The leftist website Counterpunch has published an article today entitled “Millionaires Stopped Contributing to Social Security on March 2, 2024.” The thrust of the article is that once someone reaches an income of 8,600, “they stop paying in.” The operative terms are “contributing” and “paying in.” They reflect a misguided mindset with respect to Social Security, which is the crown jewel of American socialism. This leftist mindset and terminology have become widespread and ingrained in the American people. No one “contributes” or “pays into” Social Security. Social Security is nothing more than a welfare-state program. It’s no different, for example, from food stamps, a program in which the federal government gives money to people to buy food. Where

Topics:

Jacob G. Hornberger considers the following as important: 6b.) The Future of Freedom Foundation, Featured, Hornberger's Blog, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The leftist website Counterpunch has published an article today entitled “Millionaires Stopped Contributing to Social Security on March 2, 2024.” The thrust of the article is that once someone reaches an income of $168,600, “they stop paying in.”

The operative terms are “contributing” and “paying in.” They reflect a misguided mindset with respect to Social Security, which is the crown jewel of American socialism. This leftist mindset and terminology have become widespread and ingrained in the American people.

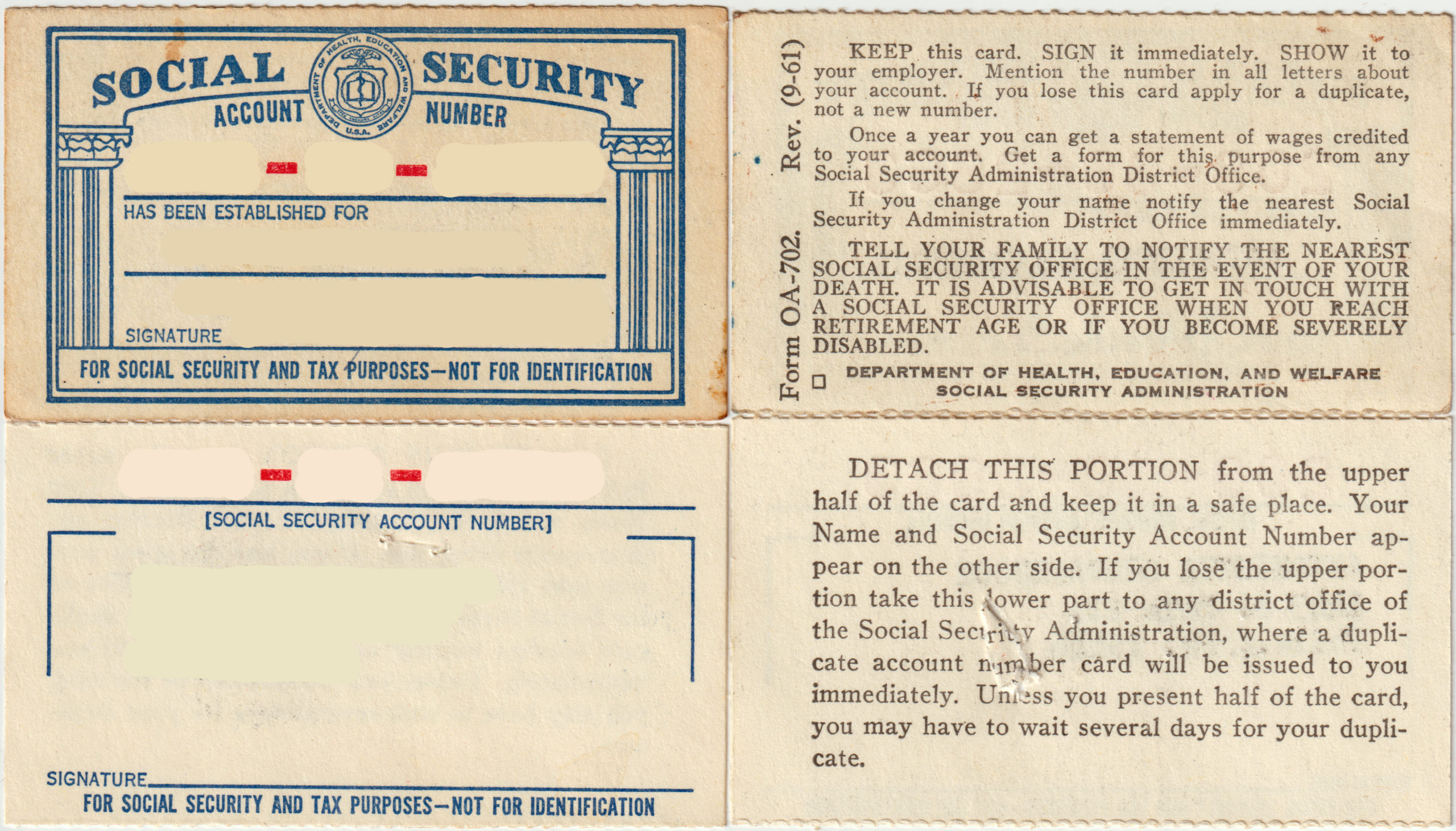

No one “contributes” or “pays into” Social Security. Social Security is nothing more than a welfare-state program. It’s no different, for example, from food stamps, a program in which the federal government gives money to people to buy food.

Where does the government get the money to fund food stamps? The money comes from the taxes that people pay on their incomes — taxes that are enforced by the Internal Revenue Service, one of the most vicious agencies in U.S. history.

Licensed under the Creative Commons Attribution-Share Alike 4.0 International license.

Where does the government get the money to give to seniors in the form of Social Security payments? The same way that it gets the money to fund food stamps — from taxation.

In other words, no one contributes or pays money into a food-stamp fund. People pay taxes, either directly through the income tax (or indirectly through inflation). The government uses those taxes to fund food stamps.

By the same token, no one contributes or pays money into a Social Security retirement fund. People pay taxes, either directly through the income tax (or indirectly through inflation). The government uses those taxes to fund Social Security.

From the very beginning, Social Security has been a welfare program, just as food stamps have been. At the risk of belaboring the obvious, the very first Social Security recipient in the 1930s, Ida May Fuller, never “contributed” or “paid into” Social Security. She simply began receiving money from the government — money that was forcibly collected from others through the force of taxation.

