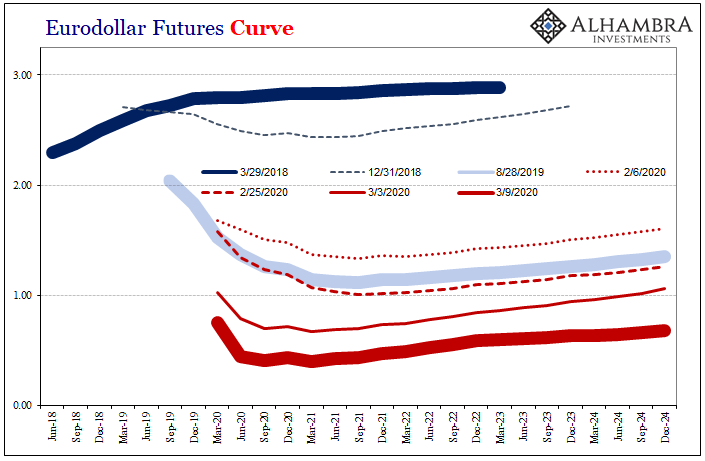

The eurodollar curve’s latest twist exposes what’s behind the long end. To recap: big down day in stocks which, for the first time in a while, wasn’t accompanied by massive buying in longer maturity UST’s. Instead, these were sold, too. Rumors of parity funds liquidating were all over the place, which is consistent with this curve behavior. Let’s start with eurodollar futures; the curve had absolutely collapsed up to Monday. It was remarkable even though not unexpected. We haven’t seen this kind of behavior since 2009 (I’m not making any comparisons, just noting the abnormality). Eurodollar Futures Curve, 2018-2024 - Click to enlarge For those who don’t just blindly swallow Jay Powell’s message and cling still to the concept of the BOND ROUT!!!!, there’s

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bond yields, bonds, credit spreads, currencies, economy, eurodollar curve, eurodollar futures, Featured, Federal Reserve/Monetary Policy, Interest rates, Markets, money curve, newsletter, Repo, repo collateral, Securities Lending, stocks, U.S. Treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

The eurodollar curve’s latest twist exposes what’s behind the long end. To recap: big down day in stocks which, for the first time in a while, wasn’t accompanied by massive buying in longer maturity UST’s. Instead, these were sold, too. Rumors of parity funds liquidating were all over the place, which is consistent with this curve behavior. Let’s start with eurodollar futures; the curve had absolutely collapsed up to Monday. It was remarkable even though not unexpected. We haven’t seen this kind of behavior since 2009 (I’m not making any comparisons, just noting the abnormality). |

Eurodollar Futures Curve, 2018-2024 |

| For those who don’t just blindly swallow Jay Powell’s message and cling still to the concept of the BOND ROUT!!!!, there’s been a ton of money made in these places. Along with eurodollar futures obviously US Treasuries, too, since these markets often trade in tandem.

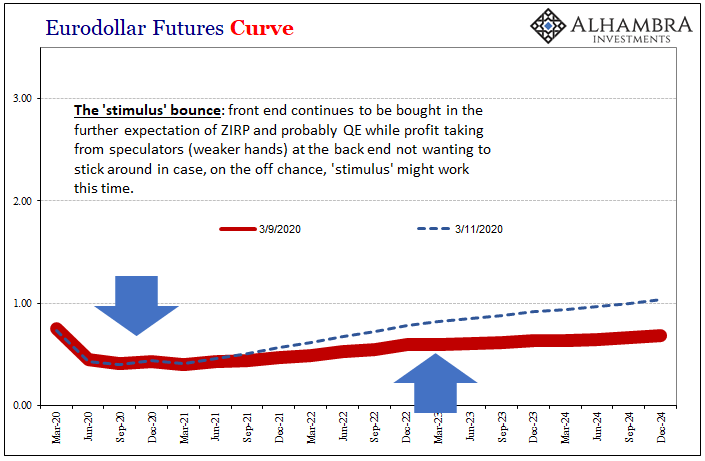

As they did today (and a bit yesterday): The front end of the eurodollar curve was bought while the back end sold – and, interestingly, the bottom of the inverted “smile” has moved way up from where it had been most of the past almost two years since inversion showed up back in June 2018. The curve’s bottom in today’s trading, more and more over the past few weeks, is around the September 2020 contract instead of the more distant 2021’s. Not long ago, in the middle of Powell’s economic turnaround fantasy, the smile finished off toward next year’s end dated contracts, the September and December 2021’s. It’s moved way up since late February. |

Eurodollar Futures Curve, 2020-2024 |

| What that suggests is the market is growing confident about at least one thing: renewed ZIRP.

