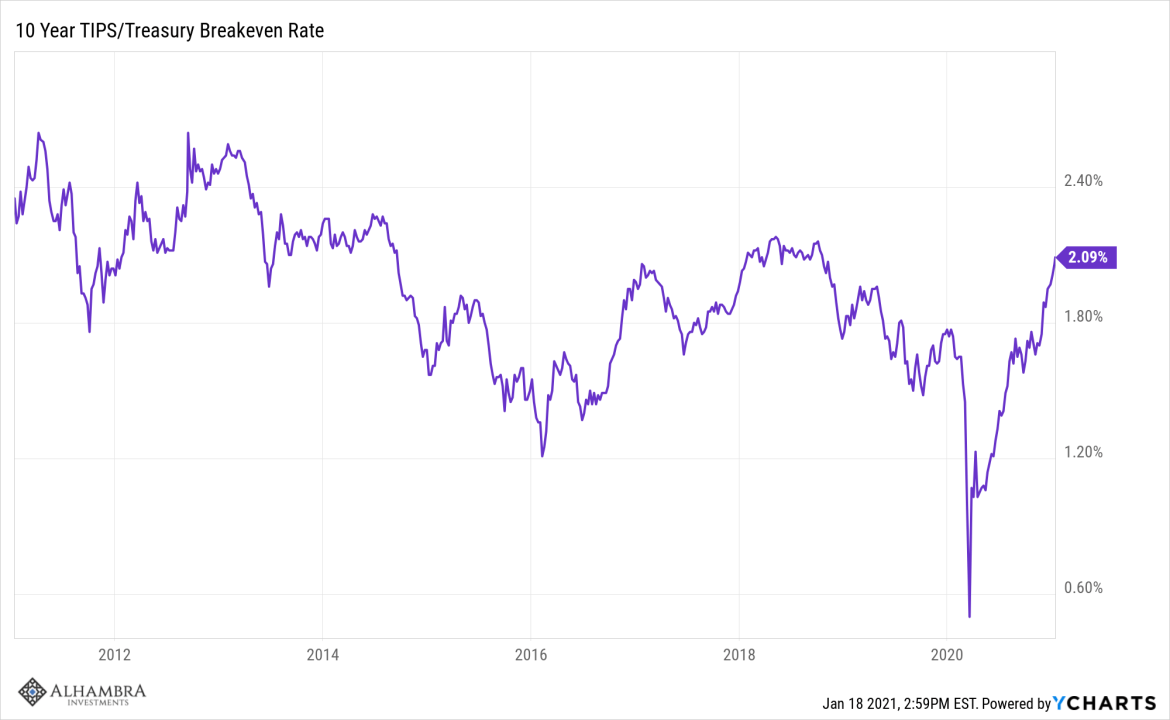

There is one glaring exception in markets that can’t be ignored. While the 10 year nominal Treasury yield has continued to rise, the same can’t be said for the 10 year TIPS yield. Most investors seem to be focusing on inflation expectations which have been rising, a positive sign in the minds of central bankers and others enthralled by the idea that economic growth causes inflation. But real rates are in fact falling, an indication that real growth expectations are as well. More inflation and less real growth does not sound like an outcome the stock market would like.

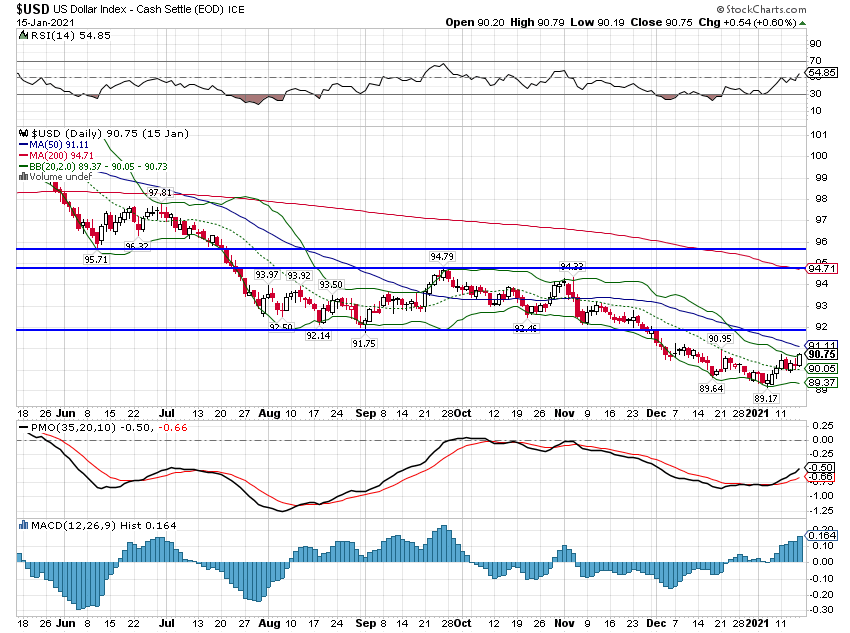

There are some trends that are losing momentum but that could just be a pause. The dollar, for instance, appears to have found at least a short term bottom at an expected support point. Sentiment on the dollar is very negative at the moment; a falling dollar in 2021 is the consensus, the one thing on which everyone seems to agree. And while futures market positioning isn’t as extreme as it has been in the past, there is a definite preference to be on the short side of the dollar.