U.S. officials did something clever, however, with Social Security that they did not do with food stamps. Rather than simply raise income taxes to fund Social Security payments, as they did with food stamps, they created a new tax on incomes called the FICA tax. Officials then correlated the amount of money seniors would receive with the amount of money they had paid in FICA taxes.

That clever tax ploy caused many Americans to conclude that they were “contributing” or “paying into” a retirement account. It made them believe that when they began receiving Social Security payments, they were simply “getting their money back.”

But nothing could be further from the truth. It’s just a classic case of self-deception. When people pay their income taxes and FICA taxes, the government spends that money on receipt. So, let’s assume that someone works from age 55-65. All the income taxes and FICA taxes collected during that 10-year period are long gone when the person reaches 65.

So, how does the government give that person a Social Security check? By taxing people who are still working. The government taxes the young and productive to give the money to seniors.

Defenders of Social Security maintain that a “promise” has been made to people that they will receive retirement pay from the government. This, however, is another instance of a self-induced delusion, albeit a very popular one. Social Security, like food stamps, is simply a welfare program that confiscates money from one group of people and gives it to another group of people. There is no promise built into either the Social Security law or the food-stamp law that either program will last into perpetuity. They are both just welfare programs that can be repealed at any time.

One of the biggest instances of self-deception with Social Security and food stamps is that supporters of these welfare program are demonstrating their compassion with this program. Of course, that is patently ridiculous. Social Security and food stamps — and, for that matter, all other welfare-state programs — are based on the initiation of force through the coercive apparatus of taxation enforced by the IRS. That’s not compassion by any stretch of the imagination. Genuine compassion comes from the willing heart of the individual — e.g., children or neighbors voluntarily helping parents or grandparents in need or voluntarily helping the poor.

It’s worth reminding ourselves that Americans lived without Social Security, food stamps, Medicare, Medicaid, and other socialist programs for more than 100 years. That’s because they favored freedom and chose not to engage in the self-deception that comes with socialism. It’s also worth noting that that unusual way of life resulted in the one of the most prosperous periods in history and produced one of the greatest outbursts in voluntary charity that mankind has ever seen.

It’s also worth pointing out —especially to young people — that Social Security and Medicare obligations currently total around $80 trillion, more than double the federal outstanding debt of $34 trillion with which the federal government has saddled young people.

Tags: Featured,Hornberger's Blog,newsletter