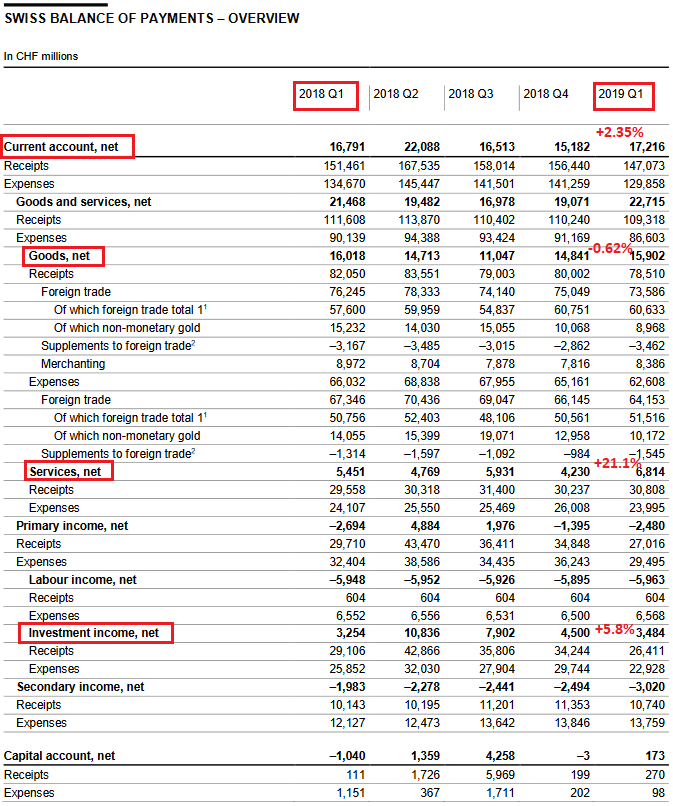

Current Account Key figures: Current Account: Up 2.35% against Q1/2018 to 17.2 bn. CHF of which Goods Trade Balance: Minust 0.62% against Q1/2018 to 15.9 bn. of which the Services Balance: Plus 21.1% to 6.8 bn. of which Investment Income: Plus 5.8% to 3.5 bn. CHF. Current Account Switzerland Q1 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge Financial account The following is from the official press release and gives more details on the other parts of the financial account. Net acquisition of financial assets The assets side of the financial account registered a total

Topics:

George Dorgan considers the following as important: 2) Swiss and European Macro, Current Account-Target2, Featured, newsletter, Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, Switzerland International Investment Position

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Current AccountKey figures:Current Account: Up 2.35% against Q1/2018 to 17.2 bn. CHF

|

Current Account Switzerland Q1 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

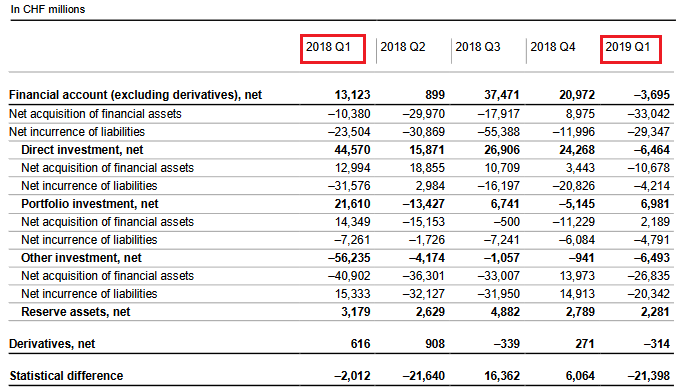

Financial accountThe following is from the official press release and gives more details on the other parts of the financial account.

|

Switzerland Financial Account, Q1 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q1 2019 Source: snb.ch - Click to enlarge |

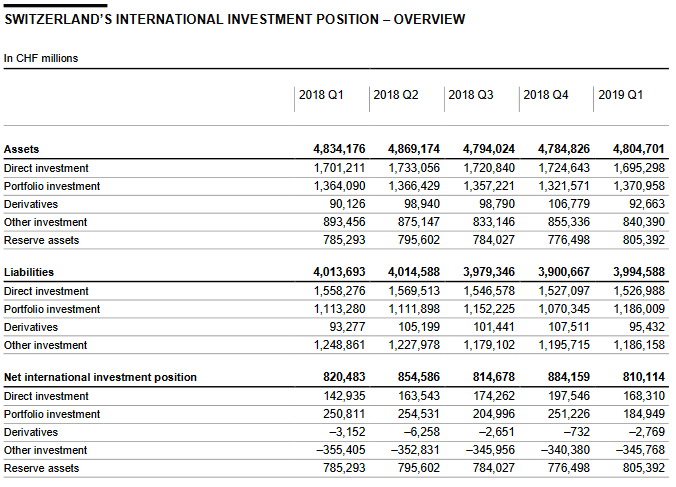

Switzerland’s International investment positionAssetsStocks of assets climbed by a total of CHF 20 billion to CHF 4,805 billion compared with the previous quarter, owing to a sharp increase in prices on foreign stock exchanges. Valuation gains were recorded in portfolio investment and reserve assets. Portfolio investment stocks increased by CHF 49 billion to CHF 1,371 billion. Reserve assets were up by CHF 29 billion to CHF 805 billion. By contrast, stocks in direct investment decreased by CHF 29 billion to CHF 1,695 billion. Stocks of other investment receded by CHF 15 billion to CHF 840 billion, and stocks of derivatives by CHF 14 billion to CHF 93 billion. LiabilitiesStocks of liabilities advanced by a total of CHF 94 billion to CHF 3,995 billion. As in the case of assets, this was mainly due to valuation gains as a result of the sharp increase in prices on the Swiss stock exchange. Portfolio investment accounted for all the valuation gains, which raised its stocks by CHF 116 billion to CHF 1,186 billion. Stocks in the other investment category fell by CHF 10 billion to CHF 1,186 billion, primarily as the result of transactions recorded in the financial account. Derivatives declined by CHF 12 billion to CHF 95 billion. Stocks of direct investment remained at a total of CHF 1,527 billion. Net international investment positionGiven that stocks of liabilities (up CHF 94 billion) showed a more pronounced increase than stocks of assets (up CHF 20 billion), the net international investment position fell by CHF 74 billion to CHF 810 billion. |

Switzerland International Investment Position, Q1 2019(see more posts on Switzerland International Investment Position, ) Switzerland International Investment Position - Q1 2019 Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position