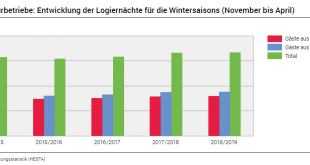

05.06.2019 – The hotel industry in Switzerland recorded 16.7 million overnight stays during the winter tourist season (November 2018 to April 2019), i.e. the best result since the winter season of 2007/2008. Compared with the same period last year this represents an increase of 0.7% (+117 000). With 8.8 million overnight stays, foreign demand rose by 1.0% (+83 000). Domestic visitors registered a slight increase of 0.4%...

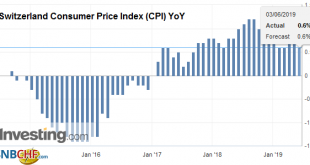

Read More »Swiss Consumer Price Index in May 2019: +0.6 percent YoY, +0.3 percent MoM

03.06.2019 – The consumer price index (CPI) increased by 0.3% in May 2019 compared with the previous month, reaching 102.7 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.3% increase compared with the previous month can be explained by several factors including rising prices for fuel and for...

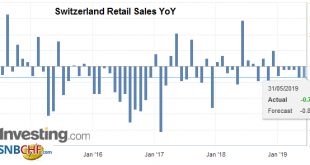

Read More »Swiss Retail Sales, April 2019: -0.1 percent Nominal and -0.7 percent Real

31.05.2019 – Turnover in the retail sector fell by 0.1% in nominal terms in April 2019 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.7% in April 2019 compared with the previous year. Real...

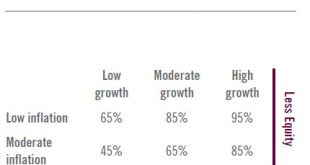

Read More »Avenues worth exploring in strategic asset allocation

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic...

Read More »Switzerland GDP Q1 2019: +0.6 percent QoQ, +1.7 percent YoY

Switzerland’s GDP rose by 0.6% in the 1st quarter of 2019. Growth was driven primarily by increasing domestic demand. Foreign trade also provided positive impetus. Value added grew in most sectors. Switzerland Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on Switzerland Gross Domestic Product, ) Source: investing.com - Click to enlarge Switzerland’s GDP rose by 0.6% in the 1st quarter of 2019, after...

Read More »European elections – a more diverse but still pro-Europe parliament

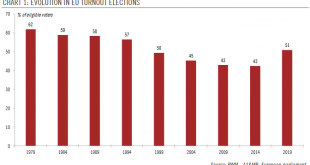

Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged. Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered...

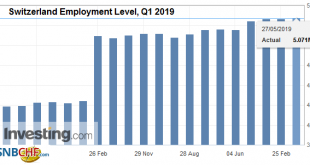

Read More »Employment Barometer in the Q1 2019: Positive employment situation

27.05.2019 – In the 1st quarter 2019, total employment (number of jobs) rose by 1.3% in comparison with the same quarter a year earlier (+0.5% with previous quarter). In full-time equivalents, employment in the same period rose by 1.5%. The Swiss economy counted 6700 more vacancies than in the corresponding quarter of the previous year (+9.4%) with the employment outlook indicator showing a downward trend (–0.1%). These...

Read More »Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected. A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this...

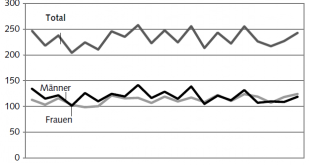

Read More »Swiss Labour Force Survey in 1st quarter 2019: 0.8percent increase in number of employed persons; unemployment rate based on ILO definition at 4.9percent

16.05.2019 – The number of employed persons in Switzerland rose by 0.8% between the 1st quarter 2018 and the 1st quarter 2019. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined from 5.2% to 4.9%. The EU’s unemployment rate decreased from 7.4% to 6.8%. These are some of the results from the Swiss Labour Force Survey (SLFS). Download press release: 1st...

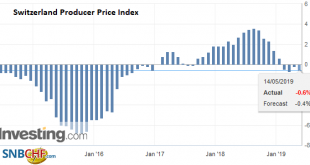

Read More »Swiss Producer and Import Price Index in April 2019: -0.6 percent YoY, unchanged MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org