While the "Trump rally" appears to have just begun, one of its initial hallmarks is that investors want beta. Beta is a measure of the volatility of a stock versus the broader market, most often the S&P 500. For instance, a stock with a beta of 1.50 implies that based on prior trading, investors should expect the stock to be 1.50% more volatile than the S&P 500. Investors seeking beta must assume the market will be heading higher in the short term; thus, higher beta stocks should outperform the market. The paragraph below, courtesy of Bloomberg, supports the beta chase into year-end. In fact, it’s a trend that plays out year in, year out. Bank of America notes that stocks with the highest volatility, known as beta, have tended to beat the market in the final

Topics:

Michael Lebowitz and Lance Roberts considers the following as important: 9) Personal Investment, 9a.) Real Investment Advice, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

While the "Trump rally" appears to have just begun, one of its initial hallmarks is that investors want beta. Beta is a measure of the volatility of a stock versus the broader market, most often the S&P 500. For instance, a stock with a beta of 1.50 implies that based on prior trading, investors should expect the stock to be 1.50% more volatile than the S&P 500. Investors seeking beta must assume the market will be heading higher in the short term; thus, higher beta stocks should outperform the market.

The paragraph below, courtesy of Bloomberg, supports the beta chase into year-end.

In fact, it’s a trend that plays out year in, year out. Bank of America notes that stocks with the highest volatility, known as beta, have tended to beat the market in the final two months, in part thanks to investors diving into high-octane shares in a bid to juice their performance. Funds tracked by BofA have been particularly allergic to risk taking this election season so far, suggesting there’s even more pressure this time round for investment managers to get bullish.

As we wrote in Seasonality, "In 2024, three primary drivers will likely support markets from the middle of October through year-end and likely into early 2025." Couple the typical year-end seasonality with underweight portfolio managers and budding investor optimism for Trump, and the recipe for a high-beta rally is in place.

The graph below shows the High-Beta S&P 500 has underperformed the S&P 500 over the last year. Might it catch up as 2024 comes to a close?

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed how professional investors are underweighted equity risk heading into year-end. That, along with $6 billion daily in corporate share buybacks, continues to put a bid under the market. As we saw yesterday, early selling pressure after a furious rally since the election was met with buyers. As we have suggested previously, such dips are likely opportunities to add equity risk, if needed, into year-end. As noted by TheMarketEar yesterday, the bullish setup for the market remains firmly intact into early March.

While there is undoubtedly a bias to the upside, it is essential to remember that this is an AVERAGE of election years, and while some have been better, there have certainly been worse years. Given that the market is currently back to overbought levels, and extended from the 50-DMA, we suggest managing risk as needed. For example, Walmart (WMT) has been on a tear this year and is up about 60% year-to-date. While we like the position in our portfolio very much, it was prudent to take profits and reduce our weight slightly heading into earnings.

On the other hand, Abbive (ABBV) was hit hard this week over the termination of a Phase II Schizophrenia drug trial. The sharp reduction in price has taken the stock well below its 50-DMA and is deeply oversold on multiple levels. The fundamentals have not changed for the company, and it continues to yield well above 3% annually. As such, we used the pullback to rebalance the position back to target weights.

This is what we mean when we discuss risk management. We rarely mean to sell large chunks of your portfolio. There will be a time to do that; when that happens, we will be very explicit in our instructions.

Today is not that day.

Scanning For Beta

If investors seek higher beta stocks heading into year-end, it is worth trying to identify some potential winners from such a risk-on trade. To help us in this endeavor, SimpleVisor has a scanning tool that allows subscribers to search for stocks meeting their custom criteria. We created a simple scan to help better appreciate how it might be used in the current environment. The first screenshot below shows our criteria: Beta >1.50, Market Cap > $25 billion, and a previous 5-day return >5%. The scan returned nine stocks. Six of the nine are in the technology sector, two in energy, and one is an industrial company. Also, note they all have impressive month-to-date (MTD) performance.

