Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC: The job market looks solid on paper. According to government data, U.S. employers added 2.7 million people to their payrolls in 2023. Unemployment hit a 54-year low of 3.4% in January 2023 and ticked up just slightly to 3.7% by December. But active job seekers say the labor market feels more difficult than ever. A 2023 survey from staffing agency Insight Global found that recently unemployed

Topics:

Lance Roberts considers the following as important: 9) Personal Investment, 9a.) Real Investment Advice, Bear Market, earnings, Economics, economy, Featured, Federal Reserve, financial markets, Financial Planning, Interest rates, Investing, newsletter, Recession, retirement income, S&P 500, S&P 500, stocks, valuations

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC:

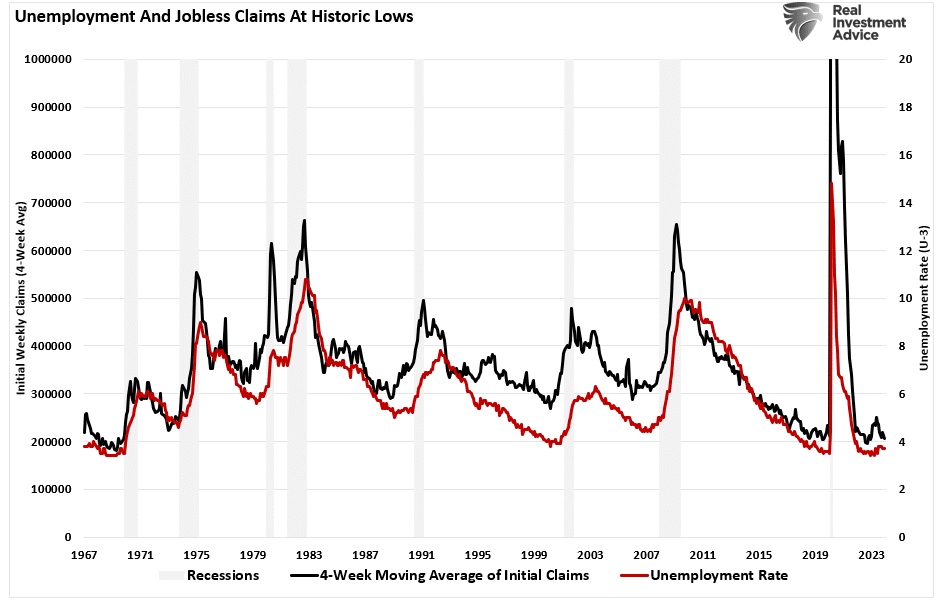

The job market looks solid on paper. According to government data, U.S. employers added 2.7 million people to their payrolls in 2023. Unemployment hit a 54-year low of 3.4% in January 2023 and ticked up just slightly to 3.7% by December.

But active job seekers say the labor market feels more difficult than ever. A 2023 survey from staffing agency Insight Global found that recently unemployed full-time workers had applied to an average of 30 jobs only to receive an average of four callbacks or responses.”