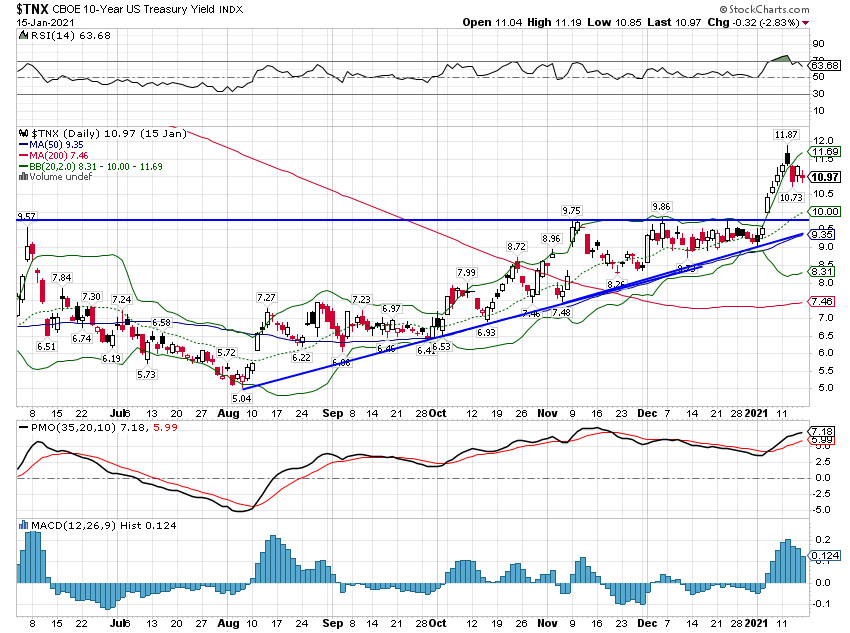

Bond yields are also stretched versus the trend and I would expect a pullback in nominal rates in the coming weeks. Whether it turns into more than that I can’t say but I would caution not to get too excited about a bond rally until you see the post-virus boom narrative start to fade (if it does). For now, I’d put any bond rally in the technical, countertrend category.

Another area that has probably moved too far too fast is the commodity markets. Futures market positioning is overwhelmingly bullish on commodities and the reflation trade right now. Large speculators are sitting on record or near record longs in everything from industrial metals to soybeans. A reversal would not be surprising in the least and with extreme positioning it could be a swift adjustment.

The markets looked past the to do on Capitol Hill because it never had any chance of success. But there has been a pretty major change in the political landscape over the last two months and yet the market’s course has not changed. If you needed more evidence that politics really shouldn’t be part of your investment plan the market action since the election should have provided all you need. As for the riot at the Capitol I’ll just quote Adam Newbold, a retired Navy Seal who was arrested for his participation: “What the hell was it all for?” Indeed.

Can the markets also continue to look past the current economic slowdown? I don’t know but with another round of COVID relief in the pipeline I wouldn’t bet against it just yet. Stay tuned.

