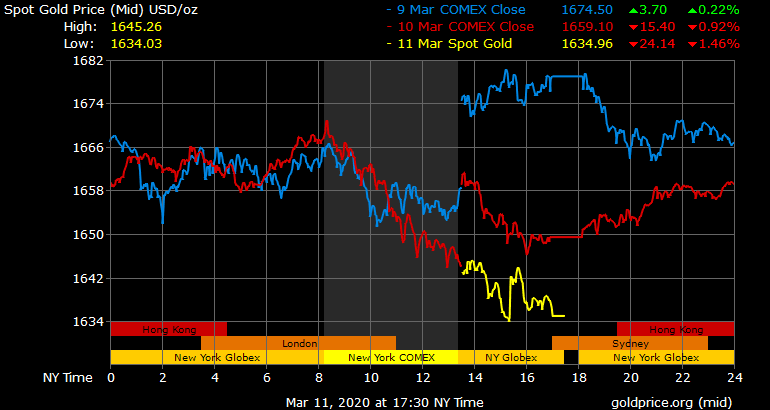

◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight. ◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy. Gold only saw a marginal gain of 0.45% in sterling to £1,285/oz but remains near all time record highs of £1,304.20/oz. ◆ ECB president Lagarde warned EU leaders last night that without coordinated action, the EU “will see a scenario that will remind many of us of the 2008 Great Financial Crisis.” Lagarde indicated the ECB will also take emergency measures as soon as tomorrow or Friday. Spot Gold Price USD/oz -

Topics:

Mark O'Byrne considers the following as important: 6a) Gold & Bitcoin, 6a.) GoldCore, Daily Market Update, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| ◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight.

◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy. Gold only saw a marginal gain of 0.45% in sterling to £1,285/oz but remains near all time record highs of £1,304.20/oz. ◆ ECB president Lagarde warned EU leaders last night that without coordinated action, the EU “will see a scenario that will remind many of us of the 2008 Great Financial Crisis.” Lagarde indicated the ECB will also take emergency measures as soon as tomorrow or Friday. |

Spot Gold Price USD/oz |

| ◆ Coronavirus cases surpass 117,000 worldwide; deaths exceed 4,200; China reports just 24 new cases; Italy infections over 10,000, cases; in the U.S. near 1,000.

◆ U.K. and European stocks advanced following the BOE rate cut, while U.S. equity futures dropped as virus cases jumped and parts of New York went into quarantine or a “containment zone” and after the Trump administration failed to to offer details on its economic package. ◆ A surge in cases of the virus globally and the growing impact on consumer and investor sentiment is weighing on consumers, companies and markets; Doubts about a stimulus package proposed by President Donald Trump to soften the economic impact of the coronavirus epidemic also appears to have weighed on risk sentiment. ◆ The outlook for gold remains very strong as we are on the verge of another crisis and are set to see a massive wave of monetary and fiscal easing and stimulus. There may be some short term weakness and consolidation after recent gains but price corrections should be seen as buying opportunities for the foreseeable future. |

15 Year Gold Price in USD/oz |

Tags: Daily Market Update,Featured,newsletter