Medicare for All is listed as the top priority of Democratic presidential candidate Bernie Sanders. He describes it as a single-payer system that is “free at the point of service” as there will be no premiums, deductibles, copays, or surprise bills. It will cover more services (dental, hearing, vision, long-term care, substance abuse treatment, etc.) than what the present Medicare system covers. It will also stop the “pharmaceutical industry from ripping off the American people” by capping prescription drug prices. Medicare for All sounds wonderful until you get into the economic weeds of it. To understand how Medicare for All is not the utopia it is being sold as, we must first analyze its antithesis, which is modeled below. The state in this model is an

Topics:

Hal Snarr considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Medicare for All is listed as the top priority of Democratic presidential candidate Bernie Sanders. He describes it as a single-payer system that is “free at the point of service” as there will be no premiums, deductibles, copays, or surprise bills. It will cover more services (dental, hearing, vision, long-term care, substance abuse treatment, etc.) than what the present Medicare system covers. It will also stop the “pharmaceutical industry from ripping off the American people” by capping prescription drug prices.

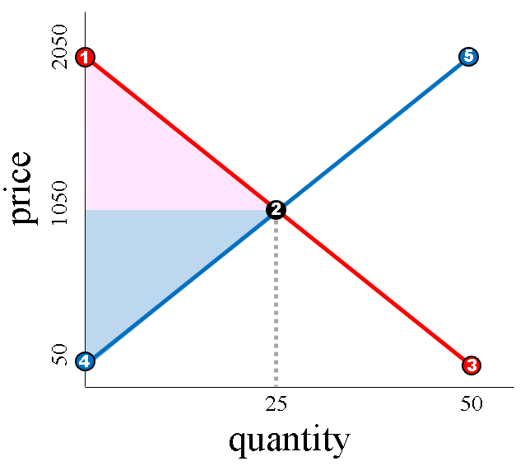

Medicare for All sounds wonderful until you get into the economic weeds of it. To understand how Medicare for All is not the utopia it is being sold as, we must first analyze its antithesis, which is modeled below. The state in this model is an observer. It is not a manager, owner, subsidizer, regulator, or licenser of healthcare products or services. Here the exchanges between providers and patients are voluntary and result in twenty-five procedures that cost $1050 each. |

|

| Supply and Demand for Medical Procedures-Free Market

The red line is the demand for medical procedures. The height of point 1 is the price that the richest patient is able to pay, $2,050. Point 2 is the price that a person of average income is willing to pay, $1,050, and point 3 is the price that the poorest patient is able to pay, $50. Thus, demand represents a queue that sorts patients by their ability to pay, from $2,050 on the left to $50 on the right. The blue line is the supply of medical procedures. Since some doctors have more skill and experience than others and since doctors work in hospitals and offices with a variety of equipment and assistance from nurses and physician’s assistants, the line represents a queue that sorts the cost of providing the procedure from the lowest cost of delivery (at point 4) to the highest (at point 5). The market price of medical procedures is determined when demand meets supply, which happens at point 2. |

The price here is $1,050. Patient 1 is happy to pay it because he is willing to pay up to $2,050 (point 1) for a procedure. The service provider is happy to receive this price because she would have performed the procedure for as little as $50 (point 4). All 25 patients feel this way because they are willing to pay more than the market price, and the pink triangle measures these great feelings. The transactions also give service providers good feelings because they would have performed the procedures for less than the market price, and the blue triangle measures these good feelings.

The above argument is the efficiency argument that neoclassicists and advocates of free markets make. It, however, results in twenty-five patients being priced out of the medical procedure market. They populate the demand curve between points 2 and 3. During high school, my mom was one of them. Being a single mother, she had no means to pay for surgery on my nose, which I had broken when an infielder and I collided going after a flyball in ninth grade PE. (I made the catch.) Fortunately for my mom, the hospital, which was run by the Catholic Church, waived the cost of the surgery. Priced-out patients must either find hospitals willing to waive fees or forgo needed medical procedures.

