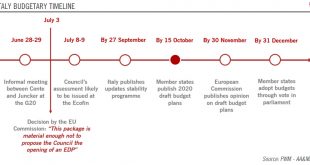

For now, Italy has avoided Brussels’ Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package. In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other...

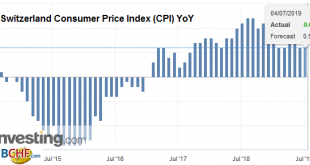

Read More »Swiss Consumer Price Index in June 2019: +0.6 percent YoY, 0.0 percent MoM

04.07.2019 – The consumer price index (CPI) remained stable in June 2019 compared with the previous month, remaining at 102.7 (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each other overall. Heating...

Read More »Swiss Retail Sales, May 2019: -1.6 percent Nominal and -1.7 percent Real

01.07.2019 – Turnover in the retail sector fell by 1.6% in nominal terms in May 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 1.7% in May 2019 compared with the previous year. Real growth...

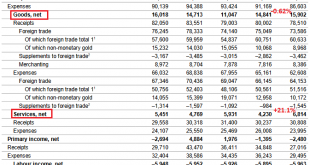

Read More »Swiss Balance of Payments and International Investment Position: Q1 2019

Current Account Key figures: Current Account: Up 2.35% against Q1/2018 to 17.2 bn. CHF of which Goods Trade Balance: Minust 0.62% against Q1/2018 to 15.9 bn. of which the Services Balance: Plus 21.1% to 6.8 bn. of which Investment Income: Plus 5.8% to 3.5 bn. CHF. Current Account Switzerland Q1 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

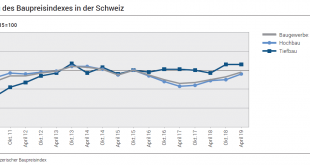

Read More »Switzerland Construction prices rose by 0.5 percent in April 2019

20.06.2019 – The construction price index recorded a rise of 0.5% between October 2018 and April 2019, reaching 99.8 points (October 2015 = 100). This result reflects an increase in building prices and a stabilisation in civil engineering prices. Year on year, construction prices increased by 0.7%. These are the results of the Federal Statistical Office (FSO). Development of the construction price index in Switzerland...

Read More »Supplementary accommodation recorded more than 16 million overnight stays in 2018

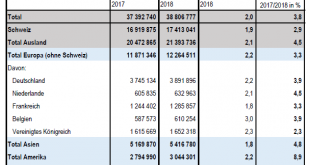

17.06.2019 – In 2018, supplementary accommodation posted a total of 16.6 million overnight stays, i.e. an increase of 4.2% compared with 2017. With 11.2 million units, Swiss visitors represented more than two-thirds of demand (67.4%), i.e. a rise of 2.9%. Foreign visitors registered a 6.9% increase with 5.4 million units. With 4.5 million units (+6.7%), European visitors generated the most overnight stays by foreigners....

Read More »Bund yields-Heading further down?

Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside. Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative...

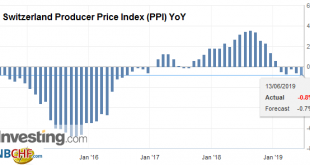

Read More »Swiss Producer and Import Price Index in May 2019: -0.8 percent YoY, unchanged MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

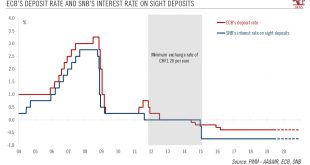

Read More »How dovish can Swiss monetary policy go?

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates. At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit,...

Read More »Why has euro inflation stayed so low?

Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020. The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org