(Disclosure: Some of the links below may be affiliate links) I have talked about several brokers on this blog. But I have not yet answered the question of which one is the best broker in Switzerland! It is now time to answer this important question. There are several Swiss brokers, and most Swiss banks have their broker service. But some international brokers are also available in Switzerland. If you want to invest in the stock market, you will need a broker...

Read More »Police Are Complicit in Politicians’ Disregard for the Rule of Law

People of a certain age might remember the old John Birch Society slogan “Support your local police!” The idea here is that your local policeman is a liberty-loving buddy of yours who would only ever support just laws and constitutional mandates. Only those bad guys in the FBI or BATF would ever consider violating your rights. Now, obviously that has always been a rather naïve fantasy, but the notion certainly has a long history of support among American...

Read More »Some Insightful Entrepreneurs Planned for a Pandemic

Listen to the Audio Mises Wire version of this article. Does a pandemic trump entrepreneurial foresight? Many in business will say yes, “nobody saw this coming.” Lack of customer demand and government lockdowns are “no fault of their own.” But Penny Chutima, co-owner of the Lotus of Siam restaurant, did see it coming. Chutima and her mother, Saipin, have operated the off-Strip Las Vegas staple for years. Saipin opened the original location with her husband in 1999....

Read More »FX Daily, May 8: Jobs and Negative Fed Funds Futures

Swiss Franc The Euro has fallen by 0.09% to 1.0528 EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 closed near its session lows for the third day running yesterday but failed to deter the bulls in Asia-Pacific, where most markets rose by more than 1%. Taiwan, Korea, and Australia lagged a bit though closed higher. Europe’s Dow Jones Stoxx 600 is firm, and the modest...

Read More »Swiss companies free to pay dividends despite bailouts

Swiss companies that receive state bailouts during the coronavirus pandemic will still be allowed to pay dividends to shareholders. A divided parliament eventually rejected calls to ban the billions that are expected to be paid out by firms this year. During a hotly debated session on Thursday, the House of Representatives initially backed a proposal to prevent companies issuing dividends if they receive taxpayer money to cope with the pandemic. But the Senate...

Read More »Dollar Mixed as Doves Fly

Measures of cross-market implied volatility have been stable for a few weeks now Weekly jobless claims are expected at 3 mln; reports suggest House Democrats are pushing ahead with a possible vote next week on another relief package Canada reports April Ivey PMI; Peru is expected to keep rates steady; Brazil COPOM delivered a dovish surprise last night The Bank of England delivered a dovish hold; The Norges Bank surprised markets with a 25 bp cut to 0%; Czech...

Read More »We All Know Who’s On First, But What’s On Second?

It wasn’t entirely unexpected, though when it was announced it was still quite a lot to take in. On September 1, 2005, the Bureau of Economic Analysis (BEA) reported that the nation’s personal savings rate had turned negative during the month of July. The press release announcing the number, in trying to explain the result was reduced instead to a tautology, “The negative personal saving reflects personal outlays that exceed disposable personal income.” Why had it...

Read More »Be Thankful for Those Who “Only Do It for the Money”

At least since I first read George Orwell’s Politics and the English Language, I have been a student of the use of weasel words. I have joined what he called the “struggle against the abuse of language,” because “Political language…is designed to make lies sound truthful…and to give an appearance of solidity to pure wind.” I even found the phrase’s origins interesting. As explained by phrases.org, “It has long been a widespread belief that weasels suck the yolks...

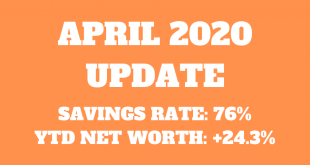

Read More »April 2020 – A month at home

(Disclosure: Some of the links below may be affiliate links) April 2020 is now over! That was one of the weirdest months of our life. We spent the entire month in our village, mostly at home. We only went out to buy groceries and help some of my relatives. Fortunately, we have a large backyard, so we spent a lot of time outside. And Switzerland is not in full lockdown, so we still went out for walks. But we respected the two meters distance and almost did not talk...

Read More »FX Daily, May 7: China Reports an Unexpected Jump in Exports, While Norway Surprises with a Rate Cut

Swiss Franc The Euro has risen by 0.10% to 1.0532 EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is a sense of indecision in the air today. There have been several developments, but investors seem mostly reluctant to extend positions. China reported a surge in exports in April and an increase in the value of reserves. Australia reported a rise in exports in March. The Bank of...

Read More » SNB & CHF

SNB & CHF