Politicians such as Sanders cite the above market failure in their equity arguments for intervening in the healthcare industry. Their proposals include subsidizing, managing, regulating, or running hospitals and health insurance companies, or mandating that premiums be equalized across age and demographics, that medical procedures be covered by insurance, or that firms provide workers with insurance. Whether politicians propose these policies for just reasons or to fish for votes, their interventions if adopted will distort markets and produce unintended consequences.

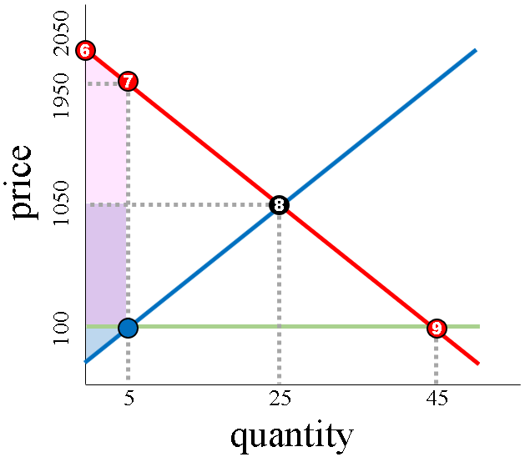

The Effect of Price Caps

The figure below shows what happens when the government caps the price of medical procedures, which is modeled by the green line. In the absence of any other government intervention, the $100 price cap induces rationing. At that artificially low price, 45 people want the procedures (point 9) but only 5 are performed (the blue point). Kate and Nate, world travelers who post videos of their experiences on YouTube, observed this while filming their trip to Cuba. In the posted video, they were surprised to learn that brain surgeons prefer driving cabs to performing surgery because doctors earn less than $100 a month in Cuba, which is due, by the way, to the Cuban government’s caps on doctors’ salaries.

Supply and Demand for Medical Procedures-Distorted Market

Assuming no other government interventions, the price cap has other unintended consequences. With the upper-class populating demand between points 6 and 7, the middle-class populating demand between 7 and 8, and the poor populating it between 8 and 9, only the upper class has access to healthcare after the cap is imposed. This is so because they, relative to the others, are willing to pay much more for the now rationed healthcare. The price cap also increases their spoils from trade from the light purple area to the light and dark purple areas. It has eliminated access to healthcare for those in the middle class. Though it was intended to help the poor gain access to healthcare, they end up not having access to it either before or after caps are set.

The solution to unintended price cap consequences is to restore economic freedom. That decision is rare. Though there are some examples of it in history, such as the one that resulted in the Chilean Miracle, governments tend to double down. They adopt layers of intervention to fix the layers of unintended consequences from the layers of previous intervention. This was F.A. Hayek’s thesis in The Road to Serfdom.

If the government does not lift the price cap, it has to devise policies to increase access to healthcare for those who have lost it (the middle class) and to those who never had it (the poor). Private providers are not supplying the forty-five needed procedures at point 9 because producing more than 5 at the blue point would result in some providers accruing economic losses. Instead of taking on these losses, some providers do something else, such as drive cabs or give guided tours in Cuba. To increase supply to point 9, the government can subsidize or nationalize the healthcare industry. Neither of these, however, suspend the laws of economics. The economics losses still accrue and have to be paid for. Raising taxes and money printing are two ways that governments can paper over such losses. Sanders’s rivals support subsidies and higher taxes. His plan includes both of those, plus nationalization and money printing.

Given how united economists, from one end of the political spectrum to the other, are on apartment rental rate caps, it is surprising that so many are so open to healthcare price caps. The taxation that will be needed to finance Medicare for All will reduce the dividends that we shareholders receive, the retained earnings that firms use to replenish their physical capital (office buildings, IT, factories, machines, etc.), the value of our retirement accounts, and the prices of individual stocks we own. The accumulative effect of all of this will slow or retard our productive capacity and incomes. Medicare for All is not a road to utopia. It is an expressway to serfdom.

Tags: Featured,newsletter