Some of around 600 cows climb the Glattalp last year, watched by spectators (Keystone) The traditional driving of cows up to mountain pastures for the summer will still take place this year in Appenzell, northeastern Switzerland, despite the coronavirus pandemic. However, the processions will not be publicised so as not to attract tourists and spectators. From the beginning of May to mid-June, farmers march hundreds of thousands of cows from their valley farms to...

Read More »Coronavirus: Swiss schools and other establishments set to reopen

© Jan Gajdosik | Dreamstime.com On 29 April 2020, Switzerland’s government announced plans to allow schools and other establishments to reopen on Monday 11 May 2020. From 11 May 2020, shops, restaurants, markets, museums, libraries, primary and lower secondary schools and sports training centres will be allowed to reopen. In addition, public transport will operate according to the standard timetable, announced the government. The easing is conditional on the...

Read More »GDP + GFC = Fragile

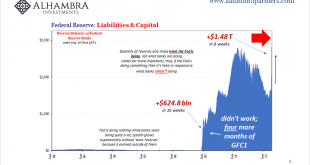

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation. It wasn’t until the middle of March that the first major shutdown orders began to appear – on Twitter feeds – and these weren’t the total lockdowns...

Read More »THE BITCOIN HALVING REVISITED – With Ann Rhefn

What is the Bitcoin Halving and What Might it Mean for the Price Watch “THE BITCOIN HALVING REVISITED – With Ann Rhefn” [embedded content] You Might Also Like Das Internet – die dezentrale (R)Evolution Menschen werden durch unterschiedliche Motive angetrieben. Die einen sehen das höchste Glück in der Ansammlung von materiellen Werten, und andere sind von geistigen Werten angetrieben. Eine Idee kann genauso...

Read More »COT Black: No Love For Super-Secret Models

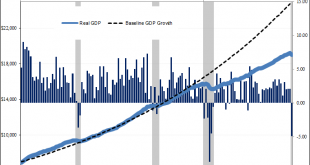

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust. Because of this set of numbers, officials here as well as elsewhere around the world chose the most extreme form of pandemic mitigations, trusting...

Read More »FX Daily, April 30: ECB Takes Center Stage

Swiss Franc The Euro has fallen by 0.38% to 1.0545 EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest...

Read More »Swiss Retail Sales, March 2020: -6.2 percent Nominal and -5.6 percent Real

30.04.2020 – Turnover adjusted for sales days and holidays fell in the retail sector by 6.2% in nominal terms in March 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 6.0% compared with the previous month. Following the COVID-19 pandemic, turnover slumped markedly in some sectors. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays fell in the retail sector...

Read More »Unbounded Conversations Episode 7 – Jeffrey Snider

Alhambra Investments CIO Jeffrey Snider joins Zach & Jack for the seventh installment of Unbounded Conversations to discuss shadow money and its effects on the global economy. The Unbounded Conversations video series features discussions between Unbounded Managing Partner Zach Resnick, Partners Dave Mullen-Muhr & Jack Laskey, & various guests building businesses on Bitcoin. In this series they discuss the possibilities of what Bitcoin can accomplish at scale, the metanet (the...

Read More »Recognition for our report from the Swiss mountains

Thanks to technology, journalist Sibilla Bondolfi was able to work in the region that she was researching: the Alps. (swissinfo.ch) A longform report that we published last autumn has been shortlisted for the Swiss Press Award. The nomination is an honour for our team. Can people in Switzerland really live and work wherever they want on account of the digital revolution? Even in the mountains? A longform multimedia report by SWI swissinfo.ch has the answer. Published...

Read More »Swiss GDP set for worst fall in decades

© Marekusz | Dreamstime.com A team of economic experts working for the Swiss government forecasts a 6.7% fall in GDP and unemployment to rise to 3.9% in Switzerland in 2020. If these predictions prove right, it will be the biggest slump in economic activity since 1975. The Covid-19 outbreak has forced many companies in hospitality, retail, culture and leisure to restrict or completely suspend their business activities, triggering an abrupt fall in output and private...

Read More » SNB & CHF

SNB & CHF