This essay is adapted from a speech delivered at the Mises Institute’s Supporters Summit in Hilton Head, South Carolina, on October 12, 2024.“Printing Power” in our title has a double meaning: It can mean “printing power”—the power to print money, which central banks have. But we will focus on “printing power”—the central bank’s money printing as an essential source of the power of the state, including of course the Federal Reserve’s printing to promote the power of the United States government. The Fed is good at literal printing, exercising its monopoly of currency issuance granted by the government. It has outstanding $2.3 trillion in pure paper money circulating around the world, of which perhaps 45 percent, or more than $1 trillion, is held abroad. All the

Read More »Articles by Alex J. Pollock

Can the Federal Reserve Buy Gold? Should It?

October 7, 2024Since the sixth century BC reign of Croesus of Lydia, refined gold has served as a monetary store of value. Today, many central banks, including the European Central Bank, the Swiss National Bank, the German Bundesbank, the Bank of France, the Bank of Italy, the Dutch National Bank, the Bank of Japan, the Reserve Bank of India, the People’s Bank of China, and the Monetary Authority of Singapore among others, hold gold as an investment and reserve against their monetary liabilities. It may surprise some that, in contrast, the Federal Reserve owns no gold at all.The original 1913 Federal Reserve Act required the Fed to hold substantial amounts of gold to back its outstanding Federal Reserve Notes and member bank deposits. In 1934, the Roosevelt administration pushed

Read More »It’s the Fed That’s a Risk to Financial Stability

June 6, 2024Published in The New York Sun:Central bankers whistle ‘Dixie’ as mark-to-market losses dramatically shrink the banking system’s economic capital.Whistling a happy tune, the Federal Reserve vice chairman for supervision, Michael Barr, recently testified to Congress that “overall, the banking system remains sound and resilient.” A more candid view of the risks would be less sanguine.Mr. Barr reported that banking “capital ratios increased throughout 2023.” He failed, though, to discuss the mark-to-market losses that have dramatically shrunk the banking system’s economic capital and capital ratios.A recent study of American banks, including analyses of both their securities and fixed rate loans, estimates that the banking system has at least a $1 trillion

Read More »How Does the Federal Reserve Fit into Our Constitutional Order?

May 3, 2024This article is adapted from a lecture delivered to the Federalist Society: The Federal Reserve is a fundamental problem for the Constitutional order of the American Republic. How can it be that it considered itself able to unilaterally impose permanent inflation on the country, without legislative debate or approval?The shifting theories believed by central banks are among the most important of macro-economic factors. For example, William McChesney Martin, chairman of the Federal Reserve Board 1951-1970, rightly characterized inflation as “a thief in the night.” In remarkable contrast, the Fed under Ben Bernanke, chairman 2006-2014, explicitly committed itself and the country to inflation forever at the rate of 2% per year, thus assuming that constant inflation

Read More »The Federal Reserve’s Capital Has Now Plummeted to Negative $121 Billion

May 2, 2024Hold up your hand if you think that the aggregate losses of an organization are an asset of that organization. No hands at all? Absolutely right. Losses are not an asset. That’s accounting 101. Yet the greatest central bank in the world, the Federal Reserve, insists on claiming that its continuing losses, which have accumulated to the staggering sum of $164 billion, are an accounting asset.The Fed seeks to palm off this accounting entry as a “Deferred Asset.” Why does the Fed do this, which perhaps makes it look tricky instead of majestic? Because it does not want to report that it has lost all its $43 billion in capital and now has negative capital. The inevitable arithmetic is plain: start with the Fed’s $43 billion in capital, lose $164 billion, and the capital

Read More »The Most Important Price of All

April 5, 2024In The Price of Time, Edward Chancellor has given us a colorful and provocative review of the history, theory, and the profound effects of interest rates, the price that links the present and the future, which he argues is “the most important price of all.” The history runs from Hammurabi’s Code which in 1750 BC was “largely concerned with the regulation of interest,” and from the first debt cancellation, which was proclaimed by a ruler in ancient Mesopotamia, all the way to our world of pure fiat currencies, the recent Everything Bubble (now deflating) including cryptocurrencies (now crashing), and the effective cancellation of government debt by inflation and negative interest rates.The intellectual and political debates run from the Old Testament to Aristotle

Read More »The Swiss National Bank vs. the Federal Reserve: The Fed’s Capital Losses in Perspective

March 12, 2024Switzerland’s central bank, the Swiss National Bank (SNB), lost $3.6 billion in 2023,

after a gigantic loss of $150 billion in 2022. But after booking these losses, and properly subtracting them from its capital, the SNB still had positive capital of over $70 billion. This gives it the quite respectable capital to total assets ratio of 7.9%. All of these numbers are after marking its investments to market, as is required by the SNB’s governing law, so the capital is a real, marked to market equity. The market value of the SNB’s holdings of gold is $65 billion, which includes a large appreciation, including $1.9 billion in 2023. Since the SNB had an overall loss for the year, it paid no dividends to its stockholders.“The SNB aims for a robust balance sheet with

Central Banks and Housing Finance

March 7, 2024Although manipulating housing finance is not among the Federal Reserve’s statutory objectives, the U.S. central bank has long been an essential factor in the behavior of mortgage markets, for better or worse, often for worse. In 1969, for example, the Fed created a severe credit crunch in housing finance by its interest rate policy. Its higher interest rates, combined with the then-ceiling on deposit interest rates, cut off the flow of deposits to savings and loans, and thus in those days the availability of residential mortgages. This caused severe rationing of mortgage loans. The political result was the Emergency Home Finance Act of 1970 that created Freddie Mac, which with Fannie Mae, became in time the dominating duopoly of the American mortgage market,

Read More »Juvenal’s Greatest Poser: “Who Will Guard the Federal Reserve?”