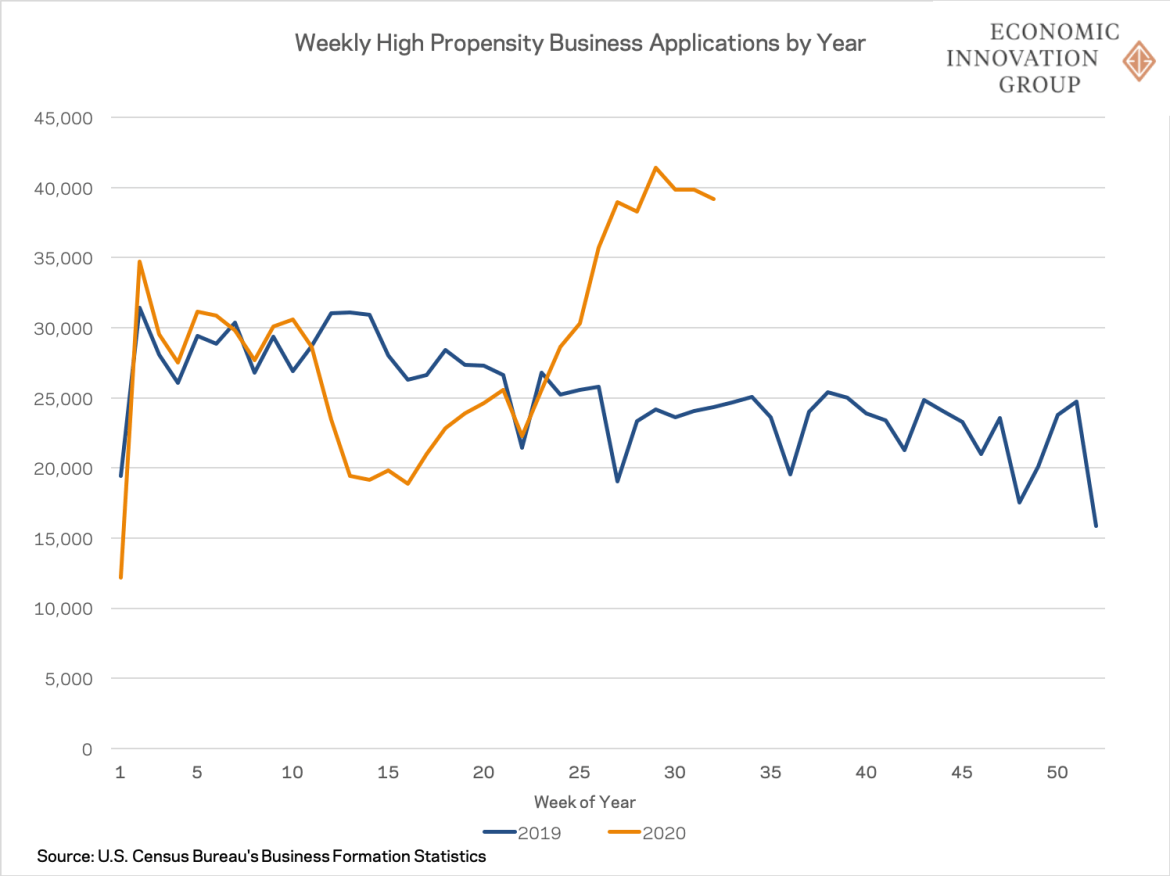

Current EnvironmentWe classify the investing environment by the trend of the dollar and the economy. The environment is still Growth Rising, Dollar Falling but both of these are a lot more tentative than they were a month ago. Growth is still positive but the rate of change continues to slow. The dollar is still in a downtrend but very short term measures of momentum have turned up. |

|

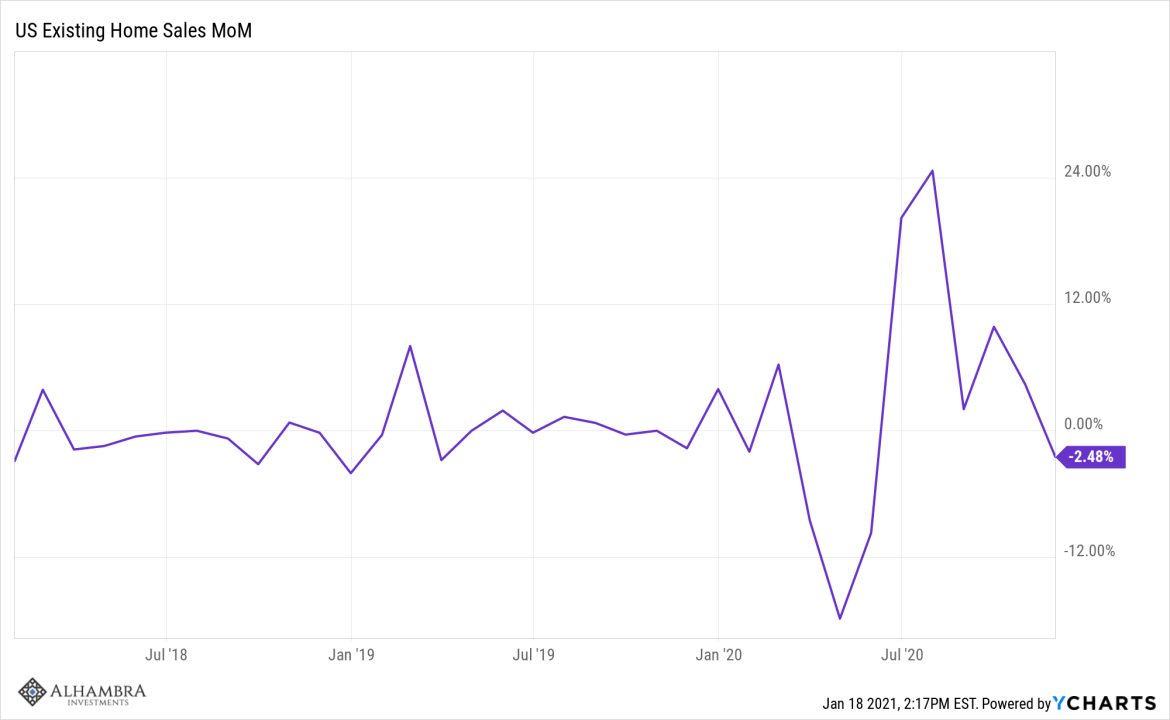

Selected Economic ChartsExisting home sales fell in November. Some of that may be due to a lack of inventory which stands at an all time low of just 2.2 months. |