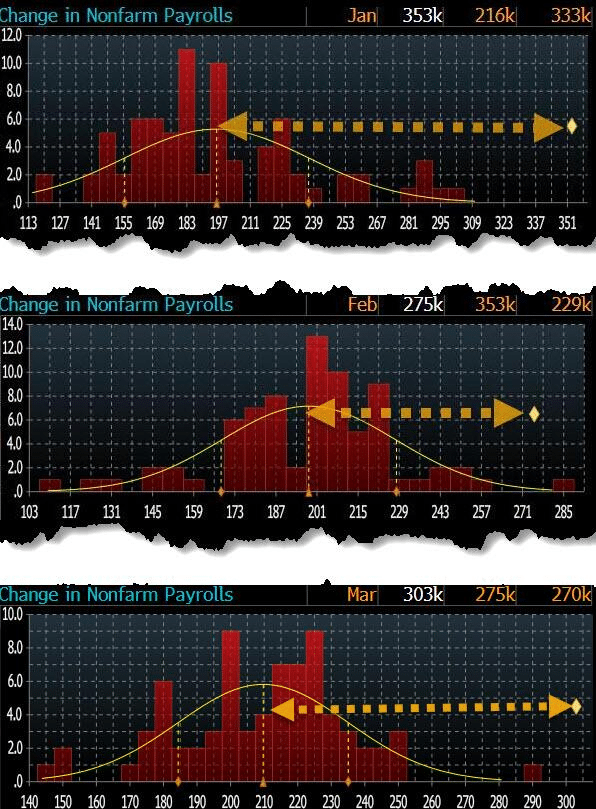

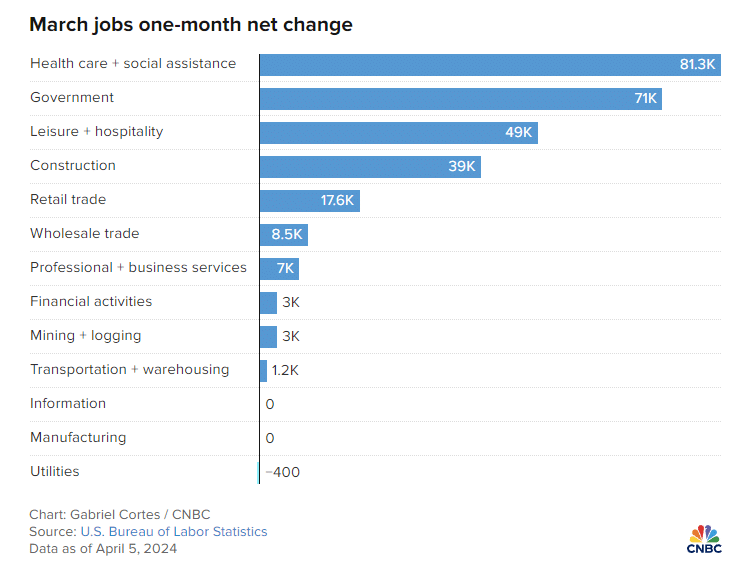

These stories are not unique. If you Google “Can’t find a job,” you will get many article links. Yet employment reports have been exceedingly strong for the past several months. In March, the U.S. economy added 303,000 jobs, exceeding every economist’s estimate by four standard deviations. In terms of statistics, a single four-standard deviation event should be rare. Three months in a row is a near statistical impossibility.

Despite weakness in manufacturing and services, with many companies recently announcing layoffs, we have near-record-low jobless claims and employment. According to official government data, the economy has rarely been more robust.

Such a situation begs an obvious question: How are college graduates struggling to find employment while the labor market remains so strong?

We may find the answer in immigration.

Immigrations Impact By The Numbers

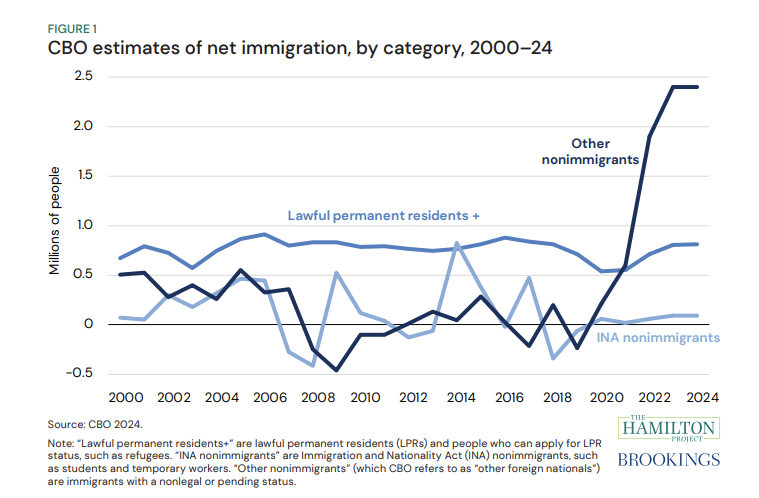

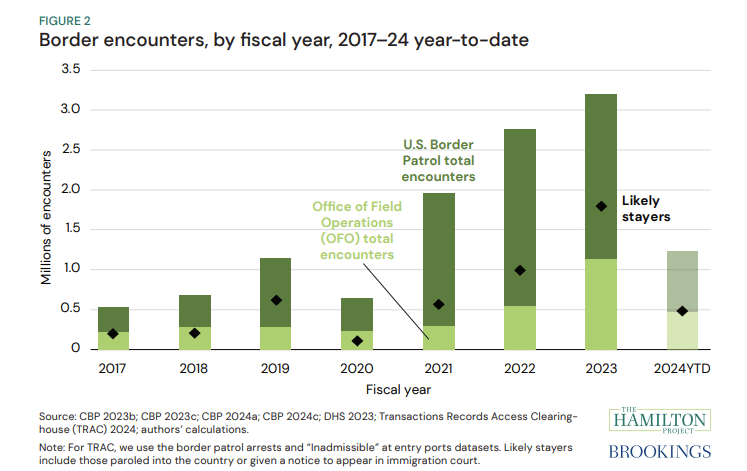

A recent study by Wendy Edelberg and Tara Watson at the Brookings Institution found that illegal immigrants in the country helped boost the labor market, steering the economy from a downturn. Data from the Congressional Budget Office shows a massive uptick of 2.4 million “other immigrants” who don’t fall into the category of lawful immigrants or those on temporary visas. The chart below shows how this figure has spiked from a level of less than 500,000 at the beginning of the 2020s.

