As we enter the final quarter of 2024, there are a lot of questions facing investors. There are, of course, always a lot of questions because investors are always dealing with the future, but today’s environment does seems to have more than usual. Some of these questions concern short-term considerations and while they are important, it is more important to remain focused on the long-term trends. Here’s what I’m thinking about lately: Let’s get the one everyone is...

Read More »Weekly Market Pulse: It’s An Uncertain World

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year. You’ll see a lot of pundits say with great confidence that this means we are on the verge of recession. Which may...

Read More »Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS...

Read More »Weekly Market Pulse: A Fatal Conceit

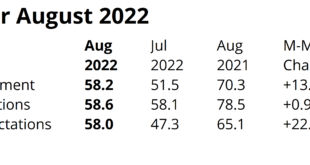

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months. Real disposable income is up 0.8% in the last six months but was down...

Read More »Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish. Interest rates are going up they said, no matter how much it hurts, no matter how many people have to be put on the unemployment line, because that’s the only way to kill this inflation, to...

Read More »Goldilocks Calling

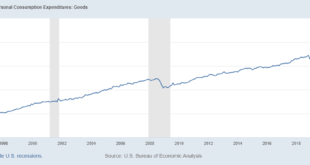

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now. There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: . Now, some of that, as we know, is due to inflation so if we correct for...

Read More »Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?” Sherlock Holmes: “To the curious incident of the dog in the night-time.” Gregory: “The dog did nothing in the night-time.” Sherlock Holmes: “That was the curious incident.” From Silver Blaze by Arthur Conan Doyle, 1892 It is hard to determine sometimes what causes markets to move as they do. Take last Friday’s stock market selloff. The widely cited “reason”...

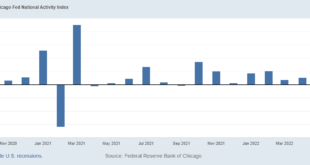

Read More »The Economy Improved In July

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7. The index had been down for two consecutive months and both May and June were revised slightly lower. The data in August so far has been positive as well, particularly the production data with IP last week surprising to...

Read More »Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld From the Seinfeld episode “The Opposite” I...

Read More »Weekly Market Pulse: A Most Unusual Economy

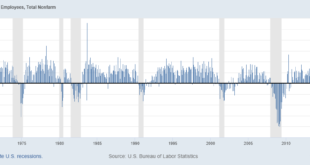

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org