US Existing Home Sales MoM data by YCharts |

| New home sales were down 11% in November but are up 20% year over year. |

US New Single Family Houses Sold data by YCharts |

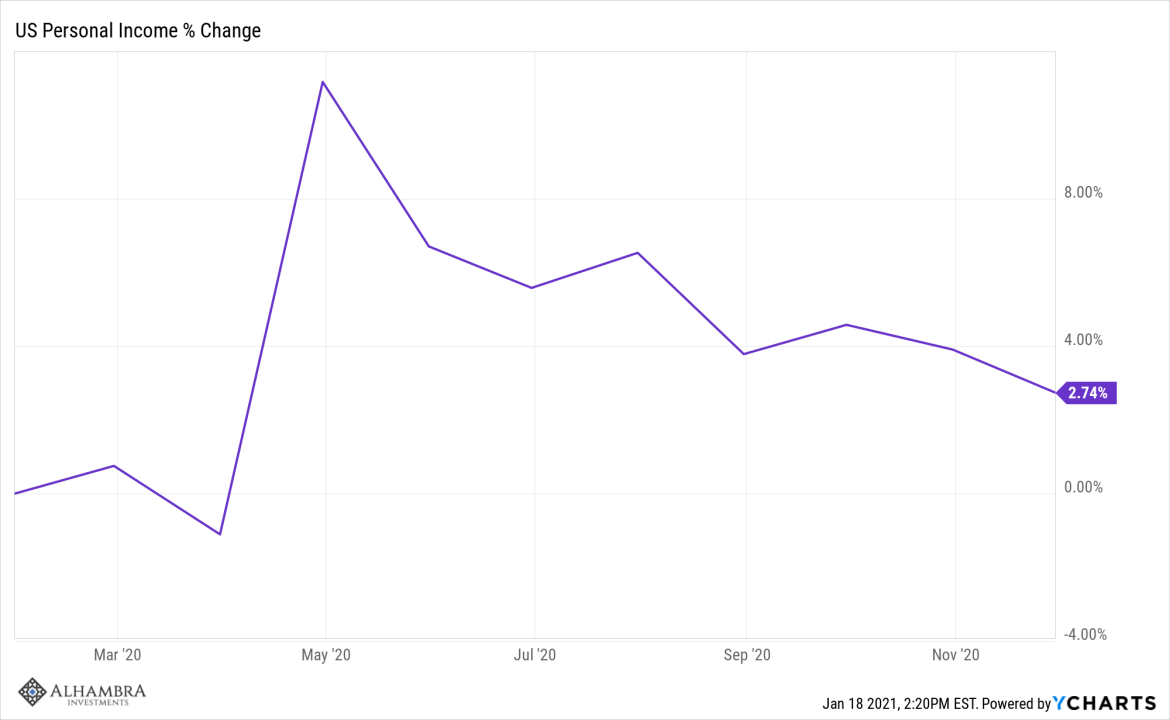

| Personal Income fell last month for the second straight month. Incomes are still higher by 3.8% year over year but that is well down from the 9% rate in July. These are also November numbers and December probably wasn’t better. |

US Personal Income data by YCharts |

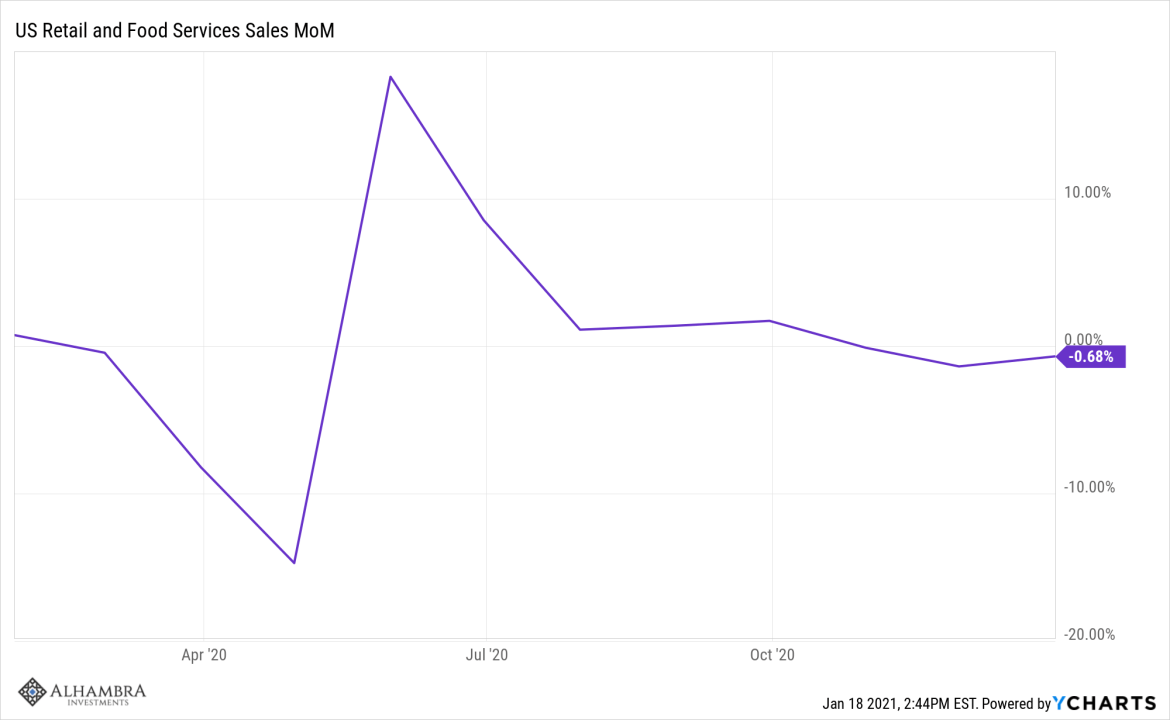

| Retail sales also fell for the second straight month but are up nearly 3% year over year. |

