As we enter the final quarter of 2024, there are a lot of questions facing investors. There are, of course, always a lot of questions because investors are always dealing with the future, but today’s environment does seems to have more than usual. Some of these questions concern short-term considerations and while they are important, it is more important to remain focused on the long-term trends. Here’s what I’m thinking about lately: Let’s get the one everyone is...

Read More »Weekly Market Pulse: It’s An Uncertain World

You’re going to hear a lot of talk about the yield curve soon and what it means for “the” yield curve to uninvert (which isn’t a real word but will get used a lot). The difference between the 10-year Treasury note yield and the 2-year Treasury note yield is about to turn positive, the 2-year note yield recently falling a bit more rapidly than the 10-year. You’ll see a lot of pundits say with great confidence that this means we are on the verge of recession. Which may...

Read More »Market Morsel: SLOOSing

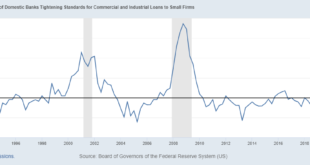

The Senior Loan Officer Survey came out yesterday and I’m sure you’ve been waiting on pins and needles, as I have, to see the results. Okay, maybe you had better things to do. I sure hope so because it isn’t exactly riveting. Here’s the description from the Fed’s website: Survey of up to eighty large domestic banks and twenty-four U.S. branches and agencies of foreign banks. The Federal Reserve generally conducts the survey quarterly, timing it so that results are...

Read More »Market Morsel: How “The Market” Is Really Doing

When people talk about “the market” they are usually referring the big indexes – the S&P 500 or the NASDAQ. For more casual observers, “the market” is the Dow which is a lousy index for a lot of reasons but has the advantage of history. But are any those really representative of how “the market” is doing? Not really. All markets – stocks, bonds, currencies, commodities – provide us with valuable information about the economy. The stock market generally reflects...

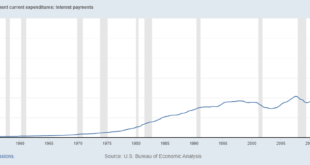

Read More »Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Interest rates surged last week on the back of a hotter-than-expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market. In the short run, all that matters is what the majority believes is the truth. What they believed last week was that inflation isn’t falling fast enough and the Fed will not be cutting rates anytime soon. That was enough to send the bond market into a...

Read More »Macro: GDP Q3 — Inflationary BOOM!

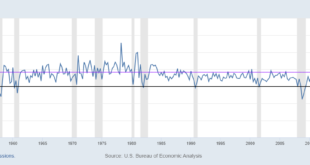

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years. It was the best real growth quarter since Q2 and Q3 of 2014. The last 12 months has been mostly about services, here are the biggest contributors to YoY GDP: Consumption of Services Consumption of Goods Lower imports Government Non-residential investment in structures Intellectual property Q2 to Q3, we saw an acceleration in goods...

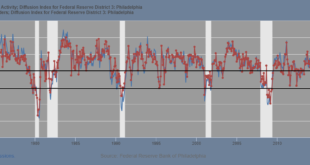

Read More »Macro: Philly Fed Mfg Survey — Umm

Tis was a poor number. The headline dropped from -5.9 to -10.5. The more eye popping number was the Index for New Orders which dropped from 1.3 to -25.6. I hate to say it, the diffusion index for new orders has never gone below 21 without an accompanying recession; that is until 2023. This is the 4th reading in the last 13 months below 21. These regional manufacturing surveys have been relatively poor since the middle of 2022. To date, it hasn’t mattered. Its as if...

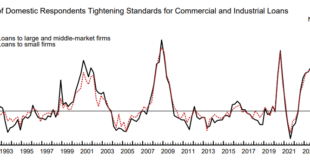

Read More »Macro: Banking: Senior Loan Officer’s Survey and Lending

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad. Banks are not seeing increasing demand for loans. I’m just posting survey results for C&I loans, the graph is very similar for commercial real estate, residential real estate and consumer loans. Commercial and Industrial loan growth has...

Read More »Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over? The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by more than a...

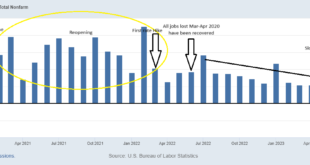

Read More »Macro: Employment Report

Wall street cheered the fact that we added fewer jobs (150,000) than expected (179,000) in October. This was a welcome relief after the hot September number that was revised down from 336,000 to 279,000. The Goods economy actually lost 11,000 jobs. The culprit here was motor vehicles and parts which was -33,000 on the month. The Services economy gained 110,000 jobs. 77,000 were in Health Care and Social Services. 10,000 were added to perming arts and spectator...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org