Overview: Stocks and bonds are lower today, and the dollar is slightly firmer having extended yesterday's recovery. Most of the G10 currencies are lower, though the Japanese yen has recovered from after falling to its lowest level since May 1. Slightly softer than expected German states' CPI did the euro no favors. It was sold to a three-day low near $1.0830 before stabilizing. Sterling steadied after dipping briefly below $1.2750. Most emerging market currencies...

Read More »US Dollar Offered but Stretched Intraday

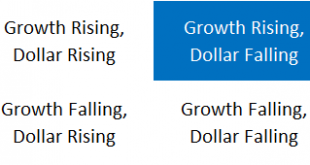

Overview: The US dollar is trading heavily against all the major currencies, led by the Norwegian krone and euro. Emerging market currencies are also firmer. However, risk-appetites seem subdued. Even though most large bourses in Asia Pacific advanced but Japan and Hong Kong, European markets are nursing small losses and US futures are little changed. Benchmark 10-year yields are firmer with European yields 3 bp firmer and Italy’s premium over Germany slightly...

Read More »Weekly Market Pulse: Fear Makes A Comeback

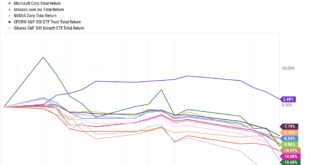

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline. Philip Roth Be fearful when others are greedy and be greedy when others are fearful. Warren Buffett The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the...

Read More »Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More Inflation is Soaring.. America’s Inflation Burst This morning on Face The Nation, Mohamed El-Erian, former Harvard endowment manager, former bond king apprentice, economist and the man who seems to have a permanent presence on CNBC, had this to say: The characterization of inflation as transitory...

Read More »FX Daily, February 1: Markets Snap Back

Swiss Franc The Euro has risen by 0.15% to 1.082 EUR/CHF and USD/CHF, February 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are snapping back today, while the greenback retained the strength seen last week that was attributed to safe-haven flows. The MSCI Asia Pacific Index snapped a four-day decline led by Hong Kong, South Korea, India, and Indonesia. Europe’s Dow Jones Stoxx is up around...

Read More »Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag. A Virginia man who was part of the riot wore a T-shirt mocking the holocaust. A Brooklyn judge’s son was photographed in the Capitol wearing an elaborate outfit of furs accented by...

Read More »FX Daily, September 4: Markets Look for more Solid Footing, but Need to Get Passed US Jobs Data

Swiss Franc The Euro has risen by 0.14% to 1.0789 EUR/CHF and USD/CHF, September 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic sell-off of US shares yesterday is the main focus, capturing the limelight from other forces, including today’s US employment report. It was the third-worst session for the S&P 500 since the March 23 bottom, and the other two did not see follow-through selling. ...

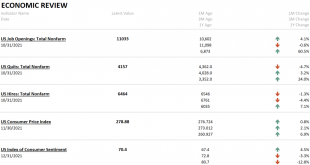

Read More »Monthly Macro Monitor: Market Indicators Review

This is a companion piece to last week’s Monthly Macro report found here. The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic. That to me, is evidence that this move is overly...

Read More »FX Daily, May 16: US Struggles to Strike a Less Strident Tone

Swiss Franc The Euro has risen by 0.02% at 1.1299 EUR/CHF and USD/CHF, May 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Retail sales and industrial production disappointed in both the US and China prior to the end of the tariff truce, declared by the US in a series of presidential tweets on May 5. The reaction function of the US to the drop in equities was...

Read More »Why China Finds it Difficult to Weaponize the Yuan and US Treasuries

It looks so easy on paper. China can sell its holding of US Treasuries and/or weaken the yuan to offset the tariffs and boost exports. It is the first and easy answers from strategists, journalists, and some academics. Often times, it is presented a novel idea; as if diplomats, investors, and policymakers have not thought it. The point is not that China cannot sell its Treasury holding or that it cannot devalue the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org