March 6, 2024[This article was first published in the New York Sun.]“Who will guard these guardians?” That poser of Juvenal, satirist of Rome, is an immortal question — nowhere more pertinent, though, than in deciding who should oversee the Federal Reserve. In the Fed, we have supposed guardians of stable prices who have decided by themselves to create perpetual inflation.Just to mark the point: Guardians of the currency have decided by themselves to depreciate it forever. Guardians of financial stability have rendered themselves technically insolvent with negative capital now at more than $100 billion. Guardians who cannot make reliable economic forecasts are tirelessly claiming that they should be “independent.”What total nonsense. No part of our Constitutional government

Read More »The Fed’s Capital Goes Negative

April 4, 2023The Federal Reserve’s new report of its balance sheet shows that in the approximately six months ended March 29 it has racked up a remarkable $44 billion of cumulative operating losses. That exceeds its capital of $42 billion, so the capital of the Federal Reserve System has gone negative to the tune of $2 billion—just in time for April Fools’ Day.

This event would certainly have surprised generations of Fed chairmen, governors, and, we’d have thought, newspapermen. The Fed’s capital will keep getting more negative in April and for some long time to come, at least if interest rates stay at anything like their current level. The Fed in the first quarter of 2023 reported losses running at the rate of $8.7 billion a month.

On an annual basis that would be a loss of

The Second Housing Bubble of the 21st Century Is Over

December 27, 2022[Originally published in the Housing Finance International Journal.]

The 21st century, only 23 years old, has already had two giant, international housing bubbles. It makes one doubt that we are getting any smarter with experience.

Among the countries involved in the second bubble, both the U.S. and Canada fully participated in the newest rampant inflation of house prices. Prices this time reached levels far above those of the last boom peak. In the U.S., the S&P/Case-Shiller National House Price Index by mid-2022 had risen to 67% over its 2006 bubble peak (130% over its 2012 trough). In Canada, the Teranet-National Bank House Price Index had soared to 143% over its 2008 peak (168% over its 2009 trough). What the Federal Reserve and the Bank of Canada both wrought

Hazlitt, Hayek and How the Fed Made Itself into the World’s Biggest Savings & Loan

April 9, 2022The Henry Hazlitt Memorial Lecture, March 18, 20221

Many thanks to the Mises Institute and to sponsor Yousif Almoayyed for this opportunity to be with you all today as we consider one of the truly remarkable developments in the history of American central banking, money printing, and credit inflation.

On a personal note, “the pursuit of clarity” has long been a goal of mine, and it’s a particular pleasure to present a lecture in honor of Henry Hazlitt, whose work is marked by such clarity of style, meaning, and logic.

Taking up our topic, “Hazlitt, Hayek and How the Fed Made Itself into the World’s Biggest Savings and Loan,” we begin with Hazlitt’s Economics in One Lesson. Central to this book is the key problem of government policies which “benefit one group only

The Federal Reserve Keeps Buying Mortgages

January 24, 2022The Federal Reserve now owns $2.6 trillion in mortgages. That means about 24 percent of all outstanding residential mortgages in this whole big country reside in the central bank.

Original Article: “The Federal Reserve Keeps Buying Mortgages”

Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation. They will keep on rising at the annual rate of 14–16% for the rest of 2021, according to the AEI Housing Center.

Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and

The Federal Reserve Keeps Buying Mortgages

January 10, 2022Runaway house price inflation continues to characterize the U.S. market. House prices across the country rose 15.8% on average in October 2021 from the year before. U.S. house prices are far over their 2006 Bubble peak, and remain over the Bubble peak even after adjustment for consumer price inflation. They will keep on rising at the annual rate of 14–16% for the rest of 2021, according to the AEI Housing Center.

Unbelievably, in this situation the Federal Reserve keeps on buying mortgages. It buys a lot of them and continues to be the price-setting marginal buyer or Big Bid in the mortgage market, expanding its mortgage portfolio with one hand, and printing money with the other. It should have stopped before now, but the purchases, financed by newly created fiat

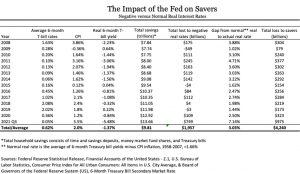

Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion

November 19, 2021With inflation running at over 6 percent and interest rates on savings near zero, the Federal Reserve is delivering a negative 6 percent real (inflation-adjusted) return on trillions of dollars in savings. This is effectively expropriating American savers’ nest eggs at the rate of 6 percent a year. It is not only a problem in 2021, however, but an ongoing monetary policy problem of long standing. The Fed has been delivering negative real returns on savings for more than a decade. It should be discussing with the legislature what it thinks about this outcome and its impacts on savers.

The effects of central bank monetary actions pervade society and transfer wealth among various groups of people—a political action. Monetary policies can cause consumer price