US Retail and Food Services Sales MoM data by YCharts |

|

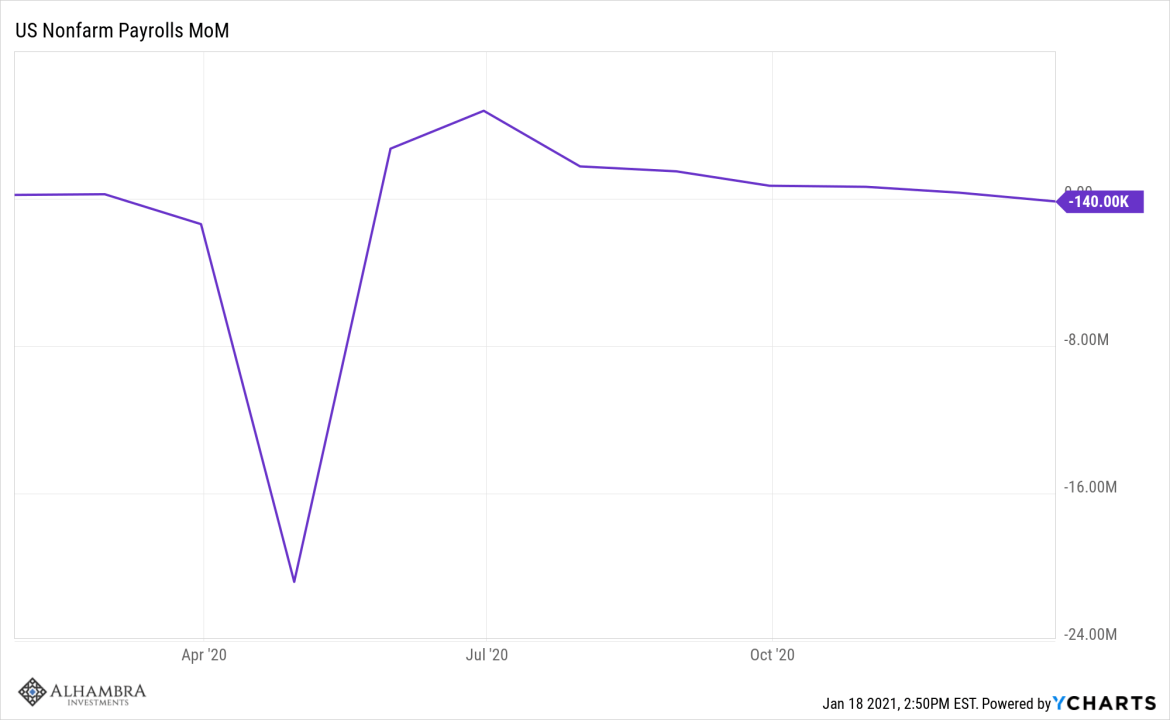

Nonfarm payrolls were down 140k in December, the first drop since April. The second or third or whatever number surge this is for the virus is having an impact. |

US Nonfarm Payrolls MoM data by YCharts |

Market Indicators10 year Treasury YieldThe 10 year Treasury yield is in an obvious uptrend, finally breaking through 1% that had acted as resistance for months. Bonds are a little oversold here though and a pullback in yields wouldn’t be surprising. |

|

| The 10 year TIPS yield touched -1.08% early in the new year, matching the August low. It has since recovered slightly to -0.94% but that is still not an encouraging sign for growth. |

10 Year Treasury Inflation-Indexed Security Rate data by YCharts |

|

Rising nominal rates and falling real rates mean inflation expectations are rising, recently moving above 2%. Of course, these are inflation expectations which have been routinely disappointed in recent years so I can’t say I’m particularly worried about it at this point. |

