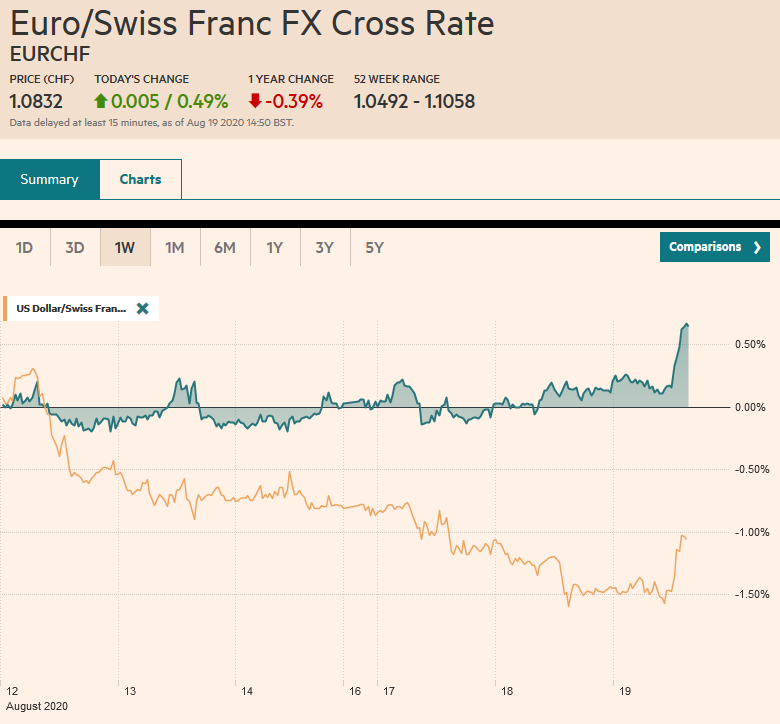

Swiss Franc The Euro has fallen by 0.07% to 1.0754 EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week has begun like last week ended. Equities are a bit heavy. The MSCI Asia Pacific Index fell for the second session, its first back-to-back loss since before Christmas. China and Hong Kong were the notable exceptions, perhaps helped by stronger than expected GDP. Europe’s Dow Jones Stoxx 600, which fell 1% at the end of last week, is a little lower in turnover in the European morning. US stocks won’t trade today in the local sessions, but futures are a bit lower. Similarly, US Treasuries won’t, and the 10-year ended near 1.08% last week. Bond markets are quiet, though,

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Canada, China, Currency Movement, Featured, Germany, Italy, Japan, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.07% to 1.0754 |

EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The new week has begun like last week ended. Equities are a bit heavy. The MSCI Asia Pacific Index fell for the second session, its first back-to-back loss since before Christmas. China and Hong Kong were the notable exceptions, perhaps helped by stronger than expected GDP. Europe’s Dow Jones Stoxx 600, which fell 1% at the end of last week, is a little lower in turnover in the European morning. US stocks won’t trade today in the local sessions, but futures are a bit lower. Similarly, US Treasuries won’t, and the 10-year ended near 1.08% last week. Bond markets are quiet, though, in Europe, the peripheral yields have edged higher. The dollar is firm. It is advancing against the majors, exception of the yen. The Norwegian krona, Canadian and Australian dollars, and sterling are weakest, with around 0.4%-0.5% losses. Emerging market currencies are also weaker, led by the Mexican peso, Russian rouble, South African rand, and Turkish lira. Gold is recovering from a spike that brought it a little below $1805, its lowest level since early December. The session high was recorded in late Asia, a touch above $1840. The 200-day moving average is $1844. Initially, February WTI slipped through the pre-weekend low to almost $51.75 but has recovered to nearly $52.50. Last week’s high was almost $54 a barrel. |

