At the last FOMC meeting, Jerome Powell was asked if they were concerned that inflation expectations are “de-anchoring, or put another way, are anchoring at a slightly higher level?” His answer specifically referenced the 5x5 forward inflation expected rate. He could have used many data points to answer the question. However, the fact that he specifically mentioned the 5x5 rate gives us an inflation expectations benchmark to better gauge how the Fed will manage monetary policy. The 5x5 inflation rate uses five and ten-year inflation expectations, as derived from the difference between nominal and TIPS yields, to calculate what they imply about inflation for the five-year period beginning in five years. For example, if the 5yr expectation was 1% and the 10yr was

Topics:

Michael Lebowitz and Lance Roberts considers the following as important: 9) Personal Investment, 9a.) Real Investment Advice, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

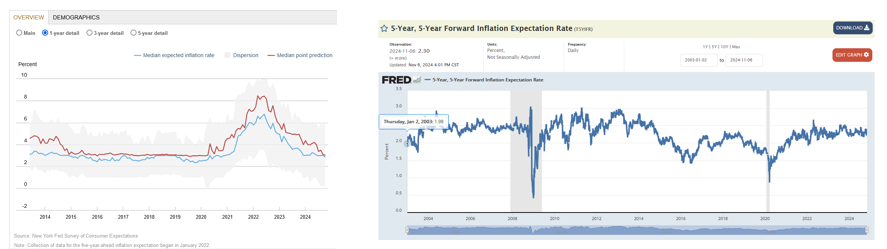

At the last FOMC meeting, Jerome Powell was asked if they were concerned that inflation expectations are “de-anchoring, or put another way, are anchoring at a slightly higher level?” His answer specifically referenced the 5x5 forward inflation expected rate. He could have used many data points to answer the question. However, the fact that he specifically mentioned the 5x5 rate gives us an inflation expectations benchmark to better gauge how the Fed will manage monetary policy.

The 5x5 inflation rate uses five and ten-year inflation expectations, as derived from the difference between nominal and TIPS yields, to calculate what they imply about inflation for the five-year period beginning in five years. For example, if the 5yr expectation was 1% and the 10yr was 2%, the 5x5 implied inflation rate would be approximately 3%. Thus, 3% makes the average of the 5-year and 5x5 equal to the 10-year inflation expectation rate.

So, back to the reporter's question. Powell answered as follows:

We're still seeing between surveys and market readings broadly consistent with -- you know, I was – I looked at the five-year, five-year earlier today and it's probably moved. But it's just not -- it's just -- it's kind of right where it's been, and also it's pretty close to -- consistent with two percent PCE inflation.

As shown below on the right, the 5x5 forward inflation expectation rate is very close to its pre-pandemic level. Furthermore, given that current inflation rates tend to have a greater impact on monetary policy, one-year inflation expectations, as shown below courtesy of the New York Fed on the left, are back to their pre-pandemic levels.

There is no indication, as the reporter suggests that inflation expectations are de-anchoring.

What To Watch Today

Earnings

- No notable earnings releases

Economy

Market Trading Update

Last week, we discussed that with the election over and the Federal Reserve cutting interest rates, many market headwinds were put behind us. To wit;

"As a result, the market surged higher, hitting our year-end target of 6000 on Friday. Furthermore, since election day, the "RE-risking" rally reversed the short-term sell signal, supporting higher prices. As we stated over the last few weeks, despite the many media-driven narratives, the underpinnings of the market remained bullish, suggesting the recent pullback to the 50-DMA was a buying opportunity."

In that Bull Bear Report, we discussed the impact of the Trump Presidency on the financial markets based on expectations of tax cuts, tariffs, and deregulation. Since then, the "Trump Trade" went into full swing, pushing the markets higher; however, as we noted, that trade had gotten a bit ahead of itself, and we saw some consolidation and profit-taking this past week. Such is unsurprising given the return to overbought conditions with a more extreme deviation from the 50-DMA.

Furthermore, as noted in Friday's Daily Market Commentary:

"Technically, there is nothing wrong with the market. Yes, it is currently overbought, but the recent “choppy” action is beginning to work off some of that condition. I would expect a continuation of choppy performance into Thanksgiving, with a pop into the first week of December. That pop will be met by additional selling as mutual funds make their annual distributions, setting the market up for the year-end “Santa Claus” rally as managers window-dress for year-end reporting. In short, the trend is higher into year-end, but expect some bumps along the way."

While there are some short-term technical concerns, as discussed in "Seasonality: Buy Signals And Outcomes," there are three primary reasons to remain optimistic into year-end:

- Corporate share repurchases

- Performance Chasing

- Momentum

With the market now into the seasonally strong period of the year, historical tendencies continue to support remaining at recommended target weights for equities in portfolios.

The Week Ahead

The week before the Thanksgiving holiday will be quiet from a data perspective. Housing starts and building permits top the economic highlights on Tuesday. On Thursday, the Philadelphia Fed manufacturing survey will provide insight into employment and price trends in the manufacturing sector.

Fed members will again be active on the speaking circuit. We want to hear their thoughts on the recent increase in interest rates. Moreover, how that may change their policy prescription as we advance.

Nvidia’s earnings release on Wednesday after the market close will likely set the tone for the market. With the stock again near record highs, the market will look for perfection. Thus far, they have done an excellent job of beating expectations and satisfying the market.

Paul Tudor Jones: I Won't Own Fixed Income

Paul Tudor Jones recently voiced concerns that rising U.S. deficits and debt and increasing interest rates could lead to a fiscal crisis. His perspective reflects the long-standing fear that sustained borrowing will trigger inflation, raise interest rates, and eventually overwhelm the government’s ability to manage its debt obligations. In short, his thesis is that interest rates will rise as the Government goes broke. However, a closer look at historical precedent and current fiscal dynamics suggests these concerns are overstated. Contrary to Jones’ warnings, the U.S. economy has structural strengths that make an imminent fiscal collapse unlikely.

Paul Tudor Jones’ warnings are not unusual, but like James Grant’s views, they are not well supported by longer-term data. The chart below shows the long-term view of short and long-bond interest rates, inflation, and GDP.

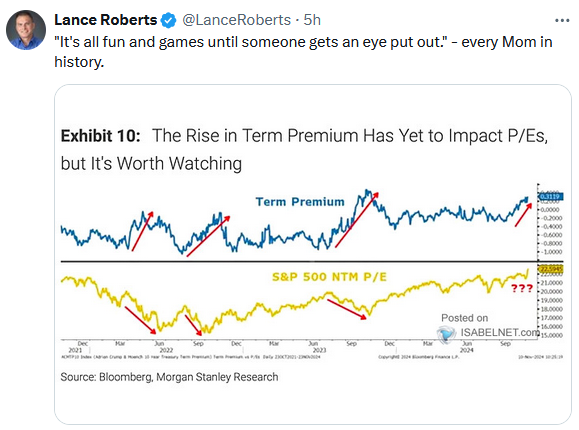

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post 5X5 Inflation Expectations: A New Benchmark To Follow appeared first on RIA.

Tags: Featured,newsletter