The Federal Reserve’s inflation of the money supply and interest rate manipulation distort capital markets through, among other things, the creation of asset bubbles. As the cost of borrowing decreases and cheap money floods an economy, speculation in capital markets increases, leading to prices unmoored from fundamentals. Underlying these asset bubbles is a certain investor psychology—one based on expectations, encouraged by Fed actions over the last thirty-five years—that the Fed will always step in with easy money when asset prices threaten to decline. Overleveraged speculators caught out by rising interest rates and risky loans are experiencing significant distress. Meanwhile, the apartment market continues to demonstrate dangerously speculative behavior.

Topics:

Artis Shepherd considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Federal Reserve’s inflation of the money supply and interest rate manipulation distort capital markets through, among other things, the creation of asset bubbles. As the cost of borrowing decreases and cheap money floods an economy, speculation in capital markets increases, leading to prices unmoored from fundamentals.

Underlying these asset bubbles is a certain investor psychology—one based on expectations, encouraged by Fed actions over the last thirty-five years—that the Fed will always step in with easy money when asset prices threaten to decline.

Overleveraged speculators caught out by rising interest rates and risky loans are experiencing significant distress. Meanwhile, the apartment market continues to demonstrate dangerously speculative behavior.

Higher Risk, Lower Return

A recent manifestation of Fed-induced speculation in the apartment market is widespread negative leverage, a condition that occurs when buyers of income-producing properties earn a rate of return lower than the interest rate on their loan. This dynamic means that the loan used to acquire the property is dragging down, rather than boosting, the profitability of the investment. At its worst, negative leverage leads to an inability to service debt and subsequently to foreclosure, wiping out investor capital.

Negative leverage is not always unacceptable. There may be instances where the initial return on an investment is temporarily below the cost of debt for known, isolated reasons. Those factors can resolve quickly to put the investor back in the black. However, the negative leverage seen in the apartment market today is systemic and ubiquitous.

According to a Wall Street Journal article written in May 2022, “negative leverage hasn’t been this widespread since the subprime crisis when defaults on apartment-building debt soared.”

Interest rates have increased since that article was written, exacerbating conditions further.

To justify continued acquisitions despite this phenomenon, apartment speculators will likely point to increasing rents as their way to bridge the gap and fix negative leverage within a short time frame. However, rents have already increased substantially in recent years, and the average American renter is struggling to keep up. Moreover, apartment expenses—led by insurance—are increasing at a more rapid pace than rents, further depressing net operating income and the ability to service debt.

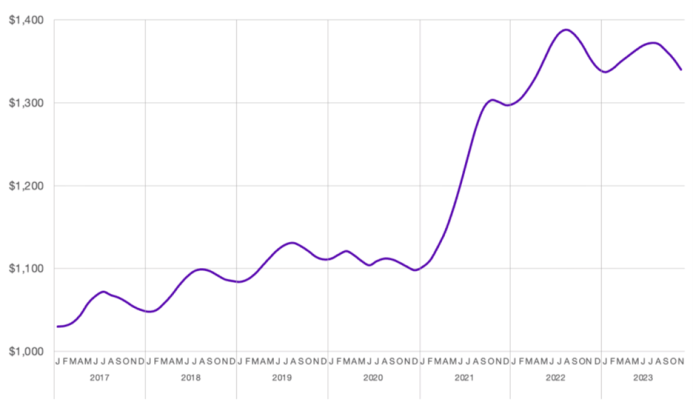

Figure 1: United States median rent (2017–present)

Source: Data from “Data and Rent Estimates,” Apartment List, accessed January 3, 2024, https://www.apartmentlist.com/research/category/data-rent-estimates.

Solutio Ex Civitate

The other justification for continued negative leverage is, of course, the expectation of a new round of interest rate cuts from the Fed. Speculators anticipating this outcome expect to keep burning their cash until rates drop substantially, then refinancing their loans at those lower rates. However, another round of rate cuts implies a slowing economy, weaker property performance, and a reinflation of the largest asset bubble we’ve ever seen, ultimately leading to a higher Consumer Price Index down the road, which will compel the Fed to make yet more drastic rate increases and will put gamblers in the apartment market still deeper underwater.

Stein’s law states that if something can’t go on forever, it will eventually stop. With over $1.8 trillion in outstanding mortgage debt backed by apartments, systemic negative leverage is a potentially lethal hazard that can’t go on forever. In the meantime, as markets are unable to function freely and correct excesses through rational investor behavior, speculation runs amok.

Tags: Featured,newsletter