The most significant change relative to the past stems from CBO’s other non-immigrant category, which includes immigrants with a nonlegal or pending status.

“We indicate our estimates of ‘likely stayers’ by diamonds in Figure 2. In FY 2023, almost a million people encountered at the border were given a ‘notice to appear,’ meaning they have permission to petition a court for asylum or other immigration relief. Most of these individuals are waiting in the U.S. for the asylum court queue, which has over a million case backlog. In addition, over 800,000 have been granted humanitarian parole (mostly immigrants from Ukraine, Haiti, Cuba, Nicaragua, and Venezuela). These 1.8 million ‘likely stayers’ in FY 2023 may or may not remain in the U.S. permanently, but most are currently living in the U.S. and participating in the economy. CBO estimates that there were 2 million such entries over the calendar year 2023, which is consistent with higher encounters at the end of the calendar year.”

According to the CBO’s estimates for 2023, the categories of lawful permanent resident migration, INA non-immigrant, and other non-immigrant equated to 3.3 million net entries. However, the number is likely much higher than estimates, subject to uncertainty about unencountered border crossings, visa overstays, and “got-aways.”

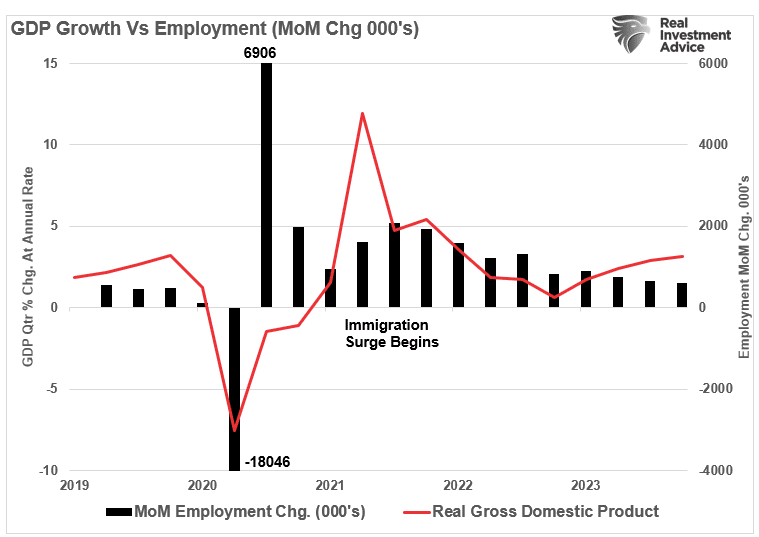

As such, this influx of immigrants has significantly added to payroll growth and has accounted for the uptick in economic growth starting in 2022. While the uptick in border encounters began in earnest in 2021, as the current Administration repealed previous border security actions, there is a “lag effect” of immigration on economic growth.

However, not all jobs are created equal.

Immigration’s Impact On Job Availability

Since 1980, the U.S. economy has shifted from a manufacturing-based economy to a service-oriented one. The reason is that the “cost of labor” in the U.S. to manufacture goods is too high. Domestic workers want high wages, benefits, paid vacations, personal time off, etc. On top of that are the numerous regulations on businesses from OSHA to Sarbanes-Oxley, FDA, EPA, and many others. All those additional costs are a factor in producing goods or services. Therefore, corporations must offshore production to countries with lower labor costs and higher production rates to manufacture goods competitively.

In other words, for U.S. consumers to “afford” the latest flat-screen television, iPhone, or computer, manufacturers must “export” inflation (the cost of labor and production) to import “deflation” (cheaper goods.) There is no better example of this than a previous interview with Greg Hays of Carrier Industries. Following the 2016 election, President Trump pushed for reshoring U.S. manufacturing. Carrier Industries was one of the first to respond. Mr. Hays discussed the reasoning for moving a plant from Mexico to Indiana.

“So what’s good about Mexico? We have a very talented workforce in Mexico. Wages are obviously significantly lower. About 80% lower on average. But absenteeism runs about 1%. Turnover runs about 2%. Very, very dedicated workforce. Which is much higher versus America. And I think that’s just part of these — the jobs, again, are not jobs on an assembly line that [Americans] really find all that attractive over the long term.“

The need to lower costs by finding cheaper and plentiful sources of labor continues. While employment continues to increase, the bulk of the jobs created are in areas with lower wages and skill requirements.

