Swiss Franc The Euro has fallen by 0.06% to 1.057 EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump’s national address in the Asian session failed to reassure investors. Trump’s remarks had to be clarified on at least three counts. The travel ban from Europe did not include trade. It applied to foreigners who traveled to Europe within the past two weeks, and insurance companies agreed to waive copayment

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Autralia, Canada, COVID-19, ECB, Featured, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

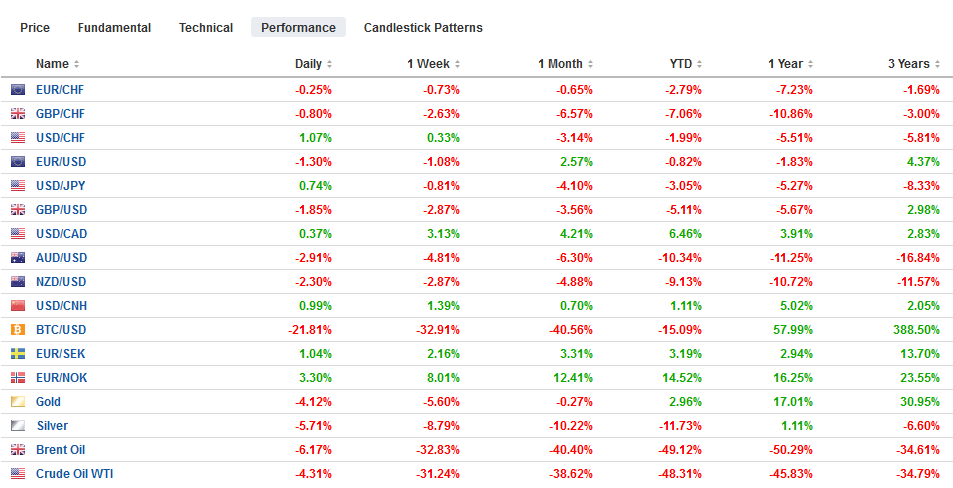

Swiss FrancThe Euro has fallen by 0.06% to 1.057 |

EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump’s national address in the Asian session failed to reassure investors. Trump’s remarks had to be clarified on at least three counts. The travel ban from Europe did not include trade. It applied to foreigners who traveled to Europe within the past two weeks, and insurance companies agreed to waive copayment for tests, not for the treatment of the coronavirus. Equities continued their headlong plunge. The Nikkei dropped more than 4%, and Australia fell more than 7% despite the announcement of a fiscal support package. Thailand crashed by nearly 12%. European bourses are off 5%-6%, and the Dow Jones Stoxx 600 is 6.6%, which brings this week’s loss to about 15.2%. US shares are pointing to a limited down opening for the S&P 500 (first circuit breaker is 7% below yesterday’s close). Yields in the Asia Pacific region rose as are peripheral yields, but core yields are falling, and the US 10-year yield is around 12 bp lower below 75 bp. The German 2-year yield beyond minus 100 bp. The dollar is mostly firmer against the major currencies. The Japanese yen and Swiss franc are the main exceptions. The euro and the Canadian dollar are little changed. The Scandis and the Antipodeans are joined by sterling as the poorest performers. Emerging market currencies are under pressure, led by the Mexican peso (~-2.5%) and the Russian rouble (~-2.2%). The JP Morgan Emerging Market Currency Index is off about 0.3% to take this week’s loss to more than 3%. Gold is about 0.5% stronger after finding support near its 20-day moving average (~$1631), and oil did not like the US travel ban or jump in US EIA inventory estimate (7.6 mln barrels). Light sweet crude for April delivery is off about 5% near $31. |