FX Performance, January 18 |

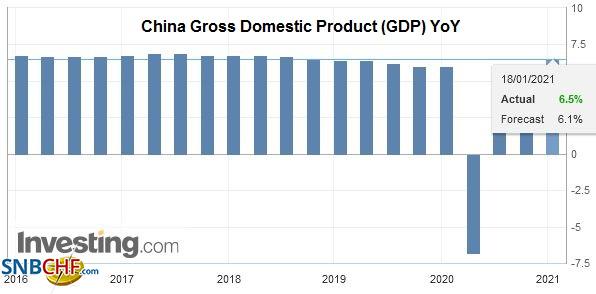

Asia PacificChina reports its economy expanded by 2.6% in Q4 20 after a revised 3% gain in Q3 (from 2.7%). That means for all of last year, the world’s second-largest economy expanded by 6.5% (Bloomberg’s survey median forecast was 6.2%). |

China Gross Domestic Product (GDP) YoY, Q4 2020(see more posts on China Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| Of note, industrial output was 7.3% higher in December from a year ago, and for all of last year, it rose by 2.8%. |

China Industrial Production YoY, December 2020(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

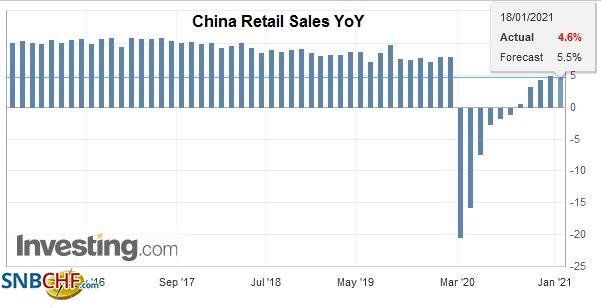

| While output was a little higher than expected, retail sales were softer, rising 4.6% year-over-year in December (5.0% in November), and fell 3.9% for the entire year. |

China Retail Sales YoY, December 2020(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

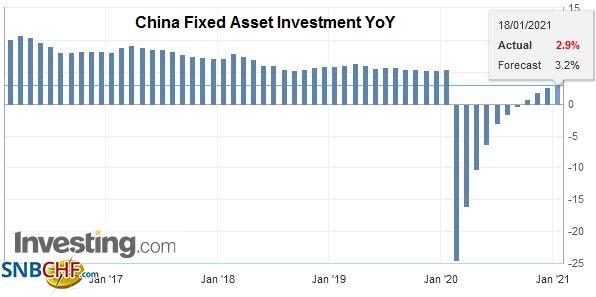

| Fixed asset investment rose 2.9% last year, better than the 2.6% pace in November, but off the 3.2% rate expected by economists. Surveyed joblessness was steady at 5.2%. Of note, coal, gas, and electricity output reached record levels in December. Crude steel output rose 7.2% last year to over one billion tons. Its refineries processed an average of 14.2 mln barrels of oil a day. Before, the focus was on “surplus savings,” a criticism that China has built redundant investment. It is this excess capacity that exerts downward pressure on prices. |

China Fixed Asset Investment YoY, December 2020(see more posts on China Fixed Asset Investment, ) Source: investing.com - Click to enlarge |

| The Summer Olympics, delayed from last year, are scheduled for July 23-August 8, but the pandemic is once again threatening. The decision to postpone last year was made in late March. This year’s decision may entail a cancelation rather than a postponement, but the timing is not clear yet. Local public support has waned, but the government wants to press ahead, of course. Prime Minister Suga’s goodwill upon replacing Abe last September has dissipated. In a speech earlier today, Suga pressed ahead with his environmental and digitization initiatives. Suga also confirmed the government’s intention to pass a law that adds penalties and incentives to a law on attempts to rein in the virus. Perhaps, the Prime Minister’s corporate governance reforms, which require major companies to have a third of their directors from outside the firm, may draw foreign asset managers’ attention. |