In addition to showing the results, you can view their technical and fundamental situation and previous performance. Unsurprisingly, given recent returns, the second graphic shows all of the stocks have very positive trends. However, the RSI indicator is very high for all nine stocks, indicating a rest or consolidation may be in order. Furthermore, we share the third screenshot for those seeking higher beta and good fundamentals.

This was a simple scan to demonstrate our tool. A significant number of screening factors can be used to best hone in on the characteristics of stocks you may be seeking.

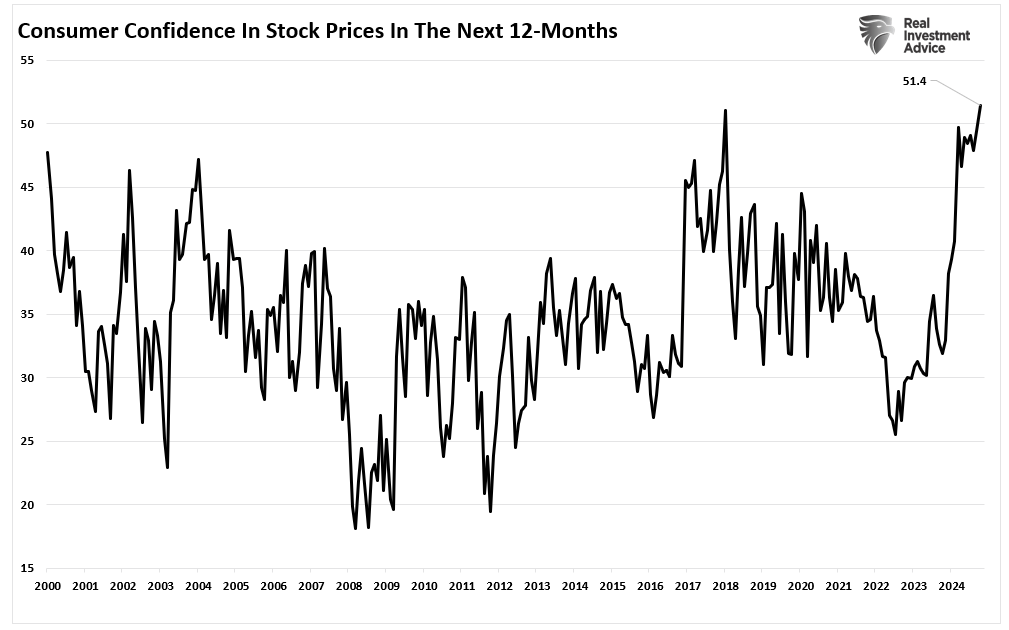

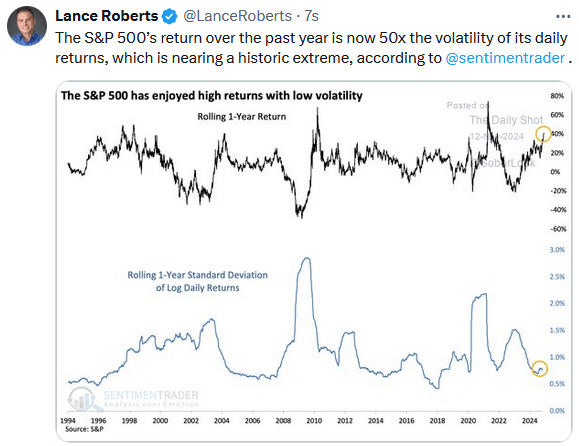

Exuberance- Investors Have Rarely Been So Optimistic

Currently, a liquidity surge supports investor exuberance, marked by enthusiastic buying and excessive risk-taking. As we will discuss, such activity often precedes significant market corrections. While optimism can drive short-term gains, history shows that when sentiment runs too hot, and valuations detach from fundamentals, such leaves the markets vulnerable to declines.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Seeking Beta appeared first on RIA.

Tags: Featured,newsletter