As noted by CNBC:

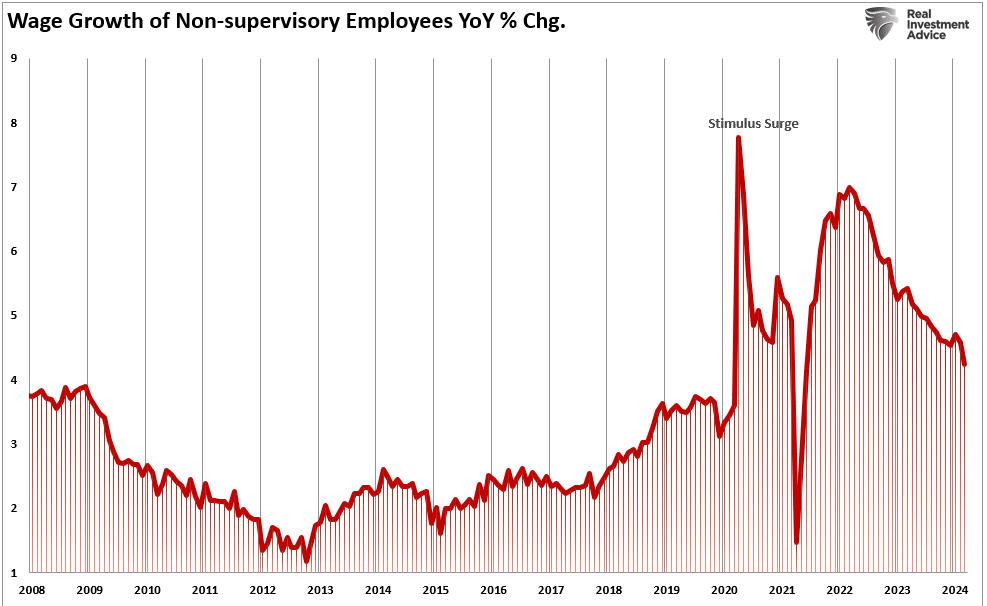

“The continued rebound of these jobs, along with strong months for sectors like construction, could be a sign that immigration is helping the labor market grow without putting too much upward pressure on wages.”

This is a crucial point. If there is strong employment growth, wages should increase commensurately as the demand for labor increases. However, that isn’t happening, as the cost of labor is suppressed by hiring workers willing to work for less compensation. In other words, the increase in illegal immigrants is lowering the “average” wage for Americans.

Nonetheless, in the last year, 50% of the labor force growth came from net immigration. The U.S. added 5.2 million jobs last year, which boosted economic growth without sparking inflationary pressures.

While immigration has positively impacted economic growth and disinflation, this story has a dark side.

The Profit Motive

In a previous article, I discussed an interview by Fed Chair Jerome Powell discussing immigration during a 60-Minutes Interview. To wit:

“SCOTT PELLEY: Why was immigration important?

FED CHAIR POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans. But that’s primarily because of the age difference. They tend to skew younger.“

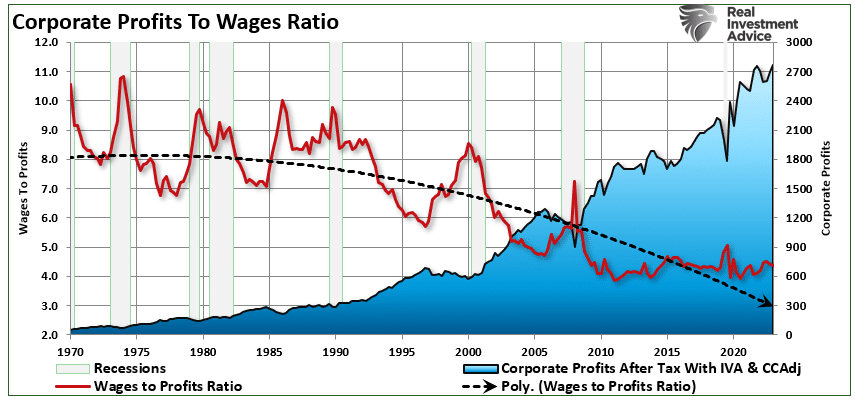

You should read that comment again carefully. As noted by Greg Hayes, immigrants tend to work harder and for less compensation than non-immigrants. That suppression of wages and increased productivity, which reduces the amount of required labor, boosts corporate profitability.