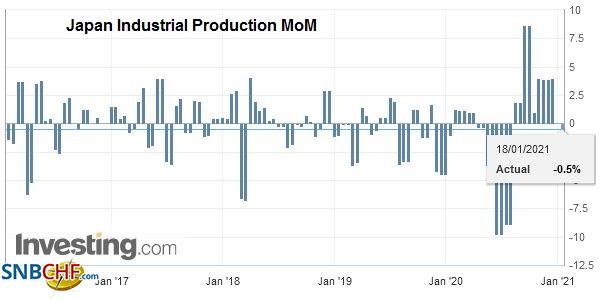

Japan Industrial Production MoM, December 2020(see more posts on Japan Industrial Production, ) Source: investing.com - Click to enlarge |

In the last days of the Trump administration, the US has reportedly revoked the licenses of several suppliers of Huawei, including Intel. The US Commerce Department has indicated it will reject a “significant number” of requests to sell to Huawei. Asian chip fabricators and other suppliers of Huawei did see their shares fall in early trading today. This move caps a campaign that has targeted China’s three largest telecom companies, its largest chip makers, its top two cell phone manufacturers, the largest social media and gaming companies, the main deepwater energy explorers, the main commercial airplane manufacturers, and the leading drone maker.

The dollar is trading in about a quarter of a yen range today. The high, a little above the pre-weekend high (~JPY103.90), was recorded in early Asia, and the low, seen late in the session, was near JPY103.70. It probably required a break of the JPY103.50 to signify anything important. Note that a $1.4 bln option at JPY103 expires tomorrow. The Australian dollar is succumbing to profit-taking pressures today. It is being pushed below the 20-day moving average today (~$0.7685) and will likely close below it for the first time in two months. The next target is near $0.7625, but the risk of a push toward $0.7500 is increasing. The broader US dollar recovery is aiding Chinese officials who had appeared to signal that it wanted to yuan to stop climbing. With today’s gain, the greenback has risen for the fourth consecutive session against the yuan to approach CNY6.50. Today’s reference rate was set at CNY6.4845, in line with expectations. The pre-weekend fix was at CNY6.4633.

Europe

Germany’s CDU chooses a new party leader who speaks to the greatest likelihood of continuity with Merkel. Laschet, the premier of Germany’s most populous state (North-Rhine Westphalia) in an alliance with Spahn, the health minister, was selected a the new party leader. It would ostensibly give him the inside track to be the party’s candidate for Chancellor in the fall election. Recall Merkel had sponsored Annegrat Kramp-Karrenbauer to succeed her as party head, but a few faux pas later and AKK resigned. Hence the election. There is still talk that the Soeder, the head of the CSU, sister-party of the CDU in Bavaria, who has gotten high marks for handling the public health crisis, may still be in the running as the candidate for Chancellor. While possible, it appears, from the outside, the CDU members are resisting the temptation to move to the right in the initial post-Merkel era. She appears to have won back much of her public support after seeing it wane over immigration a few years ago. Two state elections in March (Baden-Wurttemberg and Rhineland-Palatinate) are Laschet’s first hurdles as party head.

The closer scrutiny of foreign direct investment was supposedly really about protecting countries from predatory behavior by state-owned businesses, especially from China. It was really, we were assured, not about protectionism but ensuring a level playing field. We remain skeptical and see the rise of economic nationalism in various forms as a key development since the Great Financial Crisis. Last week, the French government blocked a Canadian company from acquiring CarreFour for around $16.2 bln. The obvious and right stat concerns seemed to have been addressed. The Canadian company Alimentation Couche-Tard promised not to make any job cuts for two years, invest three billion euros into Carrefour over the next five years, maintain the market listing in Paris, and keep the Paris headquarters. Would France really become less food self-sufficient if the deal went through? Would the French government feel differently if the acquirer was within the EU or EMU? It seems a slippery slope and one that needs to be monitored closely.