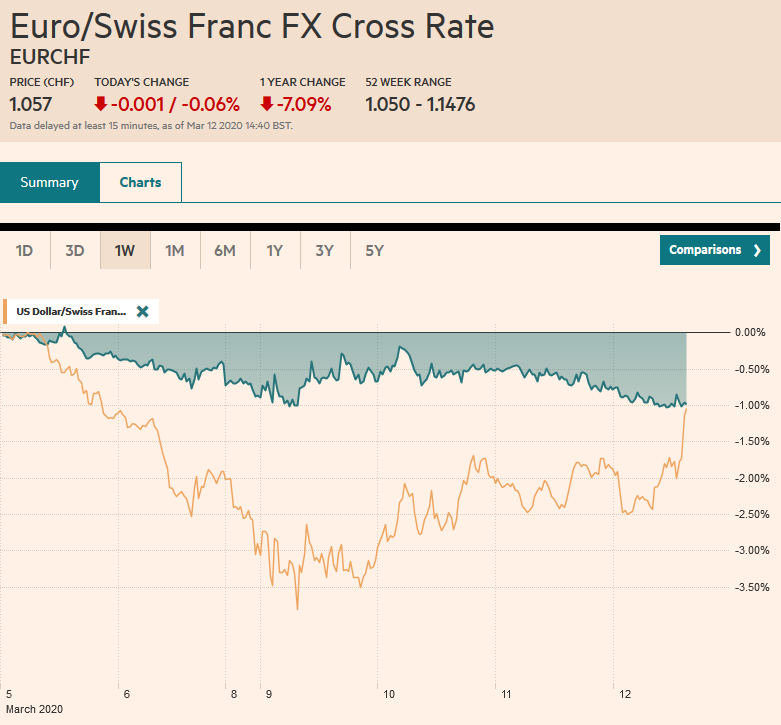

FX Performance, March 12 |

Asia Pacific

Australia announced fiscal support of roughly 1.2% of GDP over the next two years. It includes A$17.6 bln(~$11.4 bln) of tax breaks and spending increases and A$750 payment to lower-income and welfare recipients’ household. In addition, there is another A$6.7 bln earmarked to help support the cash flow to small and medium-sized businesses. New Zealand is expected to announce its fiscal package next week.

Foreign investors stepped up their purchases of Japanese bonds last week, according to the weekly MOF data. The JPY1.1 trillion of purchases was the most in more than a month. The logic is not the negative yield but the long dollar hedge. By hedging out the yen, an investor could secure an overall yield that was about 50 bp more than US Treasuries.

The dollar tested JPY106 yesterday and returned to JPY103 today, which corresponds to a (61.8%) retracement of the bounce from Monday’s low (~JPY101.30). Immediate resistance is seen near JPY104.50, where an option for about $675 mln will expire today. It is at the mercy of global stocks and bonds. The Australian dollar appears headed for a retest of the week’s low set Monday (~$0.6315). It continues to trend lower in the European morning to reach about $0.6425. Initial resistance is pegged around $0.6450. The dollar rose against the yuan for the fourth consecutive session and approached CNY7.0 for the first time this month. The 0.5% gain today is the largest since Chinese markets re-opened on February 3.

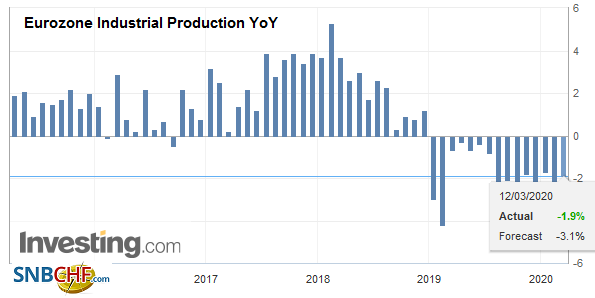

EuropeWhile market psychology is focused on US fiscal response, perhaps as a shorthand for US leadership domestically and internationally in this moment of crisis, it is the ECB’s turn to reveal its hand. It meets after Italy, the most stricken outside of China, forces all businesses but grocery stores and pharmacies to shut. Mortgage and small loan forbearance are being worked out after fatalities jumped by a third yesterday.While zero interest rates are widely criticized by economists and investors, the ECB, including the executive board member from Germany, Schnabel, has offered robust defenses. There is some concern about an effective floor beyond the zero-bound. But the tipping point is not clear, and the Swiss target is -0.75% (LIBOR). Sure, the ECB can cut rates, boost is asset purchases, and offering more generous long-term loans, all of which favor debtor countries. It can modify the tiering system, which is a bone to the creditors. Some observers suggest that to surprise the market, a 20 bp cut in rates and a more than doubling of the asset purchases may be required. However, what is needed is fiscal policy, and Lagarde, like her predecessor Draghi, has been hammering for fiscal stimulus even before the outbreak of Covid-19. The hammer has gotten bigger. |

Eurozone Industrial Production YoY, January 2020(see more posts on Eurozone Industrial Production, ) Source: investing.com - Click to enlarge |

France’s Macron wants something at the EU level, which means the much-coveted German purse. Merkel, who warned that 60%-70% of Germans are at risk, suggested possible appetite and scope for a new initiative with her pledge to do “whatever is necessary” to combat the virus, following a conference call between EU officials and the ECB. Lagarde was the French finance minister in 2008 and a parallel challenge now, but most of the firepower to address the health crisis lies with governments, not central banks.

The UK’s budget did what it had to do: provide funds for the public health crisis and begin preparing the UK’s departure from the EU with infrastructure spending aimed too at reducing the internal imbalances. The National Health Service will get a GBP5 bln boost. The new spending is roughly GBP30 bln (~$39 bln) or a little less than 1.5% of GDP. Italy has indicated it is willing to spend 25 bln euros (~$28.5 bln), or about 1.2% of GDP, to cushion the blow of the coronavirus on and already fragile economy. Chancellor of the Exchequer Sunak remained within the fiscal rules, but do not appear to be necessarily committed going forward.

For the fourth consecutive session, the euro is recording lower highs and lower lows. In so doing, it has given back all of Monday’s gains that had carried it from below $1.13 to nearly $1.15. Support near $1.1250 gave way in the European morning as stocks sank. The next technical area is the (38.2%) retracement objective of the rally from the February 20 low (below $1.08) found near $1.1220. The halfway mark is near $1.1140. Sterling’s weakness is not just about the recovery in the dollar as it is also heavy against the euro. The euro has been trending higher against sterling even as it has slipped against the greenback. The single currency is above GBP0.8800 and near its best level since last October. Against the dollar, sterling has approached this month’s low near $1.2725. The 200-day moving average is a little lower (~$1.2710), and sterling has not traded below it since mid-October. A break could spur another cent slide.