10 Year TIPS/Treasury Breakeven Rate data by YCharts |

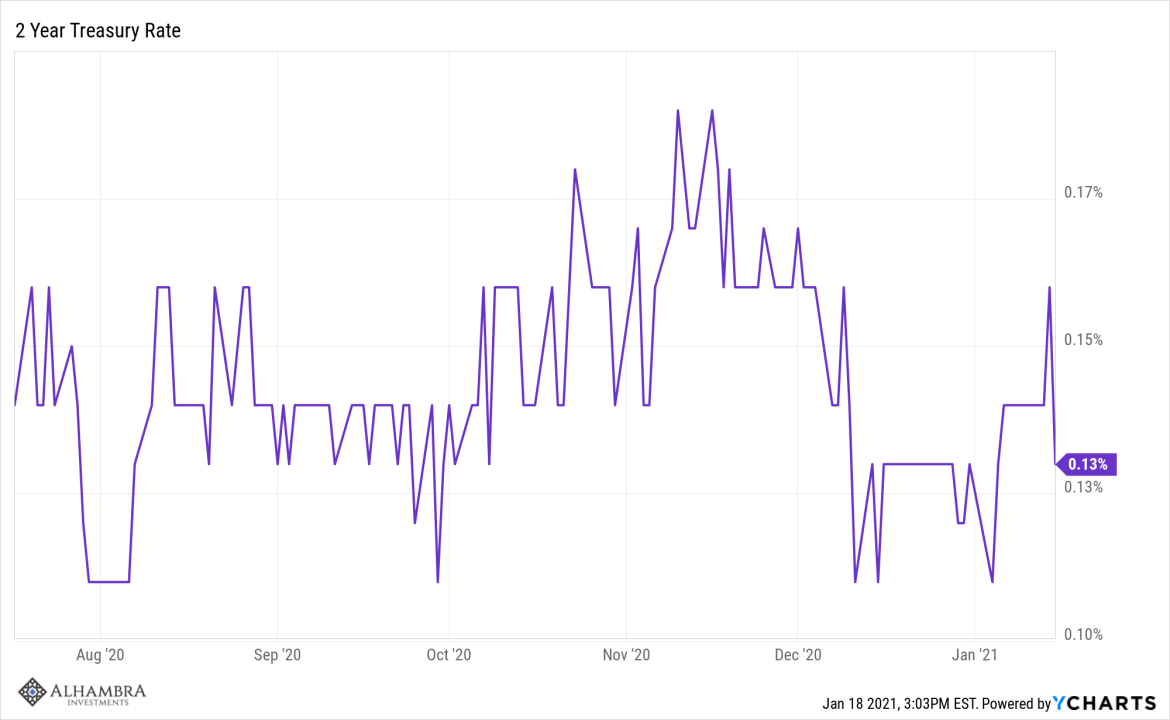

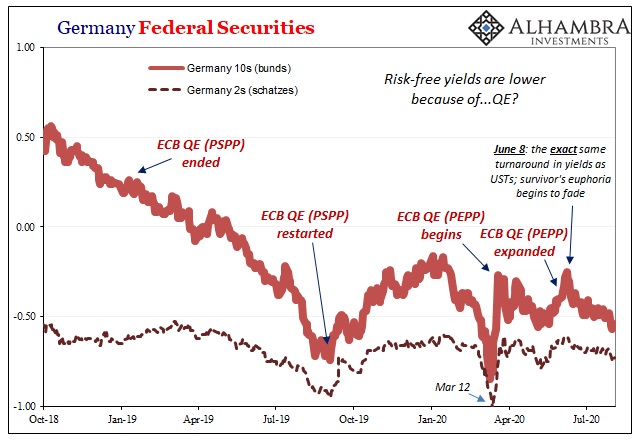

2 Year Treasury YieldsThe 2 year Treasury note yield is not budging. With Jerome Powell saying recently that they aren’t even thinking about thinking about tightening policy, this is unlikely to change. That, by the way, has nothing to do with whether it even matters whether the Fed stops QE or anything else. The only thing the Fed can really affect is the narrative but we live in an era where the only thing that really matters is the narrative. So, when – if – the time comes when they tell the market they are going to tighten policy, short rates will rise. But until then, forget it. |

