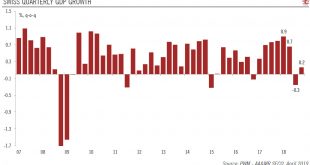

Growth and price rises should moderate in 2019. The Swiss economy posted impressive GDP growth in 2018, although there was significant divergence between strong growth in the first half and stagnation in the second. Overall, we expect Swiss GDP to expand by 1.3% in 2019, down substantially from 2.5% in 2018. Risks to our growth outlook for Switzerland are tilted to the downside. Looking ahead, we expect the Swiss...

Read More »Limited room for Swiss franc depreciation

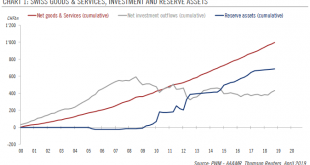

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings. The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest...

Read More »Getting ready for tiering

ECB officials have hinted at policy measures aimed at reducing the cost of negative rates for the banking sector, including a tiered system of bank reserves. Although back in 2016 the European Central Bank (ECB) ruled out tiering of bank reserves to mitigate the side effects of negative rates, the situation has since changed, and it could be implemented eventually if policy rates were to remain negative into 2020....

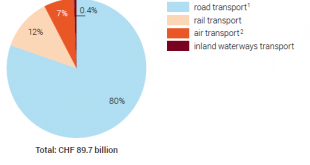

Read More »Transport costs have increased by 4 percent within five years

08.04.2019 – In 2015, transport in Switzerland generated economic costs of around CHF 90 billion. This was 4% more than in 2010. Aviation (+14%) and rail transport (+12%) recorded the largest increases. In comparison, costs for motorised road transport remained rather stable (+2%) and accounted for four fifths of the total transport costs. None of the various transport user groups fully funded the generated costs...

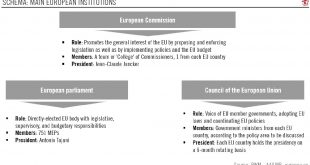

Read More »Q&A on European Parliament elections

European Parliament elections, to be held between 23 and 26 of May, will be a key political event in Europe. However, we expect limited short-term impact, given the European Parliament’s limited ability to set Brussels’ agenda. European Parliament (EP) elections will be a key political event in Europe, a form of ‘midterm election’ in which the electorates can state their approval or disapproval of their...

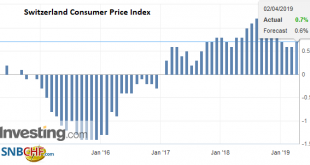

Read More »Swiss Consumer Price Index in March 2019: +0.7 percent YoY, +0.5 percent MoM

02.04.2019 – The consumer price index (CPI) increased by 0.5% in March 2019 compared with the previous month, reaching 102.2 points (December 2015 = 100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.5% increase compared with the previous month can be explained by several factors including rising prices for international...

Read More »Swiss Retail Sales, February 2019: -0.2 percent Nominal and +0.3 percent Real

01.04.2019 – Turnover in the retail sector fell by 0.2% in nominal terms in February 2019 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.2% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.2% in February 2019 compared with the previous year....

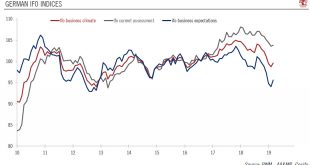

Read More »Germany: signs of rebound ?

German growth may remain subdued in H1 2019, before picking up somewhat in H2 2019 as some near-term risks dissipate. Germany’s leading indicator, the Ifo index, rose in March, driven by an increase in both sub-components: current assessment and expectations. The Ifo index differs in make-up from Markit’s purchasing manager indexes, but at the sector level, the story is the same: the more domestically driven services...

Read More »Swiss Trade Balance February 2019: New Peak of Exports

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

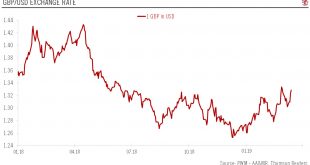

Read More »Brexit update: UK parliament opts for an extension

After an eventful week in parliament, the Brexit ball is set to keep rolling as MPs move to extend the 29 March deadline. The British Parliament concluded a series of votes on Brexit this week with an intention to extend the 29 March Brexit deadline. What remains unclear at this point is whether the UK will seek a short (two months) or a longer extension (two years). It is also not clear what this extension would be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org