AmericaPresident Trump’s remarks went over like a lead zeppelin yesterday. Stocks initially traded higher in the electronic session ahead of his address, but fell sharply through it. He did announce several executive actions, including the ban on non-citizens coming from Europe for the next month, which hit oil and the airlines) and extended the tax filing deadline for small businesses impacted by Covid-19. There were several miscommunications and but it is still not clear if it will apply to some households as well. The President threw his weight behind an immediate payroll tax relief. The fact that at first trade was included in the travel ban saw the equity slide accelerate. |

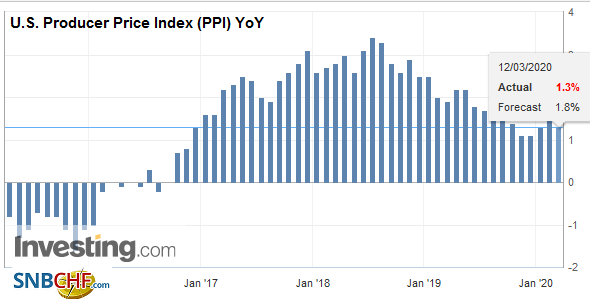

U.S. Producer Price Index (PPI) YoY, February 2020(see more posts on U.S. Producer Price Index, ) Source: investing.com - Click to enlarge |

| Senators and Representatives were slated to spend next week in their states and districts. House leader Pelosi is trying to hold a vote tomorrow on a package of measures, which includes emergency sick pay, enhanced unemployment benefits, free coronavirus testing, and enhanced food support for those impacted. When approved, the bill goes to the Senate, and it may take its cues from the Administration, which risk a further delay. |

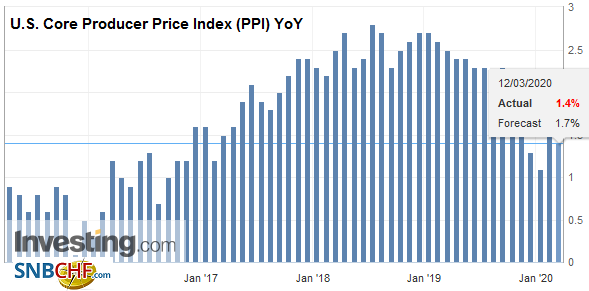

U.S. Core Producer Price Index (PPI) YoY, February 2020(see more posts on U.S. Core Producer Price Index, ) Source: investing.com - Click to enlarge |

The Federal Reserve tweaked its repo options for the second time this week. Recall it had lifted the overnight facility from $100 bln to $150 bln and the term repo to $45 bln from $20 bln on Monday. Yesterday, it raised the overnight facility to $175 bln and will offer the two-week term repo twice a week rather than once. It will introduce the first of three one-month term repos today for $50 bln. When the repos first resumed six-months ago, the spur a shortage of bank funds willing to commit to repo operations due to a few reasons, including regulatory and economic incentives. The underlying problem was not addressed, and now the risk of a financial crisis, with disruptive drops in equity markets, various liquidity problems arising, and a huge margin call. Margins in the capital markets are a function of volatility, and as volatility has soared, banks, brokers, and exchanges require more funds, which in turn forces liquidation. In addition, reports indicate that many businesses are drawing down their credit lines. Rather than be a net lender, corporations may be becoming borrowers, also creating powerful financial forces. Rinse and repeat.

Separately, Canada announced a C$1.1 bln (~$800 mln) emergency aid package that included health transfers to the provinces and territories, funds for research and development, and expansion of employment insurance sickness benefits. It seems a modest effort compared with what other countries are doing and a 50 bp rate cut by the Bank of Canada. Prime Minister Trudeau will likely go to the fiscal well again. He did point to his sidearm, the Business Development Bank and the Export Development Bank, which can be called into action if needed. They lent C$11 bln to Canadian businesses during the Great Financial Crisis. The federal budget will be formally delivered on March 30. Canada recorded a deficit in 2019 of 0.6% of GDP, which gives it some latitude to address the double shock of Covid-19 and collapse in oil prices.

After knocking on CAD1.38 for the past three sessions, the US dollar popped above there in Asia. It pulled back CAD1.3750 in the European morning but appears ready to retry the upside in North America. Above the CAD1.3800 area, there is little on the charts until closer to CAD1.40. The Mexican peso had fallen by about 2.7% in the first three sessions of this week and about that much today alone. The dollar is back to MXN22.00 that it saw on Monday’s spike. It is at record highs making resistance moot. It settled yesterday near MXN21.3840. Separately, note as a reminder, the first circuit breaker in stock indices is 7%, which triggers a 15 minutes shutdown to trading, and then another trigger at 13% (until the last half hour of trading) for a 15-minute break as well. If a 20% drop is recorded, the market is shut for the remainder of the session.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Autralia,Canada,COVID-19,ECB,Featured,newsletter,U.K.