Journal of Economic Dynamics and Control, July 2022, with Martin Gonzalez-Eiras. PDF (local copy). We investigate how politico-economic factors shaped government responses to the spread of COVID-19. Our simple framework uses epidemiological, economic and politico-economic arguments. Confronting the theory with US state level data we find strong evidence for partisanship even when we control for fundamentals including the electorate’s political views. Moreover, we detect an important role...

Read More »“The Political Economy of Early COVID-19 Interventions in US States,” CEPR, 2022

CEPR Discussion Paper 16906, January 2022, with Martin Gonzalez-Eiras. PDF (local copy). We investigate how politico-economic factors shaped government responses to the spread of COVID-19. Our simple framework uses epidemiological, economic and politico-economic arguments. Confronting the theory with US state level data we find strong evidence for partisanship even when we control for fundamentals including the electorate’s political views. Moreover, we detect an important role for the...

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Weekly Market Pulse: Is It Time To Panic Yet?

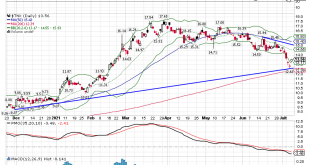

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range. The bond rally since April has been of the stealth variety, the financial press and market strategists dismissing every tick down in rates as nothing. It was a lonely trade to put on and yes...

Read More »FX Daily, April 26: Big Week Begins Quietly, with the Greenback Still Under Pressure

Swiss Franc The Euro has fallen by 0.03% to 1.1048 EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: What promises to be a notable week has begun off quietly: the US, EMU, and South Korea report Q1 GDP. The eurozone also provides its first estimate of April inflation. Corporate earnings feature tech and financial firms. Equities are mostly firmer in the Asia Pacific region and...

Read More »FX Daily, April 20: Market has Second Thoughts about Timing of First Fed Hike

Swiss Franc The Euro has risen by 0.05% to 1.1015 EUR/CHF and USD/CHF, April 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Even as US yields edge higher, the dollar struggles. With the 10-year Treasury yields now at 1.62%, nine basis points above last week’s lows, the greenback has turned mixed against the major currencies. After briefly slipping below JPY108, the dollar has recovered to around JPY108.55....

Read More »Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag. A Virginia man who was part of the riot wore a T-shirt mocking the holocaust. A Brooklyn judge’s son was photographed in the Capitol wearing an elaborate outfit of furs accented by...

Read More »“The Pandemic Endgame,” VoxEU, 2021

VoxEU, January 11, 2021, with Martin Gonzalez-Eiras. HTML. Based on the CEPR discussion paper, we draw conclusions for the pandemic endgame. We explain why Israel will likely impose a harsher lockdown than other countries, especially poor ones. And why we should expect “inverse lockdowns”—measures to stimulate social interaction.

Read More »“Optimally Controlling an Epidemic,” CEPR, 2020

CEPR Discussion Paper 15541, December 2020, with Martin Gonzalez-Eiras. PDF (local copy). We propose a flexible model of infectious dynamics with a single endogenous state variable and economic choices. We characterize equilibrium, optimal outcomes, static and dynamic externalities, and prove the following: (i) A lockdown generically is followed by policies to stimulate activity. (ii) Re-infection risk lowers the activity level chosen by the government early on and, for small static...

Read More »“Wirtschaftspolitik in Corona-Zeiten (Economic Policy in Times of Corona),” FuW, 2020

Finanz und Wirtschaft, December 9, 2020. PDF. Economic policy is not about GDP growth. It’s about welfare. Externalities are key. Infection externalities don’t go away by calling for responsible behavior. Infection externalities can turn positive. Keeping worthy companies or networks alive does not require government intervention, unless capital markets don’t work. To judge the right amount of burden sharing is beyond economics. But economics gives some clues: In an ideal world,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org