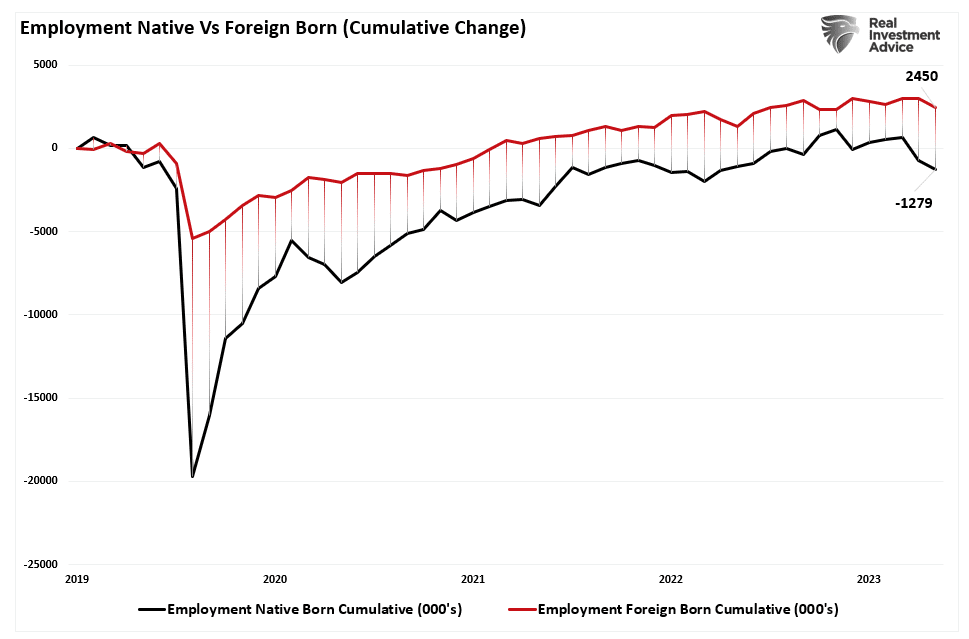

The move to hire cheaper labor should be unsurprising. Following the pandemic-related shutdown, corporations faced multiple threats to profitability from supply constraints, a shift to increased services, and a lack of labor. At the same time, mass immigration (both legal and illegal) provided a workforce willing to fill lower-wage paying jobs and work regardless of the shutdown. Since 2019, the cumulative employment change has favored foreign-born workers, who have gained almost 2.5 million jobs, while native-born workers have lost 1.3 million. Unsurprisingly, foreign-born workers also lost far fewer jobs during the pandemic shutdown.

Given that the bulk of employment continues to be in lower-wage paying service jobs (i.e., restaurants, retail, leisure, and hospitality) such is why part-time jobs have dominated full-time in recent reports. Since last year, part-time jobs have risen by 1.8 million while full-time employment has declined by 1.35 million.

Not dismissing the implications of the shift to part-time employment is crucial.

Personal consumption, what you and I spend daily, drives nearly 70% of economic growth in the U.S. Therefore, Americans require full-time employment to consume at an economically sustainable rate. Full-time jobs provide higher wages, benefits, and health insurance to support a family, whereas part-time jobs do not.

Notably, given the surge in immigration into the U.S. over the last few years, the all-important ratio of full-time employees relative to the population has dropped sharply. As noted, given that full-time employment provides the resources for excess consumption, that ratio should increase for the economy to continue growing strongly.

However, the reality is that the full-time employment rate is falling sharply. Historically, when the annual rate of change in full-time employment dropped below zero, the economy entered a recession.

While there is much debate over immigration, most of the arguments do not differentiate between legal and illegal immigration. There are certainly arguments that can be made on both sides. However, what is less debatable is the impact that immigration is having on employment and wages. Of course, as native-born workers continue to demand higher wages, benefits, and other tax-funded support, those costs must be passed on by the companies creating those products and services. At the same time, consumers are demanding lower prices.

That imbalance between input costs and selling price drives companies to aggressively seek options to reduce the highest cost to any business – labor.

Such is why full-time employment has declined since 2000 despite the surge in the Internet economy, robotics, and artificial intelligence. It is also why wage growth fails to grow fast enough to sustain the cost of living for the average American. These technological developments increased employee productivity, reducing the need for additional labor.

Unfortunately, college graduates expecting high-paying jobs will likely continue to find it increasingly frustrating. Such is particularly the case as “Artificial Intelligence” gains traction and displaces “white collar” work, further squeezing the demand for “native-born” workers.

The post Immigration And Its Impact On Employment appeared first on RIA.

Tags: Bear Market,earnings,Economics,economy,Featured,Federal Reserve,Financial markets,Financial Planning,Interest rates,Investing,newsletter,recession,retirement income,S&P 500,stocks,valuations