Fitch affirmed its AA- sovereign UK rating with a negative outlook before the weekend. It was not surprising, but it updated some of its economic forecasts as part of its announcement. It lifted this year’s GDP forecast to 5.0% from 4.1%, partly due to the trade agreement with the EU and partly because of what the rating agency thought was a better starting position. Fitch estimates that the economy contracted by around 10.3% last year. The deficit is expected to be near 12% of GDP this year and 10% next year after a little more than 16% in 2020. The Bloomberg survey found the median forecast was for 4.6% growth this year and an 8.7% budget deficit, though that was before the latest lockdown. Note that the UK government is reportedly considering a one time GBP500 payment to as many as 6 mln people. However, reports suggest the Chancellor of the Exchequer is considering tax increases as early as March.

Italy’s political crisis is playing out since former PM Renzi deserted the government last week. Prime Minister Conte will deliver a speech today ahead of the vote of confidence in the lower chamber. Tomorrow, the Senate votes, and the government enjoys narrower support in the upper chamber. There is a fear that even if Conte survives, which seems like the odds-on favorite scenario, the government is weakened. There is talk of an early election, and some have suggested June as an initial timeframe. Still, the political reforms mean that the number of seats will fall by a third, and the new division of labor with a smaller body has not been fully formulated.

The euro is off for the fourth consecutive session. In fact, since January 6, when the US capitol was stormed and the ADP estimate disappointed, the euro has risen in only one session. It is testing the $1.2050 area today and, with today’s loss, has met the (38.2%) retracement of the rally since the US election. The $1.2000 area offers psychological support and holds a 1.1 bln euro option that expires tomorrow, while the (50%) retracement objective is about $1.1975. Sterling recorded its 2.5-year-plus high last week near $1.3710. It fell before the weekend and extended those losses today to test the $1.3520 area. Last week’s low was near $1.3450, and that is the next objective. It is, though, a bit over-extended on an intraday basis, and initial resistance is seen near $1.3570.

America

US markets are closed for the Martin Luther King Jr national holiday today. The focus is on Yellen’s confirmation hearing tomorrow. We have suggested she is likely to embrace the G7/G20-backed position that exchange rates are best determined by the market. However, there is heightened concern that others fall shy of this standard, even though comments in the last four years by top US officials went against it as well. Still, Yellen may say something about wanting robust allegiance to what we have called an arms control agreement.

Biden’s inauguration is on Wednesday. That is mostly political theater. However, what is not theater will be several executive orders. Biden is expected to rejoin the Paris Agreement, reverse the ban on Muslim entry into the US, and cancel the XL Pipeline with Canada. He is also expected to extend the pause in student loan servicing and the restrictions on evictions and foreclosures while mandating masks.

The Canadian dollar was sold when the XL Pipeline news broke. The response by the Canadian government is expected shortly after the formal announcement is made. Today, Canada reports housing starting (December) and international portfolio flows (November). While CPI (December) figures will be released at mid-week, they will be overshadowed by the Bank of Canada meeting. The risks of a 10-15 bp cut seem greater than is widely recognized.

The US dollar fell to CAD1.2625 last week, its lowest level since April 2018. The US dollar bounced to CAD1.2765 before the weekend. The gains have been extended to almost CAD1.2800 today. The high from last week was near CAD1.2835, and that is the next immediate target, which is also the (61.8%) retracement target of the loss since December 21 (from almost CAD1.2960). The greenback alternated between advances and declines last week against the Mexican peso, but that sawtooth pattern is ending today as it pushes higher for the second consecutive session. It approached MXN19.97 but is now near MXN19.90 as the local session is about to begin. Last week’s high was near MXN20.2630. Although trading is choppy, the dollar has been moving broadly sideways since late November. Lastly, note that Brazil’s central bank meets on Wednesday and is widely expected to leave the Selic rate target at 2.0%.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Canada,China,Currency Movement,Featured,Germany,Italy,Japan,newsletter,U.K.