2 Year Treasury Rate data by YCharts |

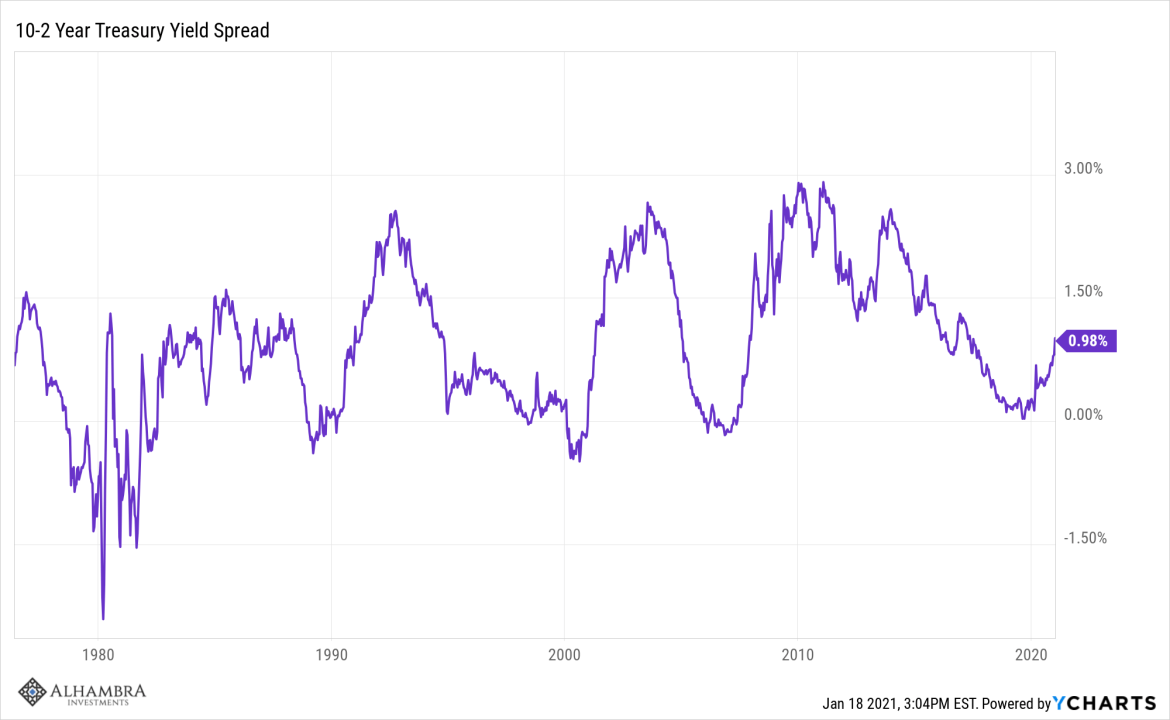

Yield CurveThe yield curve continues to steadily steepen as the 10 year rate climbs. This is a reflection of the rise in inflation expectations. Does it have any real world implications? The accepted wisdom is that it is positive for banks who borrow short and lend long. That assumes that banks care at all what the difference is between the 2 year and the 10 year Treasury yields. I can assure you, based on the rate Wells Fargo is paying on my savings account and charging me on my mortgage, that it makes no difference to them. |

10-2 Year Treasury Yield Spread data by YCharts |

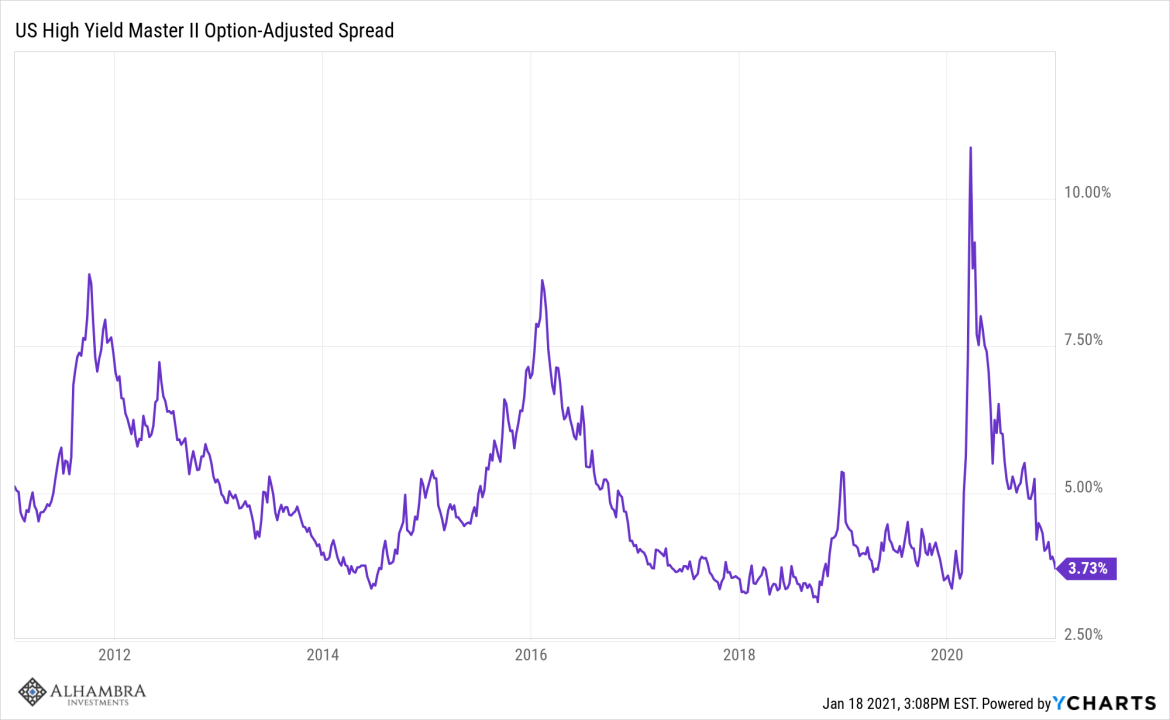

Credit SpreadsCredit spreads fell another 31 basis points since my last update in December. This isn’t far from the lows since the 2008 crisis so there is no concern in credit markets at the moment. I think the word we’re looking for here is “sanguine”. |