Not only is it being more and more priced in, the market’s expectation for when that happens is getting earlier all the time. The “it” behind everything over the last few years looms ever closer. The reluctant Fed going back to ZIRP will almost surely include some form of officially sanctioned QE; rather than the pretend not-QE of the last six months. In reality, there isn’t a lick of difference between them. Nor is there when, inevitably, the FOMC announces that as part of the next QE, QE6 by my count, the Open Market Desk will be directed to purchase ETF’s along with other forms of debt – no longer strictly UST’s or MBS. Always expectations policy, therefore more emphasis on “shock” than being technically, monetarily proficient (this really explains everything). As we’ve fastidiously documented of the Japanese experience, it doesn’t really matter what they buy or how much because the end result is public balance sheet expansion rather than private money dealer balance sheet expansion in the aggregate. It’s all the same puppet show. However, since it may seem somewhat different and could theoretically enhance QE6’s chances, some who have made their bank already buying in long eurodollar futures and UST’s are locking in their gains, any excuse to sell – including, potentially, risk parity funds who may be selling what has worked for, ironically, a growing lack of liquidity. In any event, the long end in both curves has been twisted in the short run “stimulus” manner. Buying at the front to represent the coming monetary policy moves, and some selling at the back of what would be exposed to a brief Jay Powell “bazooka” at least for the time being until the market gets a sense of if this thing is over. That’s really the big question. And it’s one that has been continuously asked since November 8, 2018; when global rates began their descent. |

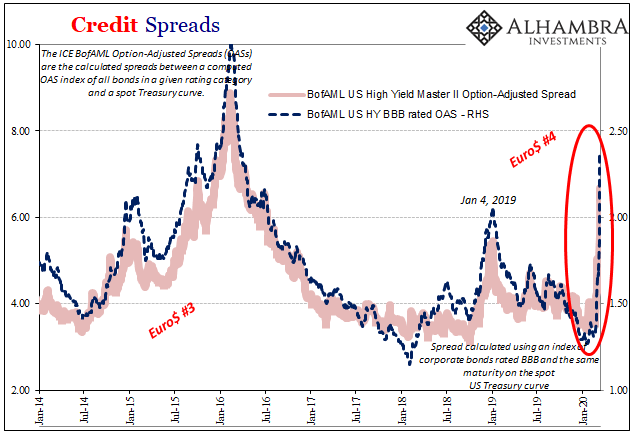

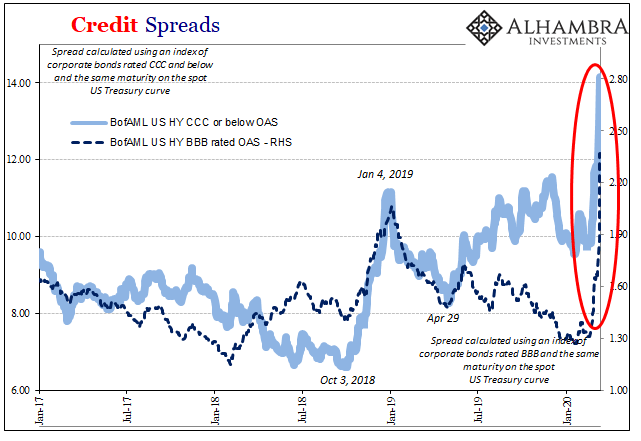

Credit Spreads, 2014-2020 |

| Each time it is pondered it usually coincides with some grand Fed gesture; recall early January 2019 when UST yields troughed and eurodollar futures prices peaked on what were then only rumors and whispers of a Fed “pause.” Though it is quaint by today’s standards, back then, we were told, it was a big deal!

Only it wasn’t. Next came the midpoint and rate cuts, even some QE in Europe. That lasted for several months before it, too, was overtaken by events. Behind all of this, the “it”, I still believe is collateral. Dealers understand in a way that the Fed never will how there had been too much stupidity in the securities lending game under the fiction of “globally synchronized growth” which allowed that stupidity to once again infect the repo market – on the collateral side. Whether directly pledged junk or more likely transformed, there’s probably quite a lot of crap collateral in the stream which can only have made dealers nervous and increasingly risk averse – therefore prone to buying and hoarding pristine collateral, building up not a cash liquidity margin but a repo reserve. The FOMC noted this“strong worldwide demand for safe assets” back when curves were merely flattening. What will they call it now with them having collapsed? It doesn’t matter because the market proceeds with or without official recognition (or the usual dismissal). The worse the global economy looks, the likelier the chance that crap collateral becomes increasingly unusable, the greater the demand for collateral that always will be. |