US High Yield Master II Option-Adjusted Spread data by YCharts |

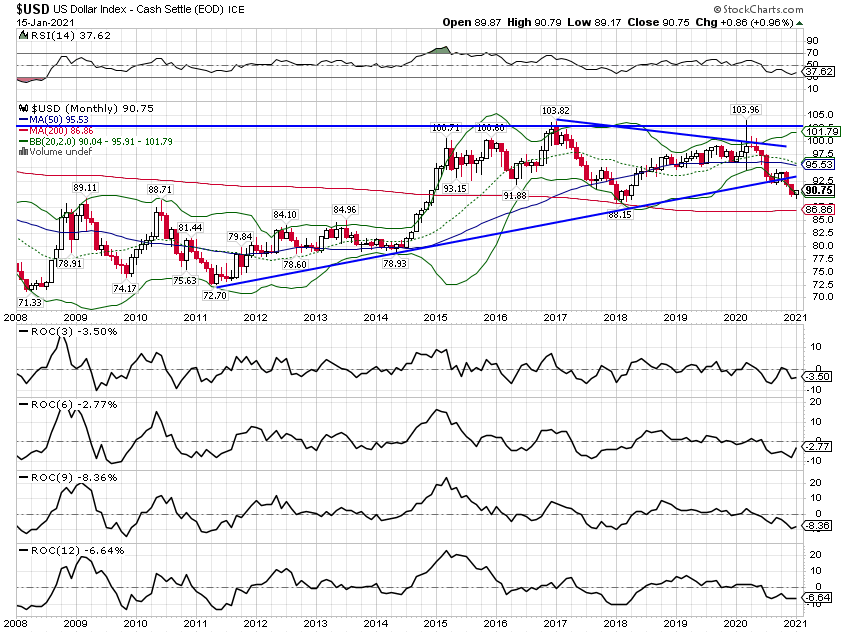

US DollarThe dollar index is still in a downtrend with 3,6,9 and 12 month rates of change negative. |

|

| However, shorter term measures of momentum have turned up. How far it goes is I don’t know but for now it is just a rally in a downtrend. | |

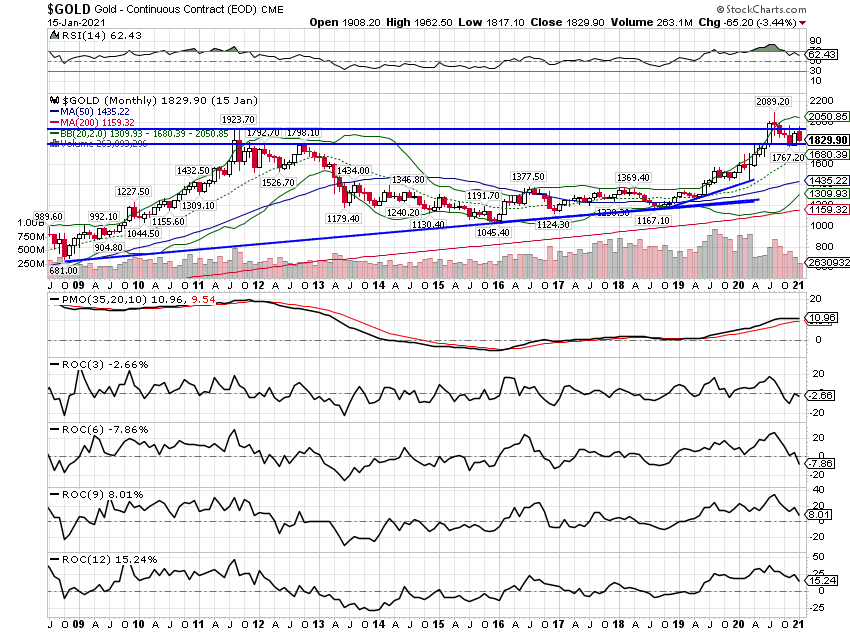

GoldGold is not confirming the slowdown thesis. We would normally expect to see gold rising when real growth expectations are falling (real rates falling). It might take new lows in TIPS yields to see gold resume its uptrend. 3 and 6 month rates of change are now negative. Much more downside and we may have to call an end to gold’s uptrend. |

|

CommoditiesCommodities have continued their rally, up over 5% since the beginning of the year. The GSCI is now up year over year as well although just about 1%. |

|

| ^GNX data by YCharts

The GSCI also continues to outperform gold as nominal growth expectations rise. |

|

| Copper is still in an uptrend but short term momentum has waned. | |

| The copper to gold ratio continues to rise with nominal interest rates. There is still a gap between rates and this ratio that I expect to close at some point. Given the extreme bullish positioning of copper futures the odds probably favor a fall in copper at some point. |

Our investing environment hasn’t changed despite some big changes in the political landscape. We’ve had a complete change of control in DC and yet market participants remain focused like a laser on the end of the virus. That could change as we get a better idea how economic policy might change once the new administration gets past dealing with the virus but I would not expect any big changes until then.

The most widely expected change is a hike in taxes, putatively on “the rich” but the definition of rich can be quite flexible. There may be some changes but I wouldn’t expect anything too radical. The Democratic party is currently in the thrall of Modern Monetary Theory which is neither modern nor much of a theory in my opinion. In that framework, taxes would only need to be raised if inflation becomes a problem. I suppose they could raise taxes for reasons other than inflation but that is a conversation for another day. The point is that even MMT would not recommend raising taxes in the midst of an economic slowdown which is where we happen to find ourselves right now.

My advice about politics and investing is always the same. Don’t let the former dictate the latter. The market is bigger than almost anything the politicians can do in DC. The key word in that sentence is “almost” though so I’ll keep one eye on politics no matter how painful.

Tags: 10 year tips,Alhambra Research,Bonds,capitol riot,commodities,Copper,copper to gold ratio,COVID-19,credit spreads,currencies,Donald Trump,economic growth,economy,Featured,Gold,Interest rates,Joe Biden,Markets,newsletter,Politics,Taxes,Taxes/Fiscal Policy,treasuries,US dollar