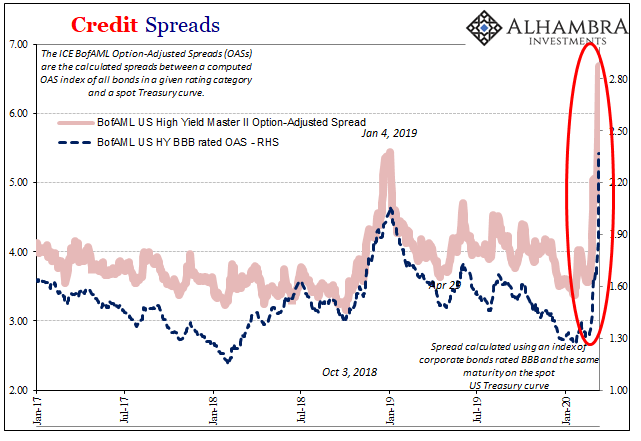

Credit Spreads, 2017-2020 |

Credit Spreads, 2017-2020 |

|

| We can’t help but notice how the massive downdraft in rates up to Monday, meaning unbelievable bidding for UST’s and the like no matter how high the price was driven, coincided with a pretty terrible blowout in risky credit spreads. The fears that have kept dealers risk averse ever since, oh, May 29, 2018, are being proven (note how the riskiest spreads never normalized after late 2018, keeping dealers on edge, and the repo market bidding for pristine collateral just “in case”, all throughout last year).

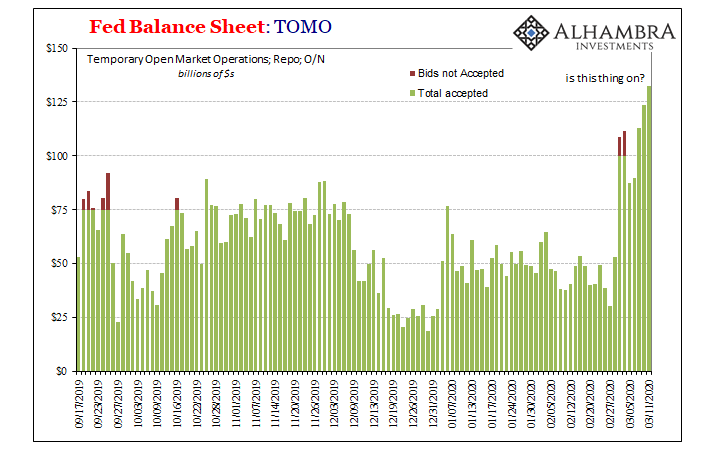

I’ll point out how this isn’t normal, mostly in the huge gamma indicated by these market moves. What you see on the charts immediately above, while not yet to the ultimate level of Euro$ #3, it has gotten into that realm in a damn hurry. This kind of gamma is the leading killer of risk-taking, proof that crap collateral and junk security can go from somewhat acceptable in repo to impossibly illiquid and unusable in a heartbeat. I have to believe this kind of move has made securities lending dealers nervous to the point of paralysis. Thus, Jay Powell’s ridiculous repo operations that go up and up and up while markets are pushed down and down and down. Chaotically, too, no matter how much bank reserves he’s (re)created over the past few months. What this suggests, to me, is that after the weak hands are done profit-taking at the long end, this risk aversion shudder that keeps running through the global system pushes UST yields lower still. Another big scramble for collateral – even if part of QE6 includes buying this crap. The dealers’ fears have continued to be proven, so such a move might simply confirm everyone’s darkest thoughts on this vital area of the global financial system. The timing isn’t as certain because it’s hard to project just how much a “weird” new-sounding QE might buoy sentiment if only temporarily. Reality, as has been proven, is over time much harder to fool. I can see the next leg in bonds taking UST yields finally below zero, a fate I’ve long felt was unavoidable so long as everything stays the way it has. Whether there’s a further bond selloff in between, and you know the grand QE gesture is coming soon, that remains to be seen. |

Fed Balance Sheet: TOMO 2019-2020 |

Tags: bond yields,Bonds,credit spreads,currencies,economy,eurodollar curve,eurodollar futures,Featured,Federal Reserve/Monetary Policy,Interest rates,Markets,money curve,newsletter,repo,repo collateral,Securities Lending,stocks,U.S. Treasuries